I think the blockquotes messed up the formatting… maybe try this? I can’t find an option to upload a txt file…that would be handy.

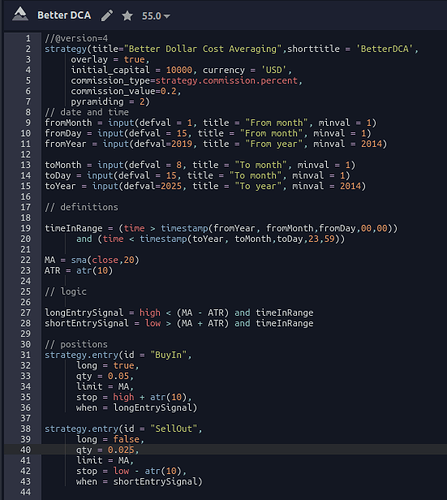

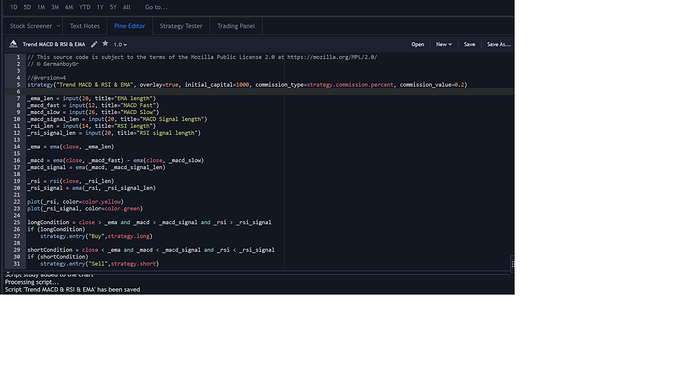

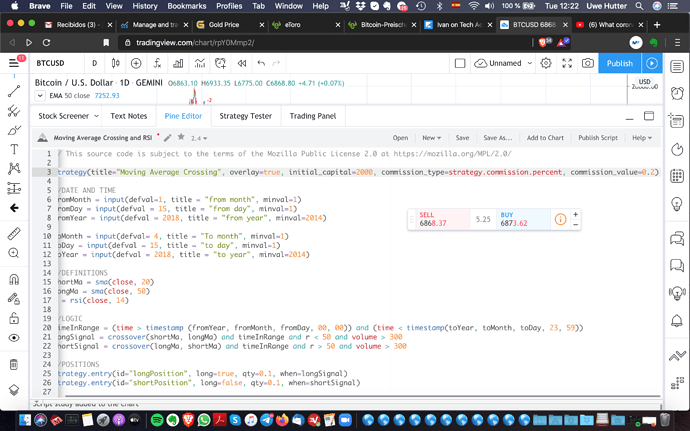

//@version=3

// Original Author: @JayRogers

// Revision Author: JustUncleL

// Revision Author: HeCormier

strategy("[HC] Strategy: Algo", shorttitle=“Strategy: Algo”, overlay=true,

default_qty_type=strategy.percent_of_equity, default_qty_value=100, initial_capital=1000,

calc_on_order_fills= true, calc_on_every_tick=true, max_bars_back=10,

pyramiding=0,commission_type=strategy.commission.percent,commission_value=0.2)

src = close

//* General Inputs //

showTrendCloud = input(title=“Show TrendCloud?”, type=bool, defval=true) // Plot Trend Cloud //

showRBDDBRColor = input(title=“Show RBR DBD Candle Colors?”, type=bool, defval=true) // RBD (Rally Base Drop) & DBR (Drop Base Rally) Candle Colors //

showTDLevelPoints = input(title=“Show TDSP/TDDP?”, type=bool, defval=true) // * TD Level Points * //

showSMA = input(title=“Show SMA?”, type=bool, defval=false) // * Simple Moving Averages * //

showPositionLevels = input(title=“Show Position Levels?”, type=bool, defval=true) // Plot Order, Stop Loss and Trailing Stop Trigger Levels *//

