After you’ve played around with Aave and Compound, let us know how it went for you in the forum. Which protocol did you like more? Were there any things I forgot to cover in the tutorial that I should have? Anything on the Aave site you have questions on? Send in your thoughts and questions and be sure to engage with the other posts as well.

Compound is having troubles loading the Kovan front-end, so I had to interact with the contract through etherscan.

If anyone else is experiencing this, you can interact through here.

Sometimes it does work but there’s some whacky code which means it can’t fetch your token balances or anything, or maybe they’re fetching for the wrong addresses.

Maybe a fun task would be to recreate a Compound frontend that works for testnet.

The front-end might work for Rinkeby testnet… I haven’t tried.

There’s really not a whole lot of differences, except for the token names switching from aERC20 to cERC20.

The mechanics are the same:

Provide collateral (which the standardise to $ value through oracles) => Borrow up to your available amount.

If collateral value < initial collateral value / ratio, you gon get beaten.

It’s worth noting that of these two protocols, only Aave can facilitate flash loans!

After using both Compound and Aave in kovan testnet I prefer Aave’s interface. It just seems a little more user friendly to me.

I actually ran into an issue where I swapped Eth for DAI on the Kovan testnet on Uniswap, but while I saw 200 DAI in my test wallet, AAVE only saw my Eth. Not sure if anyone found a way around this.

It let me only get 20 cents worth of test ETH for Kovan, which could not let me do a lot of testing. But from impression I think Compound is very simple to use, and on the other hand Aave seems more … not complex, but “complex”, as in the vibe. Not a bad thing necessarily.

I prefer absolutely Aave’s interface. It is more simpler than Compund and there for user friendly to me.

I actually found compound’s interface easier to use. I didn’t like that I had to send a transaction just to disable the collateral even though I didn’t have an active loan.

The aave app was really buggy for me, maybe it was because I was trying to use it on firefox instead of chrome.

I like way more the Aave protocol. It just feels more confortable for my taste. But I think both Aave and Compound achieve the goal we want. Thanks for the tutorials they are really helpful !!!

I didnt experience any problem usen de Kovan Net in Compound. But thanks for the insights !

Well the testnet experience is better in Aave!!! lol

Prefer Aave… always have

This is my second time I do Defi 101 course.This is much much better than the previous one where we didn’t learn these practical operations with metamask. Amazing course so far

I tried depositing on both using my metamask test wallet, and found compound’s interface a bit more confusing. Also, and maybe there’s something that I’m missing here - but I there’s no token display of the amount of Day that I supplied to Compound visible on my metamask wallet. Is that because I can only access this information through the compound app? Any help or clarity would be greatly appreciated.

Same here. I just played around with Eth instead.

I had a better experience using kovan test net on Compound. Compound is very minimalist and easy to get around. Aave gives you more tools up front to work with and manage risk. I’d use both.

i lean more toward aave. i like the clean interface and community around the protocol. I would like to get a better idea, or maybe some strategy, on how to borrow after lending in order to lend again for a higher APY. (using the USDC in the video to swap for eth and lend it out for a higher APY that could pay off the lending rate and still have gains left over…)

Aave was better for me. extra transactions e.g to enable collateral seemed unesessary on compound. Had’nt been on defi protocols for this before only binance. I imagined the grab on your small change was a CeFi thing is there no way around this seems so sloppy??

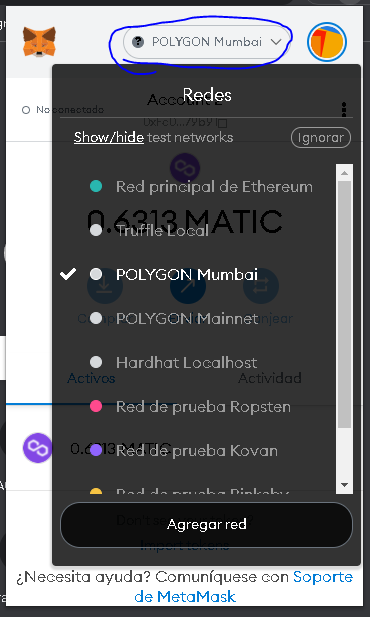

I downloaded Chrome through Safari, but my Metamask wallet won’t show me the Kovan testnet wallet with the 0.1ETH deposited. Regardless I followed along with the tutorial as far as I could and took note of each step. I checked out Compound in the meantime and I honestly prefer the Compound setup over Aave. Regardless, I like how both display the TVL between borrowers and depositors on the very front page (each in just a little different way).

I’ve played around with AAVE and Compound, I had facility with AAVE with the tutorial. I had some trouble with Compound but i finish to figure it out. The best way to understand these app is to try them and play around multiple times !