Here I have combined a script to trade the moon phases (that I found - credit to Pascal Simon) with a moving average cross strategy.

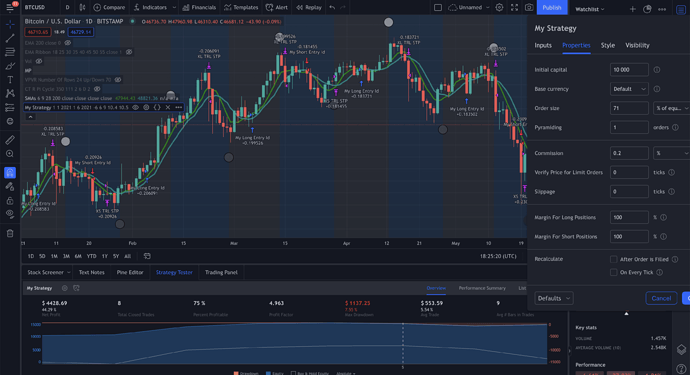

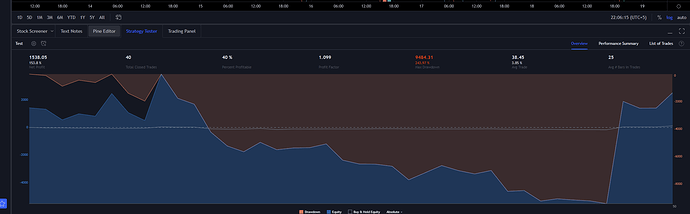

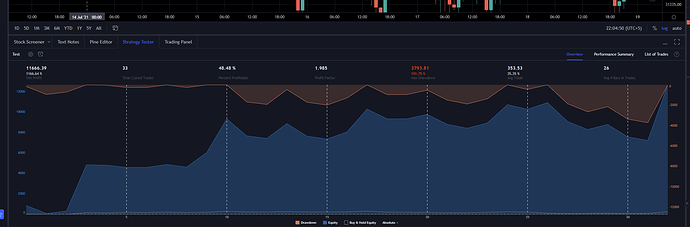

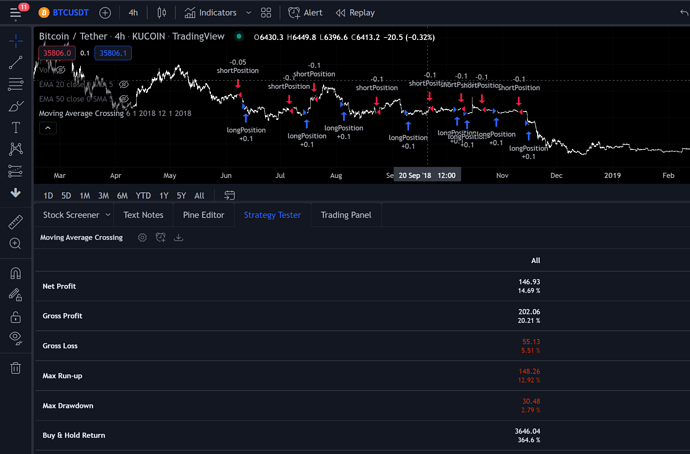

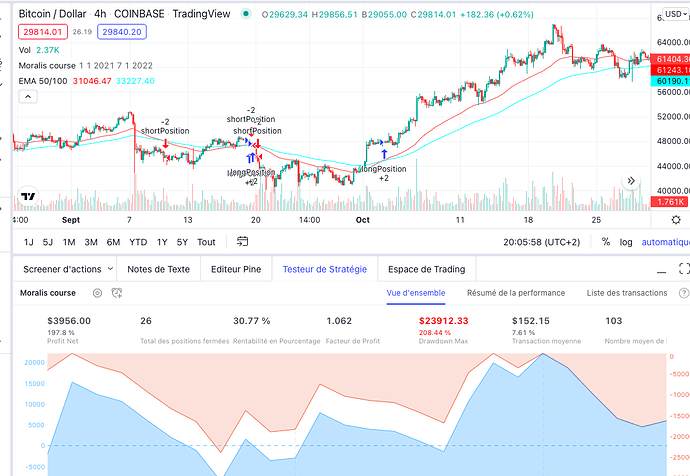

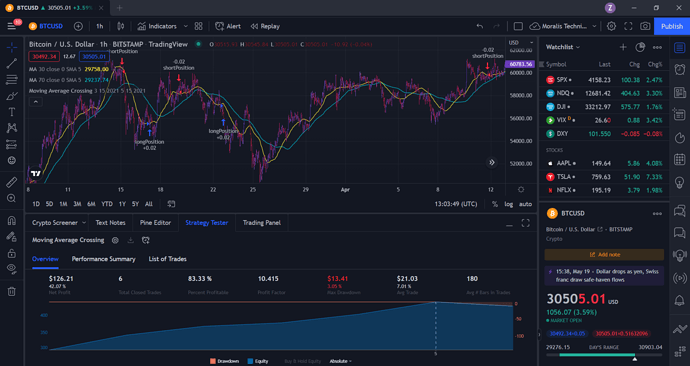

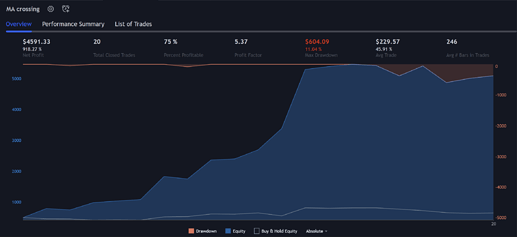

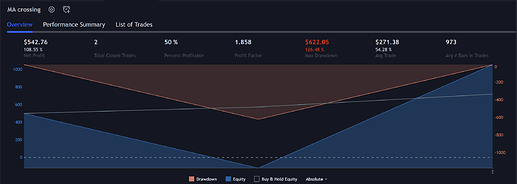

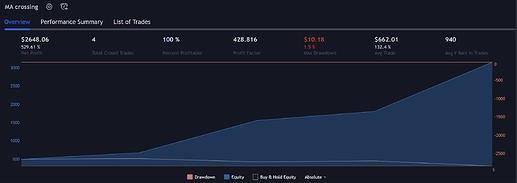

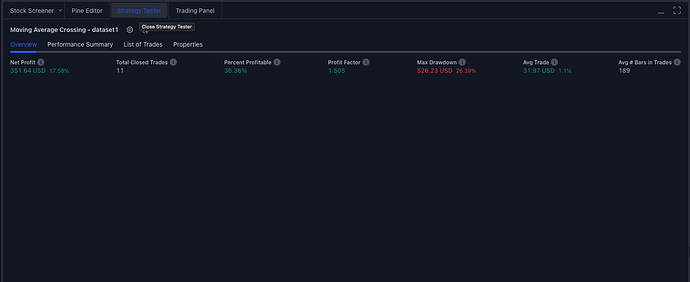

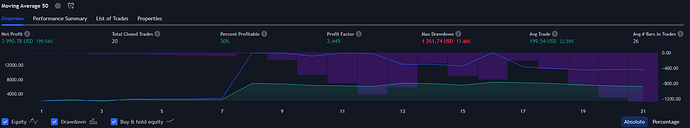

