In my opinion opportunities are in the field off funding regular SME’s through retail crypto investors. I have only seen this with fiat money instead of crypto.

- Make a screening of existing fintechs in your region by using google and map out which kind of banks that they are focusing on. Then estimate the areas that are currently underserved in your region (in other words, where the opportunities are)

What I see is that the space is way to large even in small countries, so I have to just take some companies right now and find opportunity out of that as an exercise since I already know what I need this course for. Time is valuable right now so I need to research what is relevant for me right now.

Zwipe - contactless payments that integrates chip tech

Banksoft - lending service

Promon - Security-service for blockchain and traditional banking. No clear information about what marked they are targeting. But lets say they are targeting retail banks. To my limited knowledge, they are securing paying, loaning, lending, saving and investing at least. Maybe also insurance, but as I see it at first glance, this is a specialised product for the whole banking sector. Very clever!

Kameo - lending and payment for businesses

Monner Crowd - lending and payment for entrepreneurs

Local music is still an undeserved market. No one has a viable solution that actually helps them to this day.

My country is Austria.

I was surprised to see so many “big” fintechs from Austria.

Underserved regions: Asset management / investment banking space.

*Make a screening of existing fintechs in your region using google and map out which kind of banks they are focusing on.

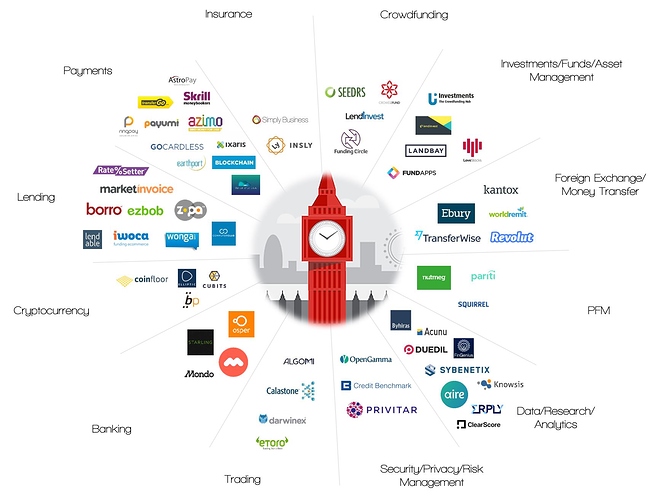

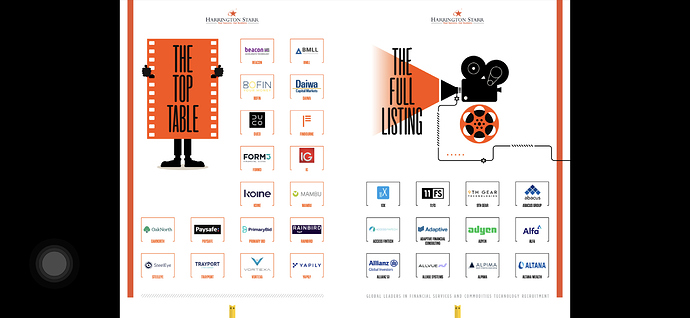

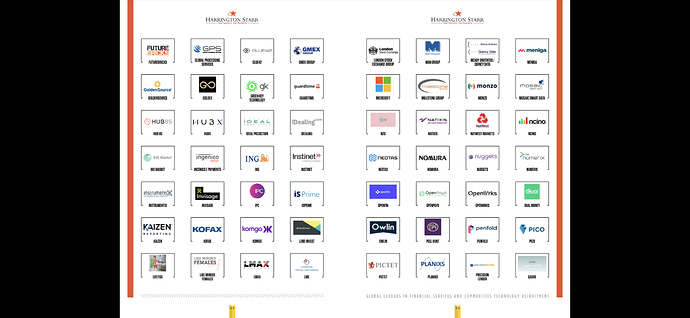

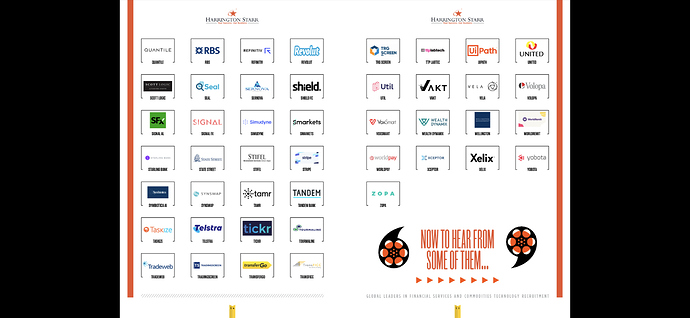

The United Kingdom has many hundreds of Fintech’s and the Financial Technologist magazine publish an annual review of the those that are most influential. In this case 187 were selected for the 2020 edition.

