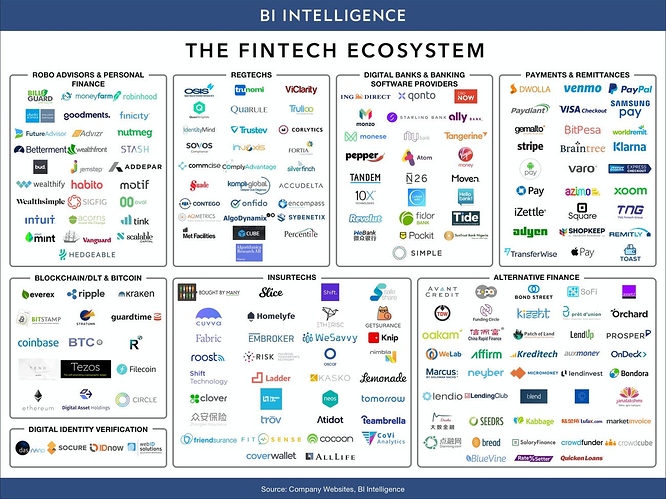

- Make a screening of existing fintechs in your region using google and map out which kind of banks they are focusing on.

- Estimate the areas that are currently underserved in your region (in other words, where the opportunities are)

My country is Italy. I just found an article on the main italian agency news ANSA (see here the link https://www.ansa.it/osservatorio_intelligenza_artificiale/notizie/societa/2020/09/17/fintech-il-censimento-di-ey-fenomeno-arriva-in-italia_4e18ba9d-e41b-4210-b5d1-f3b917724b81.html) where is reported the following interesting survey:

Total fintech companies in Italy: 345

of these we find:

71 on crowfunding (borrowing)

35 on analysis data, machine learning and artificial intelligence (basically investments)

34 on smart payments

30 on lending services

based on this analysis and comparing the list of the six financial activities in the course I can say that in Italy at the moment the best fintech opportunities are on savings and insurance, where clearly there are not so many companies to be considered as a separated category from the article writer.

Top 50 Fintech in US

Brex B2B Lending $315 M San Francisco, California

Kabbage B2B Lending $489 M Atlanta, Georgia

Betterment Investing $275 M New York, New York

iCapital Network Investing $80 M New York, New York

Kindur Investing $11 M New York, New York

Stash Investing $192 M New York, New York

Ethos Insurance $107 M San Francisco, California

Hippo Insurance Insurance $209 M Palo Alto, California

Insurify Insurance $30 M Cambridge, Massachusetts

Lemonade Insurance $480 M New York, New York

Next Insurance Insurance $381 M Palo Alto, California

Root Insurance Insurance $528 M Columbus, Ohio

Fattmerchant Payments $18 M Orlando, Florida

Finix Payments $55 M San Francisco, California

Marqeta Payments $378 M Oakland, California

Payoneer Payments $270 M New York, New York

Plaid Payments $310 M San Francisco, California

Plastiq Payments $140 M San Francisco, California

Stripe Payments $1000 M San Francisco, California

Toast Payments $498 M Boston, Massachusetts

TransferWise Payments $689 M London, United Kingdom

This is a good idea lots of interesting companies.

- Insure

Goose is a travel insurance company

Breathe is a B2B software solution for insurance companies.

Nuera Highly tech focused insurance broker focused on easy of use.

Nexus Mutual insure smart contracts

-

Lend

Crypto.com Lend with weekly payments, not insured

BlockFi Lend with monthly payments, not insured

Nexo Lend with daily payments, insured

Ledn Not insured -

Save

Mylo Automatic saving and investing platform -

Borrow

Borrowell allows borrowing of money from various lenders.

fundthrough borrow money against invoices -

Invest

Mylo Automatic saving and investing platform -

Pay

Instant get paid after every shift

Paybright consumer goods in payments biweekly or monthly

There is still some opportunities in bridging Crypto and Traditional finance. Though many on/off ramps have emerged in the last year. As they are small opportunity I have found is helping people find these few new emerging companies. Most of these companies happily pay from you to provide them users.