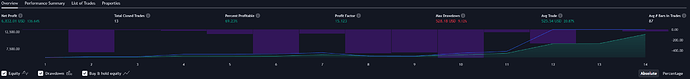

I have set the commission to 0.2% and get a fairly good profit factor (up to 7 on some 6 month periods) on different sets of data. An order size of about 70% and trailing stop losses for both long and short trades of about 10.5% seems to be the optimum.

I also used a variable offset to the moon phase days, offsetting this by about 6 days seems to give better results.

The moving averages I chose were 6 and 9 simple daily

The downside is that there are only a couple of trades a month max.

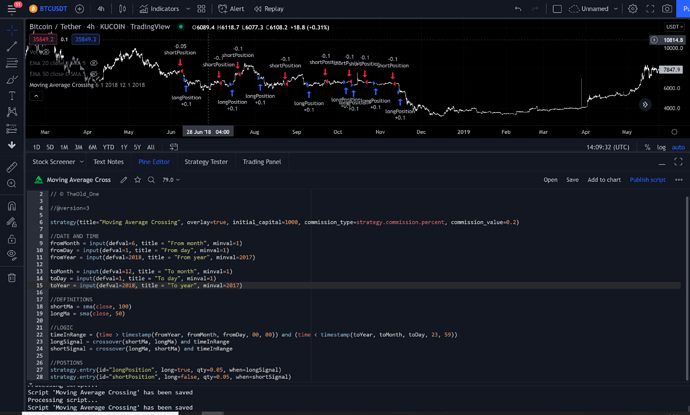

The code and screenshot are below:

Cheers,

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// ---------------------------© paaax----------------------------

// --------------------------------------------------------------

// ---------------- Author: Pascal Simon (paaax) ----------------

// --------------------------------------------------------------

// -------------------- www.pascal-simon.de ---------------------

// --------------------------------------------------------------

// ---------------- www.tradingview.com/u/paaax/-----------------

// --------------------------------------------------------------

// Source: https://gist.github.com/L-A/3497902#file-moonobject-js

// --------------------------------------------------------------

//@version=4

strategy(“My Strategy”, overlay=true, margin_long=100, margin_short=100)

//Test time range

fromDay = input(defval=1, title=“From day”, minval=1)

fromMonth = input(defval=1, title=“From month”, minval=1)

fromYear = input(defval=2018, title=“From year”, minval=2008)

toDay = input(defval=1, title=“To day”, minval=1)

toMonth = input(defval=1, title=“To month”, minval=1)

toYear = input(defval=2018, title=“To year”, minval=2008)

// Moon day offset

dayOffset = input(defval=0, title=“Moon day offset”)

shortSMA = input(defval=14, title=“shortSMA”)

longSMA = input(defval=28, title=“longSMA”)

// Configure trail stop level with input options

longTrailPerc = input(defval=3, title=“Trail Long Loss (%)”, type=input.float, minval=0.0, step=0.1) * 0.01

shortTrailPerc = input(defval=3, title=“Trail Short Loss (%)”, type=input.float, minval=0.0, step=0.1) * 0.01

fillBackground = input(true, “Fill Background?”)

// Moon Phase FUNCTION — {

normalize(_v) =>

x = _v

x := x - floor(x)

if x < 0

x := x + 1

x

calcPhase(_year, _month, _day) =>

int y = na

int m = na

float k1 = na

float k2 = na

float k3 = na

float jd = na

float ip = na

y := _year - floor((12 - _month) / 10)

m := _month + 9

if m >= 12

m := m - 12

k1 := floor(365.25 * (y + 4712))

k2 := floor(30.6 * m + 0.5)

k3 := floor(floor((y / 100) + 49) * 0.75) - 38

jd := k1 + k2 + _day + 59

if jd > 2299160

jd := jd - k3

ip := normalize((jd - 2451550.1) / 29.530588853)

age = ip * 29.53

//} — FUNCTION

// INIT — {

age = calcPhase(year, month, dayofmonth + dayOffset)

moon = floor(age)[1] > floor(age) ? 1 : floor(age)[1] < 15 and floor(age) >= 15 ? -1 : na

//} — INIT

//Logic

// Determine long trail stop loss price

longStopPrice = 0.0

longStopPrice := if (strategy.position_size > 0)

stopValue = close * (1 - longTrailPerc)

max(stopValue, longStopPrice[1])

else

0

// Determine trailing short price

shortStopPrice = 0.0

shortStopPrice := if (strategy.position_size < 0)

stopValue = close * (1 + shortTrailPerc)

min(stopValue, shortStopPrice[1])

else

999999

// Timerange

timeInRange = (time > timestamp(fromYear, fromMonth, fromDay, 00, 00)) and (time < timestamp(toYear, toMonth, toDay, 23, 59))

// Submit entry orders if the moon phase is favourable, the time is within the time range and the trend as defined by two SMAs is favourable

longCondition = (moon<=0) and (timeInRange) and (sma(close, shortSMA) > sma(close, longSMA))

if (longCondition)

strategy.entry(“My Long Entry Id”, strategy.long)

shortCondition = (moon>=0) and (timeInRange) and (sma(close, shortSMA) < sma(close, longSMA))

if (shortCondition)

strategy.entry(“My Short Entry Id”, strategy.short)

// Submit exit orders for trail stop loss price

if (strategy.position_size > 0)

strategy.exit(id=“XL TRL STP”, stop=longStopPrice)

if (strategy.position_size < 0)

strategy.exit(id=“XS TRL STP”, stop=shortStopPrice)