1.- Pay: There is a local Fintech called "Global66 that secures payments world wide

2.- Invest: Local company “Fintual” provides low cost investing for people and companies that want exposure to the stock market in the USA

3.- Borrow/Lend: Cumplo is a local company that does bith services and has over 100,000 clients

4.- Save/Insure: Ubank helps you save money in a very interactive way, using real life scenarios for savings that go to a personal account only you have access to.

Some London based Fintech companies:

Lending and borrowing -> AAVE -> an Ethereum based DEFI protocol allowing users to lend and borrow crypto assets without taking custody of them. Users can also get flashloans with ZERO COLLATERAL and use them in Ethereum smart contracts. This is crazy, you can literally borrow millions to take advantage of arbitrage opportunities with no collateral.

Investing -> eToro -> Allows users to invest in cryptocurrencies and stocks. They also have a feature where you can copy trades made by “professional investors” and the quotes are used there for a reason…

pay -> GoCardless -> Makes it easier for businesses to set up and receive recurring payments (direct debits) from customers.

save -> Celsius Network -> Allows users to deposit their crypto and earn earn interest paid out monthly (currently 4.4% APY for BTC and 6.35% APY for ETH)

Insurance -> Marshmallow -> A car insurance company that uses a proprietary pricing algorithm to give users fair prices no matter if they are immigrants, expats, nomads etc.

Sweden

Payment: Klarna, is used by most web shops to accept payments by card, bank transfer, invoice etc. Also offers a free payment card and app to customers.

Savings: Dreams, an app that helps users set goals for their savings.

Investing: Opti, an investment robot app.

Borrowing: Brocc, peer 2 peer lending and borrowing.

Lending: Brocc, peer 2 peer lending and borrowing.

Insurance: Insurely, gives the user an overview of al insurances they have at different companies and suggests what kind of insurances you might need.

- South African FinTech companies

- Pay

- Fivewest

- Global payments

- get your money to where it needs to be with minimal fuss & at a preferential rate

- Global payments

- Fivewest

- Invest

- Easy Equities

- Is an online platform which allows anyone to buy shares in brands and companies

- Easy Equities

- Borrow

- Rainfin

- Peer to Peer lending

- Rainfin

- Save

- Luno

- Pays returns on crypto assets held in savings accounts

- Luno

- Lend

- Fivewest

- Returns to high net worth investors willing to lend coins for a fixed duration.

- Fivewest

- Insure

- Naked Insurance

- App for online & home and vehicle cover

- Naked Insurance

- Pay

Pay:

CLOVER NETWORK

Is an all in one payments solution to small business that allows them to take payments invoicing and transaction online orders.

Invest:

COINBASE

Is an online platform for purchasing, trading and managing digital currencies. Provides its users with secure mobile access. Includes a wide range of options in cryptocurrencies to purchase.

Borrow:

MAKERDAO

Allows its users to borrow Dai currency through locking up crypto assets as collateral.

Users can repay their DAI + Fee to retrieve collateral.

Lend:

SYNTHETIX

is an issuance platform, collateral type and exchange that allows users to mint and range of synthetix assets. Synthetix crypto are used to mirror the value of the crypto asset of choice while tracing the price it is used whole lending as a form collateral hedge.

Insure:

NEXUS MUTUAL (NXM)

Nexus Mutual is an eth based platform that creates insurance products with community driven management and financials. Nexus Mutual products features Smart contract coverage, which protects against smart contract vulnerabilities for smart contracts uses on various DEFI platforms.

Save:

UMPQUA BANK

Is an evolutionary bank, that is merging and adapting through changing times. Its your typical community feel bank that allows you to transact, save and deposit with services you’re most familiar too. Its a great bank to look into and take benefit of.

- PAY: PayU is a fintech company that provides payment technology to online merchants. It allows online businesses to accept and process payments through payment methods that can be integrated with web and mobile applications. Used by the biggest online auction platform in my country- allegro

2.INVESTMENTS: Polish trading platform- XTB one of the largest stock exchange-listed FX & CFD brokers in the world, providing retail traders instant access to hundreds of global markets.

-

Borrowing: Provident- Provident Polska is a large, international financial institution, leader on the cash loan market, well known for their quick, instant loans for short period of time (apparently with high interest so not best to choose:))

-

SKOK- an unusual combination of features: it is a bit of a cooperative and a bit of a bank.

SKOK, is a cooperative savings and credit union, is a cooperative institution belonging to a wide group of financial institutions. The purpose of the SKOK is to collect the money of their members only and save (it is very small percent and I would never put there my money :)) -

Lending- www.finansowo.pl- peer2peer online platform, project introducing the idea of "social lending" to the Polish market. Simply put, our service allows for granting loans between individuals without the intermediation of banks - offering customers speed, simplicity and convenience.