Well, blown away!

Forget what I wrote in the previous assignment, there is a HUGE israeli fintech companies, only that most of them have gone global:

- eToro

- Lemonade

- Payoneer

to name a few.

Check out this:

Switzerland, being a financial oasis has an incredible amount of Fintech companies.

https://fintechmap.ch/map/

Hi @Gustaf Hård af Segerstad

Can you please let me know why this answer is wrong in the assessment? In the presentation you state that Retail has high amount of customer but do not earn much per customer. Thanks

On average, what is most true about retail banks

Your Answer

check_box They have many customers and do not earn much per customer

Correct Answer

check_box They earn very little per customer

That’s a really good page you posted thanx. I recommend it. The Swiss know how to do this stuff.

Australia has over 800 companies in the fintech space. Grew from a 250 million industry in 2015 to a 4billion industry in 2020.

No1 in the world for contactless payment.

Australia boasts the 4th largest pool of managed funds in the world

2nd highest penetration of smartphones in the world.

Ventre of creating world blockchain standards.

Fintech regulatory sandbox leads the world.

https://www.fintechaustralia.org.au/wp-content/uploads/2017/10/FinTech-Ecosystem-Map-medium-res.jpg

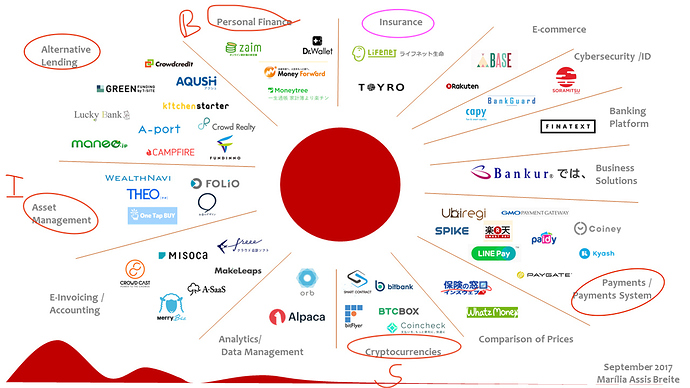

Japan seems to have a well balanced Fintech companies. Everyone is well connect to Internet so easily accessible but I don’t know statistics about adoptability and usability of the services.

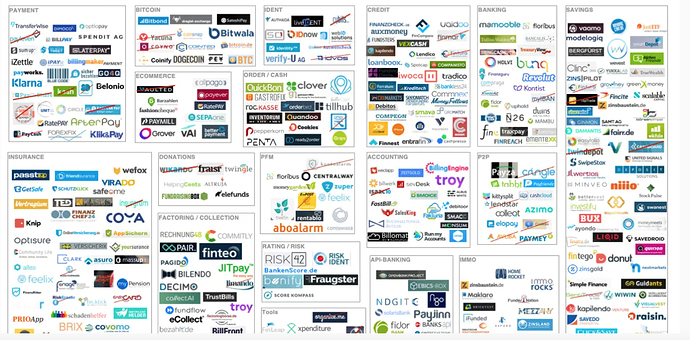

The Fintech market in Germany has many companies participating, some banks like Fidor and Bitwala war well established in the banking sector. The problem here is that a vast majority of people (also young people) prefer the traditional banking system with local saving banks. It’s a huge potential market, but any company in the sector has to face the traditional scepticism of Germans against everything that is online. Once this can be overcome there is a huge potential in ALL Fintech areas to be exploited. Possibly a way to overcome the scepticism is providing easy working apps and an excellent 24/7 phone backed customer service with personal help and no or little waiting holds.

