My idea is a bit of a long-term project that pieces together a separate project I’m working towards that deals with AI. I have lots of research and work ahead of me to accomplish this.

My idea is this:

Phase 1

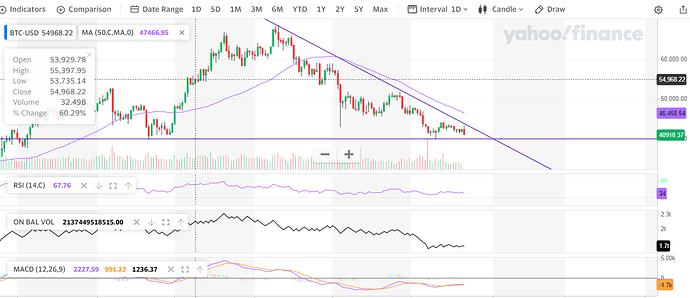

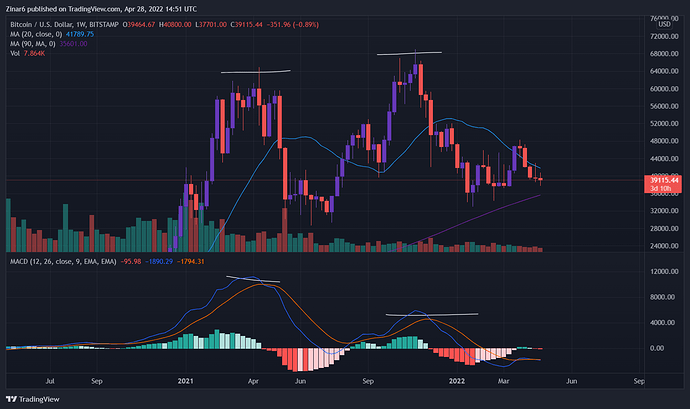

Buidl a platform that allows me to pick which cryptocurrency I want to watch, and have an AI chatbot analyze the chart(s) and notify me of all found buy/sell signals/patterns that we’ve been discussing;

Phase 2

When the AI assistant finds and notifies me of signals for each chart, I want it to suggest possible options (buy, sell, hold, setup a resistance/support line to notify me when it gets close/passes the line, etc);

Phase 3

Have my AI assistant use Twitter to find sentiments for the chosen coin(s) and map the overall human sentiments along the graphs; I’ll use this to observe how the chart(s) behave, based on how the coin(s) are being discussed on Twitter.

This phase will be rather large, as I’ll first need to research what I can do with Twitter API’s, buidl my AI to interact with the AI, provide the accounts, tags, etc for the bot to watch/collect sentiment data from in Twitter (with the future being the AI attempting to find the data on it’s own and I’ll review/edit the data it’s going to monitor), and then find a way to graph that along the chart(s).

Phase 4

Do actual trading based on what I’ve been observing/testing in above phases; this phase will be implementing what I’ve learned, and (hopefully) have data to support making my decisions on when I’ll buy/sell. In the previous phases I’m hoping to do “fake trading” to see how well everything works based on making decisions from the data collected. If I’m able to, I want to make this closely resemble a game where I’m ultimately just managing resources (fiat and crypto), and if things have been going well, I’ll toggle it to use real fiat.