6.Insurance- ERGO Hestia is made up of two insurance companies: STU ERGO Hestia SA and STU life ERGO Hestia SA. The companies of the Group offer insurance for individual clients in the field of property and life protection, as well as for industry and small and medium-sized business

1 - Array - transparent and secure ways to shop online.

2 - Argyle - allows employees to instantly connect their information to a single application

3 - Clyde - everal plans for business customers to choose from and a wide-ranging network of insurance carriers offering extended warranties and accident protection

4 - Yapstone - simplify global transactions and payment integration for industry-specific businesses

5 - Nerdwallet - financial tools and services, including credit card and bank comparison, investing how-tos, loan information and mortgage advice

6 - Greensky - consumer- and business-facing loan service

I live in China which is an interesting ecosystem when you combine innovation, commercial acumen and sometimes heavy government ‘engagement’ in the financial and economic space.

Ant Group, affiliate of Alibaba, is probably the standout player for now, offering most of the facilities associated with banking, with social credit monitoring thrown in as an extra! I’m sure that as I progress through the course and learn more that other names and companies will serendipitously come to my attention (and/or fall by the wayside depending on their ‘appropriateness’)

Pay: Paytm PhonePe GooglePay Mobikwik etc. These use India’s UPI(unified payment interface) for making payment easy and accessible to everyone. Just scan and pay from phone.

Invest: Zerodha,ICICI direct for stock market investment.CoinDCX,Wazirx for crypto investment

Borrow: OfBusiness

Save: Jupiter Fampay

Lend: LendingKart,ZestMoney. With ZestMoney I can buy stuff from E-commerce and pay the amount later making it essentially a lending platform.

Insure: PlumHQ Helps small organisation employees get insurance products which is generally not provided by the organisations

Payments

Google/Apple Pay

- You don’t need cash, a wallet, or even a card. If you have your smartphone, or smartwatch, you can transact with those.

Saving

Raiz/Acorns

- Raiz does something similar to Spaceship, however the novelty here is that they round up your payments, and put it towards saving and investing in particular index funds.

- In my opinion, this is a great way to get people to save and invest without going to any effort, or knowing what to invest in.

Investing

Spaceship

- Spaceship makes the process of investing simple by offering a piece of the pie to their index funds.

- The Platform hooks up to your bank, and you can choose when to invest by choosing an amount and pressing a button, or by scheduling periodic times to invest, so that a piece of your salary goes straight into your Spaceship investment fund.

Borrowing

AfterPay

- Immediate and interest-free borrowing for purchases.

- Instead of funds coming out of your chequing/savings account, Afterpay will pay the merchant, and then you have a credit to Afterpay.

Lending

Marketlend

- Allows people to lend for a specified interest rate. On the backend, they loan this money out to others, in the two-sided marketplace.

- Perhaps they would be better off sourcing institutional borrowers or lenders depending on asymmetric market forces.

Insurance

Cover Genius

- I have honestly never heard of them, and services like Cuvva and Lemonade don’t work in Australia - so sounds like opportunity.

- They have a product called XCover which appears to be an API service which merchants from around the world can hook up to.

- So, this is more directly marketed to merchants - advertising any type of insurance, in any language, anywhere in the world.

Pay -> Twint is a very easy to use app which connects to all swiss bank accounts and allow easy and fast payments for shopping and also between users of different banks

Invest -> SwissBorg, I don’t think I need to elaborate

Borrow-> Cembra.ch seems to be a very quick and userfriendly website where in few click you can borrow money (never used so don’t quote me on this)

Save-> inyova.ch allows to earn money with a sustainable savings plan

Lend-> lend.ch allows crowd-lending peer to peer

Insurance-> did not find anything interesting, the market in switzerland is well covered by online offering of big insurances (maybe I’m not informed enough)

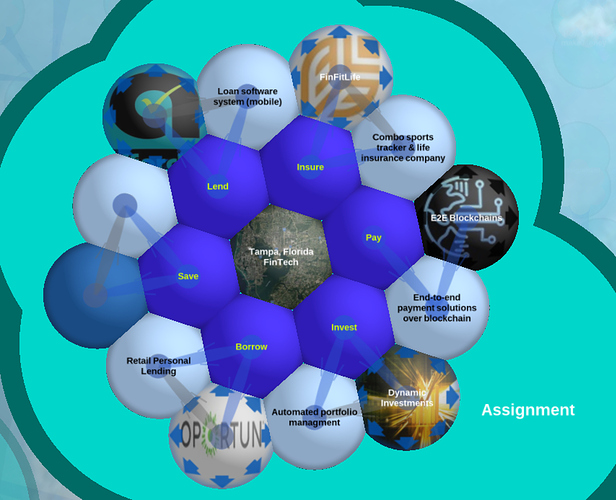

So I looked around on Google Earth for FinTech companies with headquarters within commuting range of my current home. I wasn’t actually able to find a FinTech savings solution…and that may be an opportunity.