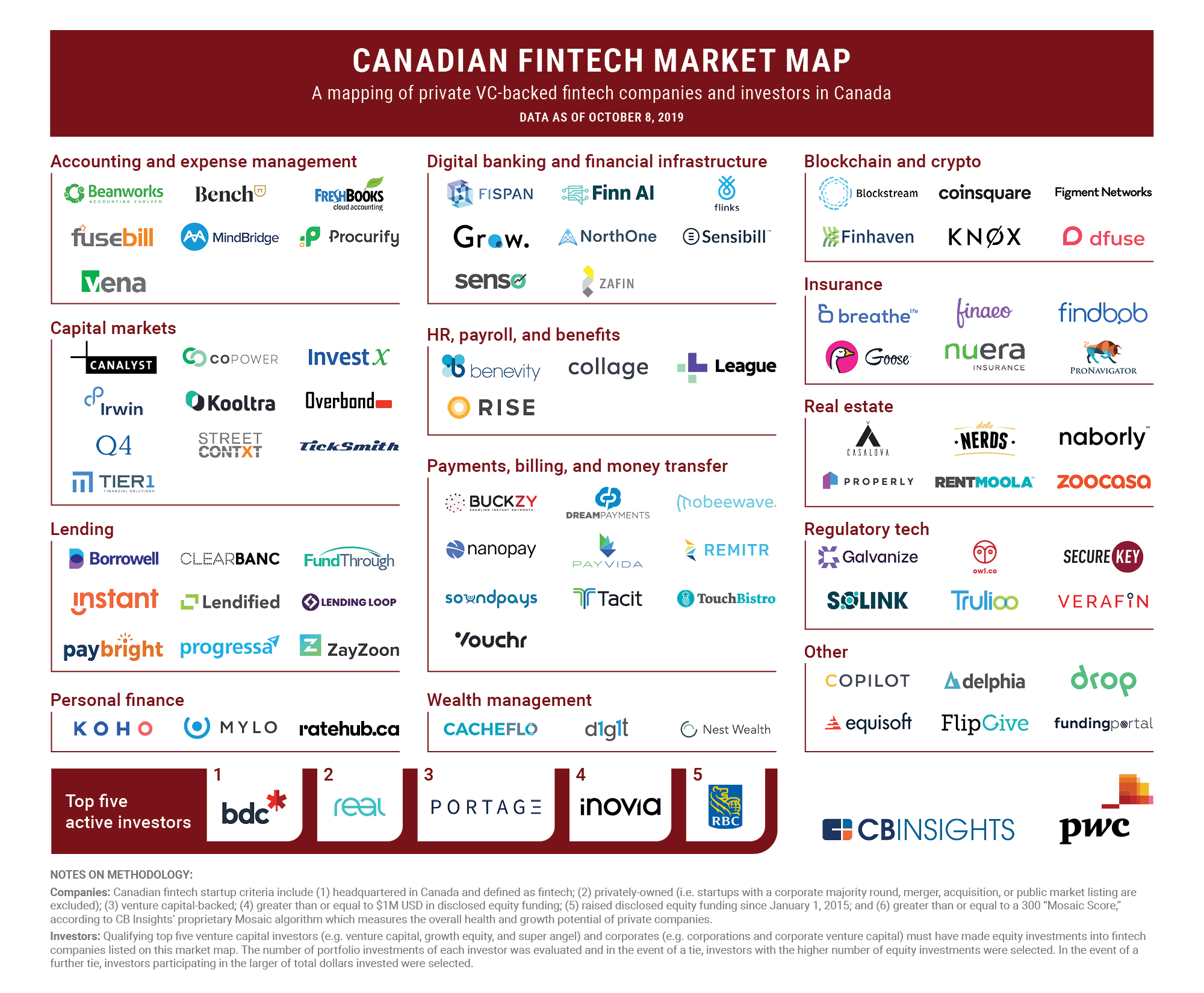

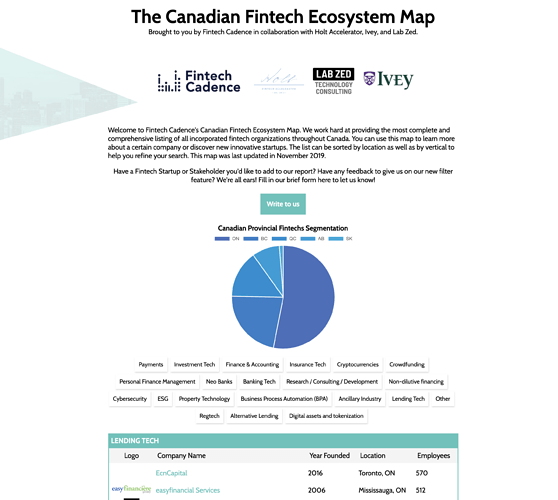

Canadian market is underserved in rural markets

Three cities are currently driving the fintech market Calgary, Toronto and Vancouver.

Opportunities arise in payment services where merchants consistently complain about high transaction costs

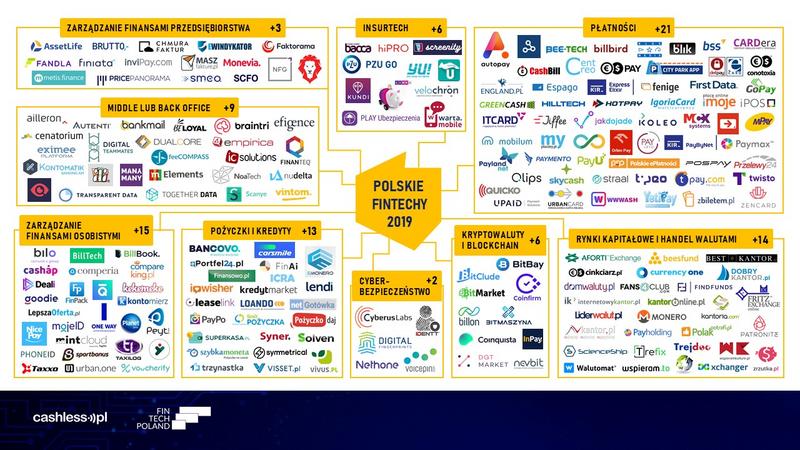

After screening existing fintechs in my region and connecting the information with the previous assignment, I believe that Poland lacks quality fintechs in many areas, especially Lending, Saving, and Investing.

Previous Assignment:

This is the document explaining in detail Polish fintech industry. (Unfortunately, it’s in Polish.)

https://www.cashless.pl/system/uploads/ckeditor/attachments/2258/mpf2020b.pdf

I found a website and a database of 204 Finnish fintechs. That’s too many to look into. I made a selection of six companies between A and F in the alphabet and I noticed that according to my understanding investment banking could be an area which is underserved. Or those kinds of services can better be provided by bigger regional and global players so there are no opportunities if you aim only at the Finnish market.

Airpay Digital https://www.airpaydigital.fi/ In corporate card payments - retail or commercial banks

Basware - https://www.basware.com/ payments services - retail or commercial banks

Clento https://www.clento.fi/ KYC solution - for all banks except central banks and perhaps investment banks (that have mainly institutional customers as far as I know)

Detech https://www.detech.fi/

Asset and liability management (ALM) - probably all forms of banks except Central banks and perhaps investment banks

eKeiretsu http://www.ekeiretsu.fi/

not in banking but in logistics, health, municipalities and insurance

FA solutions https://fasolutions.com/

wealth management - applicable for most kinds of banks except Central banks and perhaps investment banks.

Not easy to get an overview. There are a lot of companies here in Germany, too. I found this lists: https://big-picture.com/fintechs-germany.php or https://fintech-consult.com/germany.

Hi @CryptoMel,

Thank you for the catch.

We have adjusted the question and answers. It should be correct now.

Thank you for screening different fintechs in your region.

@spongetti, @Rick.Everitt, @Lucky_Mkosana

Could also expand on what areas you feel may be underserved in your region?