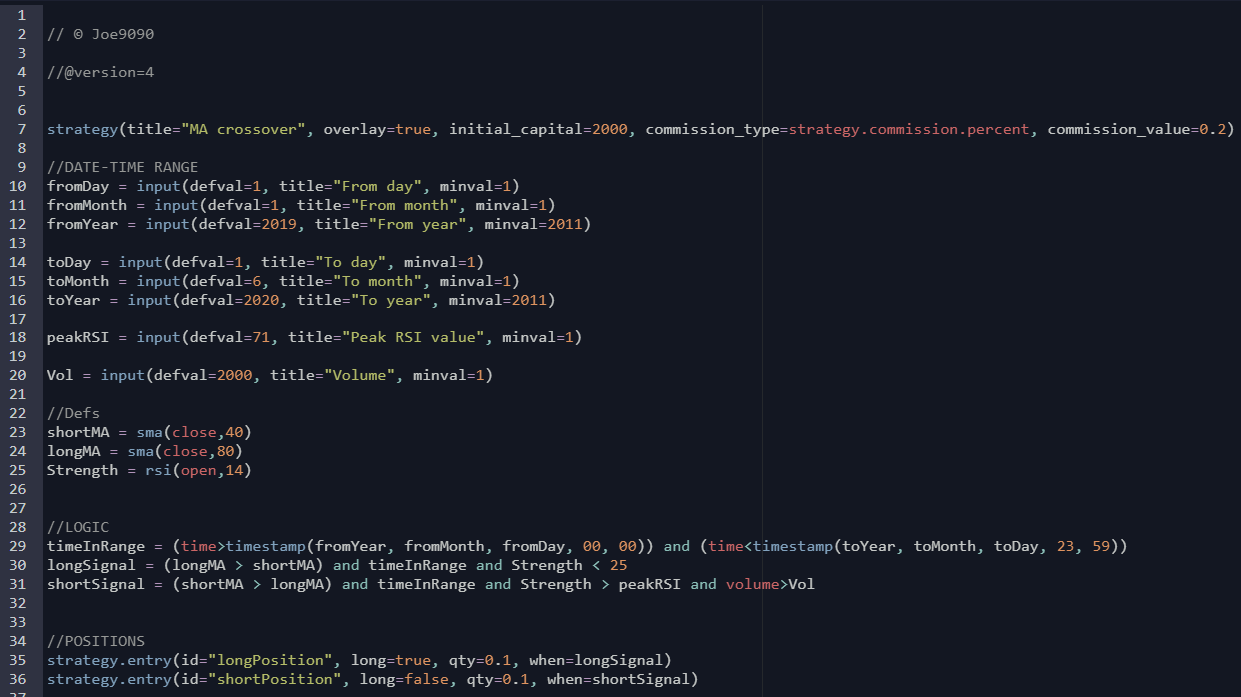

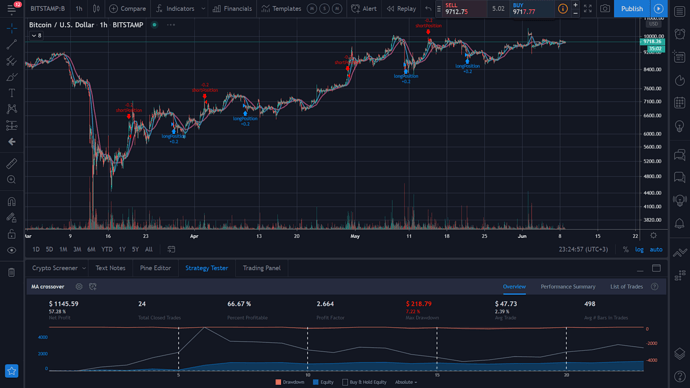

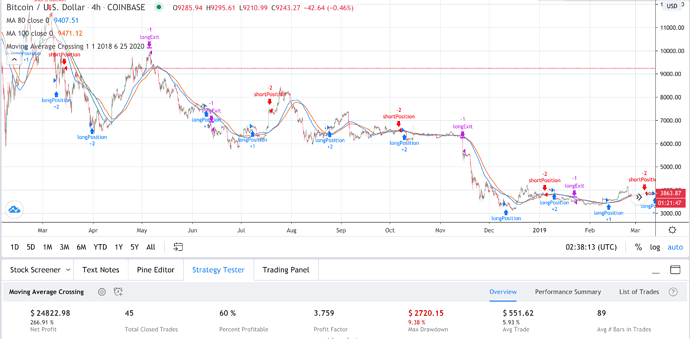

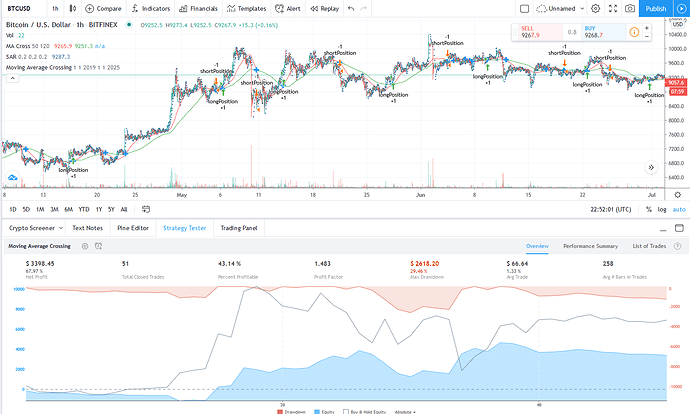

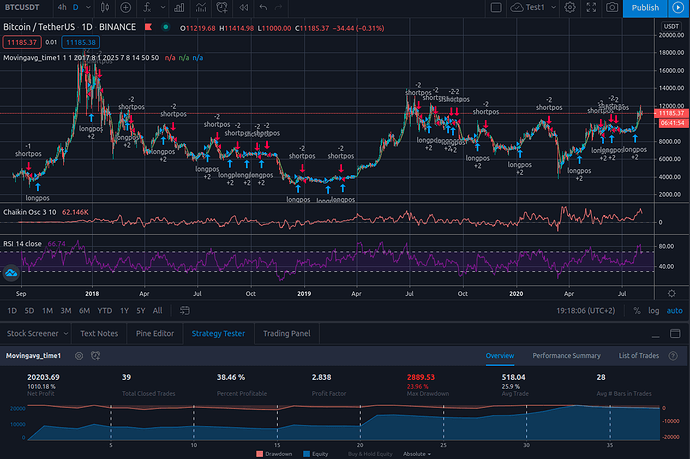