//* Simple Moving Averages *//

ma12 = na

ma12 := sma(src, 13)

ma21 = na

ma21 := sma(src, 21)

ma55 = na

ma55 := sma(src, 55)

ma89 = na

ma89 := sma(src, 89)

ma200 = na

ma200 := sma(src, 200)

plot(showSMA ? ma12 : na, color=red, transp=0, style=line, title=“SMA13”, linewidth=1)

plot(showSMA ? ma21 : na, color=yellow, transp=0, style=line, title=“SMA21”, linewidth=1)

plot(showSMA ? ma55 : na, color=lime, transp=0, style=line, title=“SMA55”, linewidth=1)

plot(showSMA ? ma89 : na, color=aqua, transp=0, style=line, title=“SMA100”, linewidth=1)

plot(showSMA ? ma200 : na, color=purple, transp=0, style=line, title=“SMA200”, linewidth=1)

//* RBD (Rally Base Drop) & DBR (Drop Base Rally) Candle Colors *//

cR = (close - open) >= 0 ? ((close - open) / (high - low))*100 > 50 ? true : false : na //Rally Candle

cB = (abs(close - open) / (high - low))*100 < 50 ? true : false //Base Candle

cD = (open - close) >= 0 ? ((open - close) / (high - low))*100 > 50 ? true : false : na //Drop Candle

limeBar = cR

whiteBar = (cR[1] and cB) or (cD[1] and cB)

redBar = cD

barcolor(showRBDDBRColor ? limeBar ? lime : na : na)

barcolor(showRBDDBRColor ? whiteBar ? white : na : na)

barcolor(showRBDDBRColor ? redBar ? red : na : na)

// * TD Level Points * //

TDSP1 = high < high[1] and high[1] > high[2]

TDSP2 = high < high[1] and high[1] < high[2] and high[2] > high[3] and high[3] > high[4]

TDSP3 = high < high[1] and high[1] < high[2] and high[2] < high[3] and high[3] > high[4] and high[4] > high[5] and high[5] > high[6]

TDDP1 = low > low[1] and low[1] < low[2]

TDDP2 = low > low[1] and low[1] > low[2] and low[2] < low[3] and low[3] < low[4]

TDDP3 = low > low[1] and low[1] > low[2] and low[2] > low[3] and low[3] < low[4] and low[4] < low[5] and low[5] < low[6]

plotshape(showTDLevelPoints ? TDSP3 ? TDSP3 : na : na, title= “TDSP3”, color=yellow, transp=40, size=size.tiny, style=shape.cross, location=location.abovebar, offset=-3)

plotshape(showTDLevelPoints ? TDDP3 ? TDDP3 : na : na, title= “TDDP3”, color=yellow, transp=40, size=size.tiny, style=shape.cross, location=location.belowbar, offset=-3)

plotshape(showTDLevelPoints ? TDSP2 ? TDSP2 : na : na, title= “TDSP2”, color=yellow, transp=80, size=size.tiny, style=shape.cross, location=location.abovebar, offset=-4)

plotshape(showTDLevelPoints ? TDDP2 ? TDDP2 : na : na, title= “TDDP2”, color=yellow, transp=80, size=size.tiny, style=shape.cross, location=location.belowbar, offset=-4)

//* Algo Strategy Inputs //

inpDescriptionStrategy = input(defval=true, title = “Strategy Settings”)

useRes = input(defval = true, title = “Use Alternate Resolution?”)

intRes = input(defval = 3, title = “Multiplier for Alernate Resolution”)

stratRes = ismonthly? tostring(intervalintRes,"###M") : isweekly? tostring(intervalintRes,"###W") : isdaily? tostring(intervalintRes,"###D") : isintraday ? tostring(interval*intRes,"####") : ‘60’

basisType = input(defval = “SMMA”, title = "Basis Moving Average Type: ", options=[“SMA”, “EMA”, “DEMA”, “TEMA”, “WMA”, “VWMA”, “SMMA”, “HullMA”, “LSMA”, “ALMA”, “SSMA”, “TMA”])

basisLen = input(defval = 8, title = “MA Period”, minval = 1)

offsetSigma = input(defval = 6, title = “Offset for LSMA / Sigma for ALMA”, minval = 0)

offsetALMA = input(defval = 0.85, title = “Offset for ALMA”, minval = 0, step = 0.01)

delayOffset = input(defval = 0, title = “Delay Open/Close MA (Forces Non-Repainting)”, minval = 0, step = 1)

cloudSpread = input(defval = 1, title=“Cloud Spread Trigger”, minval = 0)

