-

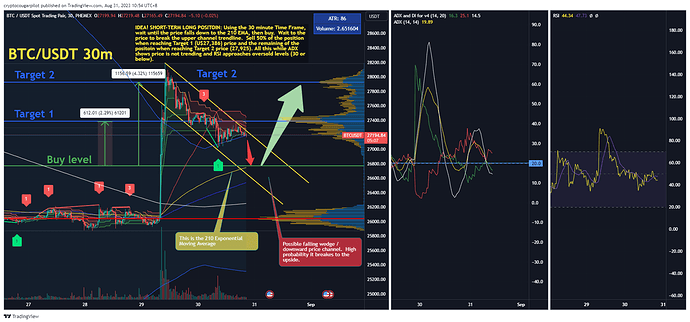

Use a technical indicator, such as the RSI or Stochastic oscillator, to confirm that the retracement is overbought (in an uptrend) or oversold (in a downtrend).

-

Enter the trade: Once the retracement has ended and the technical indicator confirms that the trend is resuming, enter the trade in the direction of the trend.

-

Set a stop-loss: Set a stop-loss order below the recent swing low (in an uptrend) or above the recent swing high (in a downtrend) to limit potential losses if the trade goes against you.

-

Set a take-profit: Set a take-profit order based on a predefined risk-reward ratio. For example, if you risk $100 on the trade, aim to make at least $200 in profit.

-

Monitor the trade: Monitor the trade and adjust the stop-loss and take-profit levels as the trend continues. Consider taking partial profits if the trade moves in your favor

1 Like

I forgot to mention the stop-loss level. Should be located below the lower yellow trendline at a level around U$26,620.

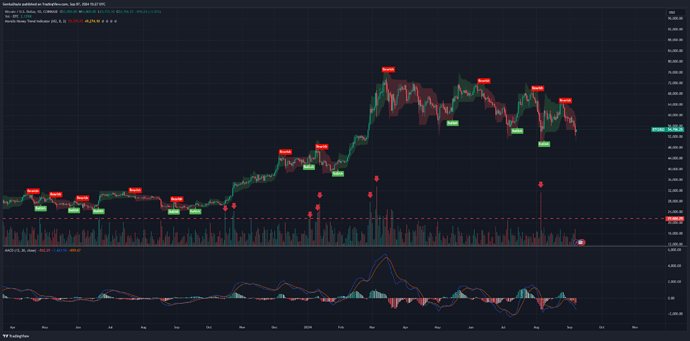

The trend is your friend.

Follow the general direction of the movement of the underlying and use the 50 day and 200 day moving average to decide on trade.