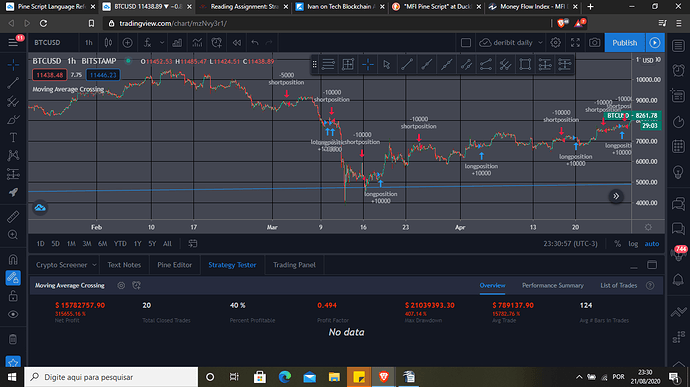

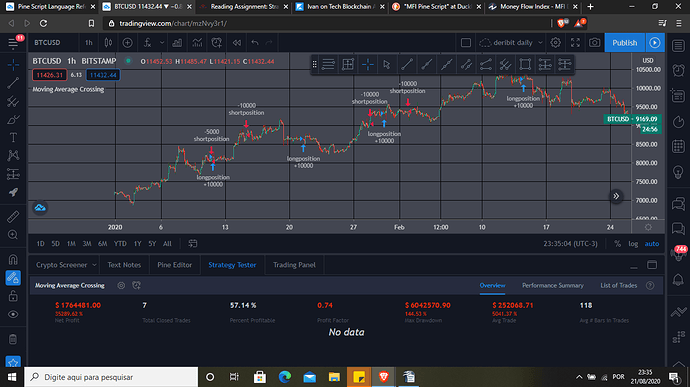

had to use a pyramiding value of 2 to actually get it to execute, USD base currency, and commission based on % of each trade