//* Return MA Input Selection //

variant(type, src, len, offSig, offALMA) =>

v1 = sma(src, len) // Simple

v2 = ema(src, len) // Exponential

v3 = 2 * v2 - ema(v2, len) // Double Exponential

v4 = 3 * (v2 - ema(v2, len)) + ema(ema(v2, len), len) // Triple Exponential

v5 = wma(src, len) // Weighted

v6 = vwma(src, len) // Volume Weighted

v7 = 0.0

v7 := na(v7[1]) ? sma(src, len) : (v7[1] * (len - 1) + src) / len // Smoothed

v8 = wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len))) // Hull

v9 = linreg(src, len, offSig) // Least Squares

v10 = alma(src, len, offALMA, offSig) // Arnaud Legoux

v11 = sma(v1,len) // Triangular (extreme smooth)

// SuperSmoother filter

// © 2013 John F. Ehlers

a1 = exp(-1.4143.14159 / len)

b1 = 2a1cos(1.4143.14159 / len)

c2 = b1

c3 = (-a1)a1

c1 = 1 - c2 - c3

v12 = 0.0

v12 := c1(src + nz(src[1])) / 2 + c2nz(v12[1]) + c3*nz(v12[2])

type==“EMA”?v2 : type==“DEMA”?v3 : type==“TEMA”?v4 : type==“WMA”?v5 : type==“VWMA”?v6 : type==“SMMA”?v7 : type==“HullMA”?v8 : type==“LSMA”?v9 : type==“ALMA”?v10 : type==“TMA”?v11: type==“SSMA”?v12: v1

//* Security Wrapper for Alternate Resolution *//

reso(exp, use, res) => use ? security(tickerid, res, exp, gaps=barmerge.gaps_off, lookahead=barmerge.lookahead_on) : exp

//* Plot Trend Cloud *//

closeSeries = variant(basisType, close[delayOffset], basisLen, offsetSigma, offsetALMA)

openSeries = variant(basisType, open[delayOffset], basisLen, offsetSigma, offsetALMA)

closeSeriesAlt = reso(closeSeries, useRes, stratRes)

openSeriesAlt = reso(openSeries, useRes, stratRes)

trendColor = (closeSeriesAlt > openSeriesAlt) ? green : red

closeP=plot(showTrendCloud ? closeSeriesAlt : na, title = “Close Series”, color = trendColor, linewidth = 1, style = line, transp = 1)

openP=plot(showTrendCloud ? openSeriesAlt : na, title = “Open Series”, color = trendColor, linewidth = 1, style = line, transp = 1)

fill(closeP,openP,color=trendColor,transp=80)

// *** Strategy Long/Short Call Calculation ***

longEntry = na

shortEntry = na

inLongPosition = na

inShortPosition = na

flat = na

inLongPosition := longEntry[1] ? true : shortEntry[1] ? false : inLongPosition[1]

inShortPosition:= shortEntry[1] ? true : longEntry[1] ? false : inShortPosition[1]

flat := not inLongPosition and not inShortPosition

xlong = cross(closeSeriesAlt, openSeriesAlt) and closeSeriesAlt > openSeriesAlt

xshort = cross(closeSeriesAlt, openSeriesAlt) and closeSeriesAlt < openSeriesAlt

longEntry := xlong[1] and abs(openSeriesAlt - closeSeriesAlt) > cloudSpread

shortEntry := xshort[1] and abs(openSeriesAlt - closeSeriesAlt) > cloudSpread

// *** STRATEGY *** //

//Variables declarations

inpDescriptionPosition = input(defval=true, title = “Strategy Position Settings”) // Settings Header

inpTakeProfit = input(defval = 20, title = “Take Profit %”, minval = 0)

inpStopLoss = input(defval = 2, title = “Stop Loss %”, minval = 0)

inpTrailStop = input(defval = 2.5, title = “Trailing Stop Loss %”, minval = 0)

inpTrailOffset = input(defval = 0.5, title = “Trailing Stop Loss Offset %”, minval = 0)