- Pay : In my country, there are the following options: Nequi, Daviplata

- Investments: Couldn’t find any

- Borrowing : Movii

- Saving: Couldn’t find any

- Lending : Don’t exist

- Insurance: Rappi

Fintechs for the 6 pillars of finance:

Savings: Edfundo - This basically is a bank account for kids on an app that allows them to store and use their money.

Payments: Beam wallet - This is a payment app like Apple Pay or google pay.

Investment: Sarwa - This app allows the user to manage their investments.

Borrowing: deem.io - This app allows the users to access loans more conveniently

Lending: beehive.ae - This app allows businesses to access loans.

Insurance: axa.ae - This is an insurance app

Pay: Paytm is an Indian payment system utilizing Unified Payments Interface (UPI) is an instant real-time [payment system developed by [National Payments Corporation of India] (NPCI) facilitating inter-bank [peer-to-peer (P2P) and person-to-merchant (P2M) transactions.

Invest: Coindcx is a cryptocurrecy exchange with liquidity of muliple international exchanges.

Borrow: Lendingkart Technologies Private Limited has developed technology tools based on big data analysis which facilitates lenders to evaluate borrower’s creditworthiness and provides other related services.

Saving: Jupiter provides products including savings accounts, investments, and lending services to its target audience.

Lending: Lendingkart is a a digital lending platform for SMEs founded in 2014 by Harshvardhan Lunia and Mukul Sachan. Lendingkart Group compromises Lendingkart Finance Limited and Lendingkart Technologies Private Limited.

Insurance: PlumHQ aims to bridge this gap by helping small organizations to buy insurance products for their organization. SMBs can get insurance quotes within minutes by entering basic information about the organization, a number of employees, and the required insurance benefits.

1)Pay - https://www.pitakamo.online/ PitakaMo provides a wallet based payment solution for consumers, It features a solution for bill payments, credit & debit card payments, online payments, money transfer, mobile top-up, travel booking, insurance management, and more. Its application is available for Android and IOS devices.

2)Invest - https://www.cboevest.com/

3)Borrow - https://www.andeno.com/ Online platform for personal loans. It allows individuals to apply for personal financing by registering on its online platform. It offers loans for vacations, debt consolidations, career growth, unforeseen expenses, and more.

4)Save - https://zenus.com/ Online bank

5)Lend – Sofi.com

6)Insure - https://aseguratec.com/ Aseguratec is an auto insurance comparison platform that lets users compare and buy car insurance online. It has partnered with insurance carriers such as Mapfre, One Alliance, Guardian etc. The company also distributes cancer insurance through the platform

- Payments: Paypal, Stripe, Transferwise

- Investments: eToro, Libertex, XTB

- Lending: Mintos, Estateguru, IUVO-group p2p

- Borrowing: Nibble Finance, Brickstarter, Estateguru

- Savings: Hype, Money manager, Monefy

- Insurance: Nexus mutual, Insur.ace, Facile.it (Finds best insurance quotes for auto insurance and others)

Fintech in Lagos, Nigeria

Payments: Flutterwave

Investments: FarmCrowdy

Borrowing/Lending: Renmoney

Saving: PiggyVest

Insurance: Tangerine

Fintech in Argentina

Payments: Ualá

Investments: Investoland

Borrowing/Lending: Afluenta

Saving: Bondarea

Insurance: 123Seguro

In New Zealand there is a conglomerate called FintechNZ that encourages and supports startups and IPOs and includes divisions like WealthtechNZ and Insuretech and so on.

There is an online company called Sharsies that is quite successful and trades on the ASX. (Investing)

All banks employ fintech through ATMs and general processing. NZ was the first country in the world to adopt EFTPOS in the 80s. Its a good small population to test case a lot of innovations, like skis for instance. New skis get tested in NZ, if they are any good and popular then they roll them out the next season in North America and Europe.

Insuretech is being rolled out but I don’t know the company.

But savings, loans (and borrowing) have existed electronically for years back home.

But as I read more on it, the technological innovation some people are raving about is shortly about to become obsolete with the advent of Defi.

Unless these companies semi adopt blockchain development I think they will go the way of the Dodo.

So there’s opportunity right there.