*Estimate the areas that are currently underserved in your region (in other words, where the opportunities are)

As explained by our esteemed tutor and lecturer Gustaf, the U.K. (as with much of Northern / North Western Europe) is extremely well served as to Fintech solutions aimed at the Retail consumer and also the SME, and less well served as regards the medium sized and global corporations and still less so the institutional customer, from what I can surmise.

One company that I am affiliated with, Volopa (which is part of the Quantum Group) is aiming at that higher end of customer base, where they have not only a first class Retail service (and B2B2C solutions via white labelling with partners) but are also targeting the high-level business and corporate sector with multi-currency prepaid cards (up to 14 currencies to which gold & silver will be added), and also they specialise in Cyber Security, and separately Lifestyle (& luxury) products and services. This year they launched the first Nigeria-specific remittance service (Oya, which is fastest and cheapest in-market payments arriving in around 30 seconds), made some strategic acquisitions, and will also target newer innovations in the coming year.

The U.K. also has an outstanding RegTech sector and in the assignment on Financial Regulations the Top 10 will be illustrated in my answer to the corresponding question there.

Blockstream - Blockchain & Bitcoin

Borowell - lending

Mylo - investing

PayBright - spending

There isn’t a lot in lending/borrowing, saving, or insurance. In general, all areas seem underserved.

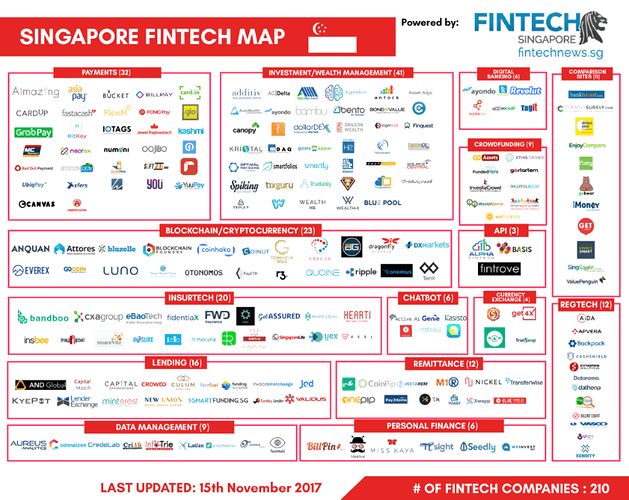

In Singapore the fintech landscape is pretty stacked. There isn’t a lack of companies providing services across the 6 pillars.

In fact Singapore also recently granted digital banking licenses to a dew fintech companies like Grab.

Where I see an opportunity is actually in the persona finance space. Being able to equip individuals with the right knowledge to pick the right solutions for their financial needs.

What do you guys think?

On this graphic we can overview the german fintech landscape. It is already covering quite a big part of retail and SME. As well as the supplier landscape. We can also see on the second graphic how fintechs are working together with traditional banks, partnering to provide them with innovative solutions

What I have not found is fintechs innovating in the territory of central banking, institutions and global corp. As Gustaf is explaining in the lessons, that is probably the area with most opportunities in German and most of European fintech.

Thank you for screening the Fintechs in your region!

Please also estimate the areas that are currently underserved in your region and where the opportunities maybe be if you want to finish the assignment completely.

Cheers

Hi,

Useful Links:

https://big-picture.com/fintechs-germany.php

https://www.gtai.de/gtai-en/invest/industries/financial-sector/fintech-65682

I noticed that Agricultural and Gambling sectors are currently underserved in my region.

http://www.wheregeorgialeads.com/fintech/fintech-maps/

In georgia there are hundreds of fintech companies, and it seems the most opportunities would be as listed in order:

-

Electronic Billing & Presentment/ Gateways or Alternative Payments

-

Identity/ Analytics/ risk

-

Capital markeets

In CANADA, the Fintechs are primarily located in the major city centers of Montreal, Quebec; Toronto, Ontario, and Vancouver, British Columbia. Even though Canada is vast in geographic size, markets are well served, with access to banking services apparently a-ok!