procent = 0.0

openprice = 0.0

curprice = close[0]

useTakeProfit = 0.0

useStopLoss = 0.0

useTrailStop = 0.0

useTrailOffset = 0.0

openprice := nz(openprice[1])

useTakeProfit := nz(useTakeProfit[1])

useStopLoss := nz(useStopLoss[1])

useTrailStop := nz(useTrailStop[1])

useTrailOffset := nz(useTrailOffset[1])

useTakeProfit := useTakeProfit==0.0 ? na : useTakeProfit

useStopLoss := useStopLoss==0.0 ? na : useStopLoss

useTrailStop := useTrailStop==0.0 ? na : useTrailStop

useTrailOffset := useTrailOffset==0.0 ? na : useTrailOffset

openprice := openprice==0.0 ? na : openprice

// Date and Time Backtest Ranges

inpDescriptionBacktest = input(defval=true, title = “Strategy Backtest Range Settings”)

st_yr_inp = input(defval=2018, title=‘Backtest Start Year’, type=integer)

st_mn_inp = input(defval=07, title=‘Backtest Start Month’, type=integer)

st_dy_inp = input(defval=01, title=‘Backtest Start Day’, type=integer)

en_yr_inp = input(defval=2020, title=‘Backtest End Year’, type=integer)

en_mn_inp = input(defval=12, title=‘Backtest End Month’, type=integer)

en_dy_inp = input(defval=31, title=‘Backtest End Day’, type=integer)

// Set start and end dates for backtest

start = timestamp(st_yr_inp, st_mn_inp, st_dy_inp,23,59)

end = timestamp(en_yr_inp, en_mn_inp, en_dy_inp,23,59)

testDateRange = time > start and time < end

// Long Strategy

if (longEntry and testDateRange and (strategy.position_size==0 or inShortPosition))

openprice := close[0]

procent := nz((curprice/100)(1/syminfo.mintick))

useTakeProfit := inpTakeProfit >= 1 ? inpTakeProfitprocent : na

useStopLoss := inpStopLoss >= 1 ? inpStopLossprocent : na

useTrailStop := inpTrailStop >= 1 ? inpTrailStopprocent : na

useTrailOffset := inpTrailOffset >= 1 ? inpTrailOffset*procent : na

strategy.entry(‘L’,strategy.long)

strategy.exit(“Exit Long SL/TP”, from_entry = “L”, profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)

// Short Strategy

if (shortEntry and testDateRange and (strategy.position_size==0 or inLongPosition))

openprice := close[0]

procent := nz((curprice/100)(1/syminfo.mintick))

useTakeProfit := inpTakeProfit >= 1 ? inpTakeProfitprocent : na

useStopLoss := inpStopLoss >= 1 ? inpStopLossprocent : na

useTrailStop := inpTrailStop >= 1 ? inpTrailStopprocent : na

useTrailOffset := inpTrailOffset >= 1 ? inpTrailOffset*procent : na

strategy.entry(‘S’,strategy.short)

strategy.exit(“Exit Short SL/TP”, from_entry = “S”, profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)

//* Plot Order, Stop Loss and Trailing Stop Trigger Levels //

plot(showPositionLevels ? inLongPosition ? openprice[0]-(useStopLosssyminfo.mintick) : na : na,color=red,style=cross, linewidth=1, title=‘SLL’)

plot(showPositionLevels ? inShortPosition ? openprice[0]+(useStopLosssyminfo.mintick) : na : na,color=red,style=cross, linewidth=1, title=‘SLS’)

plot(showPositionLevels ? inLongPosition ? openprice[0]+(useTrailStopsyminfo.mintick) : na : na,color=aqua,style=cross, linewidth=1, title=‘TSL’)

plot(showPositionLevels ? inShortPosition ? openprice[0]-(useTrailStop*syminfo.mintick) : na : na,color=aqua,style=cross, linewidth=1, title=‘TSS’)

plot(showPositionLevels ? inLongPosition ? openprice[0] : na : na,color=white,style=cross, linewidth=1, title=‘TSL’)

plot(showPositionLevels ? inShortPosition ? openprice[0] : na : na,color=white,style=cross, linewidth=1, title=‘TSS’)