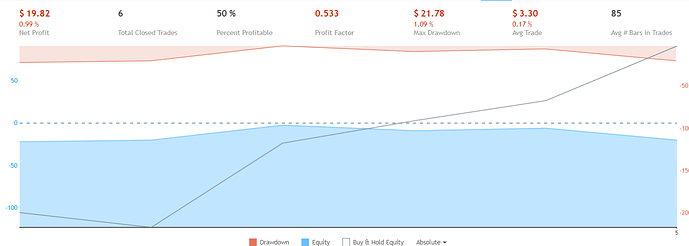

net profit $ 11,511.17, $5,778.47 max draw 43% ouch, 20 closing trades, 50% POP

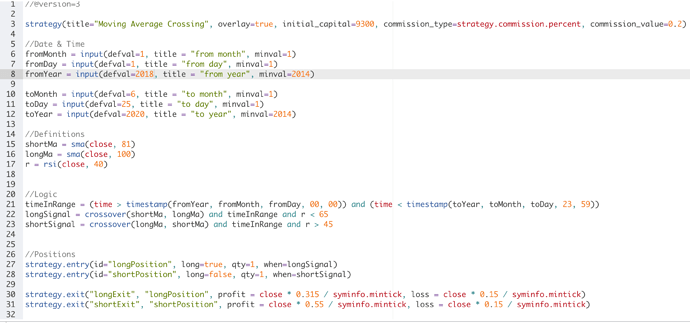

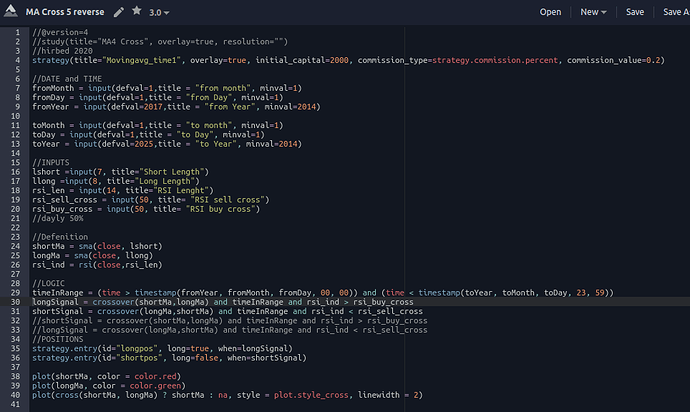

strategy(title =“Moving Avg Crossover”, overlay = true, initial_capital = 2000, commission_type = strategy.commission.percent, commission_value = 0.2)

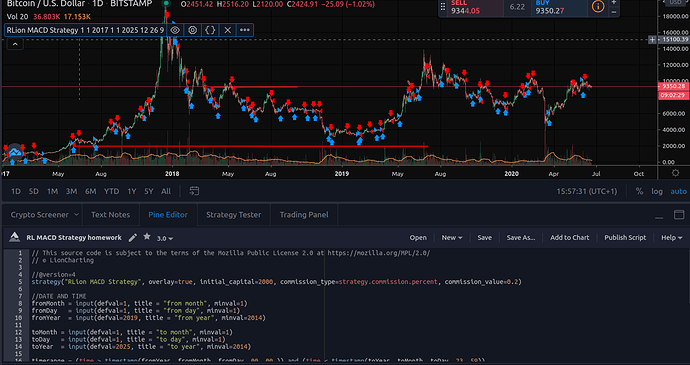

//date and time

fromDay = input(defval=1, title = “from Day”, minval = 1)

fromMonth = input(defval=1, title = “from Month”, minval = 1)

fromYear = input(defval=2014, title = “from Year”, minval = 1)

toDay = input(defval=1, title = “to Day”, minval = 1)

toMonth = input(defval=1, title = “to Month”, minval = 1)

toYear = input(defval=2025, title = “to Year”, minval = 1)

// definitions

short = sma(close,20) // 20 day simple moving avg of close price

long = sma(close,50) // 20 day simple moving avg of close price

// logic

timeinRange1 = time > timestamp(fromYear,fromMonth,fromDay,00,00) and time < timestamp(toYear,toMonth,toDay,23 , 59)

longSignal1 = crossover(short,long) and timeinRange1

shortSignal1 = crossover(long,short) and timeinRange1

// positions

strategy.entry(id = “longPosition”, long = true, when = longSignal1)

strategy.entry(id = “shortPosition”,long = false,when = shortSignal1)

// 2nd time range stretch it out 1 year, 6 months from inital from and to ranges

timeinRange2 = time > timestamp(fromYear,fromMonth-6,fromDay,00,00) and time < timestamp(toYear,toMonth+6,toDay,23 , 59)

longSignal2 = crossover(short,long) and timeinRange2

shortSignal2 = crossover(long,short) and timeinRange2

// positions

strategy.entry(id = “longPosition”, long = true, when = longSignal2)

strategy.entry(id = “shortPosition”,long = false,when = shortSignal2)