Right now, I see an opportunity in Specialized Crypto Tax (Advisory) Services, especially as it relates to the advent of Crypto Buying, and Crypto Trading, for I can find NOT-a-one except for HR Block and Canadian Revenue Agency, though i believe there is some indication that there will be integration of this, from a filing perspective, in tax preparation software, yet as it may appear to suit, it is certainly an end of the line - which by then, it too little to none, too late!!!

-

Payment

a…Flexiti Location: Toronto

b… Interac Location: Toronto

c… Lightspeed Location: Montreal

d… Nuvei Location: Montreal

e… Payment Rails Location: Toronto

f… Plooto Location: Toronto

g… Salt Edge Location: Toronto

h… Smooth Commerce Location: Toronto

i… Snap Financial Location: Vancouver

j… TouchBistro Location: Toronto

k… Wave Location: Toronto -

Investments

a… Canalyst Location: Vancouver

b… Hockeystick Location: Toronto

c… Inovestor Location: Montreal

d… Justwealth Location: Toronto

e… Mylo Location: Montreal

f… Lending Loop Location: Toronto

g… Nest Wealth Location: Toronto

h… WealthBar Location: Vancouver -

Borrowing

a… Borrowell Location: Toronto

b… Lendesk Location: Vancouver

c…Planswell Location: Toronto -

Savings

a…Mylo Location: Montreal

b… Wealthsimple Location: Toronto -

Lending

a… Easyfinancial Location: Mississauga

b… Lendesk Location: Vancouver

c… Lending Loop Location: Toronto

…

6. Insurance

a… Finaeo’s Location: Toronto

b…Ratehub.ca Location: Toronto

c…Snap Financial Location: Vancouver

- the fintechs used in Slovakia: TrustPay, Papaya POS, Viamo, Vacuumlabs

- what is missing? the connection to crypto

I reside in Antwerp- Belgium. I found one company called FintechBelgium. basically not a company but more like an association for people in the fintech space.

another one in Brussels focusses on crowdlending ( called Look&Fin)

Most Fintech in Belgium operate in payment services, robo-advice, crowdlending and Distributed ledger technologies

USA

Here are the 10 most valuable private, venture-backed fintechs in the U.S.:

- Stripe , $35 billion. …

- Ripple, $10 billion. …

- Coinbase , $8.1 billion. …

- Robinhood , $7.6 billion. …

- Chime, $5.8 billion. …

- Plaid, $5.3 billion. …

- SoFi, $4.8 billion. …

- Credit Karma, $4 billion.

Before jumping on Duck Duck Go to explore the FinTech landscape in Australia, I started my research on this assignment by reviewing the existing thread here and got a great start based on Roger777’s fine work below.

I then looked for any updated data from 2020 to add to this great work and found the following from KPMG:

https://australianfintech.com.au/wp-content/uploads/2020/12/KPMG-Fintech-Landscape-2020.png

I must say, for a country that has not been known for any diversity or complexity in its economy in recent years, especially since the collapse of the car manufacturing industry, I was surprised to see the number of FinTech players in Australia.

There are too many to cover here, but to focus discussion on a few I’ll pick the lending space as that seems to be a big retail area in Australia. zippay.com.au and https://www.afterpay.com/en-AU/index are widely recognised and have a visible presence in retail outlets. There are payday lenders advertising on television such as https://www.walletwizard.com.au/ and nimble.com.au that seem to focus on a predatory style of instant cash business which to me speaks to a couple of things. Firstly, there must be many people who are desperate for stop gap funding in the market and secondly there are likely opportunities in this space if that is the case.

Being a very property focused culture, Australians also have access to mortgage lending aggregators such as https://www.lendi.com.au/ which seem to be the modern version of the legacy player in this space “Aussie Home Loans”. Lendi offers a comparison of lenders and a means by which users can quickly query borrowing power and apply for a home loan. In this regard, they’re not focusing on any one particular bank it would seem.

Real Insurance is another well known and television advertised player in the insurance space in Australia.

In fact, according to the KPMG data at https://australianfintech.com.au/australian-fintech-ecosystem-continues-to-grow-kpmg-fintech-landscape-2020/, Lending is the largest FinTech category in Australia at 103 (up from 77 in 2019) with the total number of FinTechs coming in at 733 in 2020 up from 629 in the previous year.

Amazing! Thank you for sharing.