Hey Amadeo. I just finished your DeFi course and DAI really interests me as a stable coin. im looking for a stable coin to cash out into when we start moving into a bear market in the future. A question that i cannot find the answer for though is what happens if price on all collateralized assets plummits like we have seen in a bear market? is this going to make DAI collapse in on itself?

[ This is a Kovan Testnet transaction only ]

Transaction Hash:

0x7041e3b0db13896c83da83c3eccc9f597cf16febb89601c30443107873314c25

Status:

Success

Block:

23170386 2 Block Confirmations

Timestamp:

12 secs ago (Jan-27-2021 12:44:32 AM +UTC)

From:

0x4d6bb4ed029b33cf25d0810b029bd8b1a6bcab7b

To:

0x9ddfc8c2714752b535a8f85100e232f1be63726c

Value:

1 Ether ($0.00)

Transaction Fee:

0 . 0000945 Ether ($0.000000)

Gas Price:

0 . 0000000045 Ether (4 . 5 Gwei)

Why would people lock ETH on Compound earning a mere 0.14% IPA?

Is it because it is safer on Compound than on an ERC-20 wallet and are ready to do something with that ETH so they don’t want to have it on cold storage?

Is it that they get cETH to keep on cold storage and are earning that interest no matter how small it is in comparison with the risk involved of losing the coins?

THANKS!

I’m not an expert or anything… but I think you have described the risk of lending in a DAO. If all the collateral collapses, they have no way of keeping the number of stable coins in circulation pegged at $1. Thus, everything would be rekt and DAI would be worthless.

While I love the idea that DeFi could provide loans to anyone, anywhere without the annoying paperwork that is involved with trust, the fact is that the borrowing rates are high while the loans are small. The only reason I would borrow from a DAO is if the lending rate was greater than the borrowing rate. At that point, I would take my loan and give it back to the liquidity pool in order to profit from the difference in borrowing and lending rate. On the other hand, lending and getting a good interest rate does sound interesting. If I were to lend, it would be after cashing out at the market peak. Then I’d lend AND purchase insurance on my loan. Seems like you could get way more than inflation’s 2% without much risk.

I have three accounts in MetaMask and I’m trying to connect my MetaMask wallet to oasis.app. Apparently I have to “sign to verify my wallet”, because I’m a new user. However, when I click the Sign button in MetaMask, oasis.app complains that the signature failed.

When I look at the response of https://oasis.app/api/auth/signin, I can see that it comes back with a 500 code and this JSON response :

{“name”:“InternalError”}

I tried this in Brave (shield on and off), Chrome, Safari and the MetaMask iOS app, but no luck. Has anyone encountered this before and/or know how to fix this?

Edit: By the way: I can connect my wallets just fine with uniswap, compound or aave.

Edit21: I used chai.money for the assignment. I converted DAI to CHAI, but I’m not converting CHAI back to DAI for a gas fee of $26.21. I think I’ll just let it generate enough interest to cover the gas fee. That might take a while though.

Using the Kovan testnet I opened a Maker Vault and locked 3 ETH. 0x8297c26527f6be651e27e1eece1ae8ed5d3c011ff0e439c62753706fe607d055

Then generated 500 DAI.

0x8297c26527f6be651e27e1eece1ae8ed5d3c011ff0e439c62753706fe607d055

Then I went to Compound and provided my DAI as supply. It doesn’t show up on my Supply Balance though. Not sure if it’s supposed to show on testnet or not. Does somebody know?

When I try to transfer funds from my Citibank account to Coinbase, the bank simply denies the transfer. Banks are definitely shooting themselves in the foot because customers are going to be annoyed and take their money someplace else.

I created DAI in Oasis:

CONTRACT: 0x6B175474E89094C44Da98b954EedeAC495271d0F

I went on to use Chai and Compound but the fees were higher than the money I had to play with. And Kovan faucet only lets you get 1 DAI a day, so that operation would have taken too long.

I did do one Kovan Transaction, converting DAI to ETH:

CONTRACT: 0x6B175474E89094C44Da98b954EedeAC495271d0F

The rest of the time I was working on the mainnet. I tried many approaches, many transactions, but the high fees made me decide I did not want to park any money in Compound or Chai. To put this in perspective, I was working with just under 40 DAI (39.92 or $39.94 USD) and transaction fees were over $50. This seemed unreasonable. If there is something I was doing wrong, please advise.

In the past I have used the Voyager app wallet to purchase USDC stable coin swiftly and easily. I’m not sure why I would pay $50 for a small transaction with Compound, even though I like the concept.

This was definitely a learning process.

Wow, I am going to rewatch the course and force myself to participate more. I was lost from the git go. I have been a tech guy all of my life but never tech and finance. I think if I retake the course I will know what to really key in on. I was able to grasp some of it which makes me want to absolutely learn it now.

I tried to go through Oasis and sign up and buy Dai. I chose wyre for my region\provider then went to buy My metamask does not popup. Metamaks does show up in my extensions in chrome. What am I doing wrong?

from Amadeo Twitter account:

In my view, the potential ban on stablecoins is a bullish sign that we are moving in a good direction and they can feel the heat … technology is coming to disrupt the legacy financial system whether they like it or not the Gini is out of the bottle.

I believe that this RobinHood scandal, that happen last week, is not gonna cool down the heat?

Thank you for very good course.

This course has been very informative.

It’s amazing to see all the possibilities the DeFi network can already accomplish.

This is definitely a technology that I will keep watching evolving into the future.

When it comes to the assignment, It seems however, it’s a better time now to park the DAI to a supply market on Compound, rather than saving it on Chai, where the saving rates (DSR) are now just at 0%.

As DSR is the reward for providing liquidity to money market protocols, protocols can be created that give rewards for providing economic incentives that increase the growth of crypto capital markets.

Other multi-collateral platforms such as compound, balancer, and so on further contribute to the initiative above. Dexes such as unswap, sushiswap and so on also provide trading pair liquidity contribute to the initiative as well.

Borrowing ideas from centralized exchanges, where staking also provides reserves for the exchange; Dexes, decentralized money markets, NFT markets and so on can provide staking functions in their protocols as well.

When building new protocols and enhancing existing ones, interoperability and bridges ought to be considered to have more network proficiency. And interoperability and bridges can be preferred to isolated networks, if there is a multi-choice of access to different protocols providing different interest rates that are related to desired interoperable tokenomics.

For example, a wallet could have tokens locked in a contract, and still have access to desired interest rates in other protocols without affecting the tokenmetrics of the underlying protocol.

The example above is reminiscent to chai money, but not necessarily the same.

This will reduce opportunity cost for having tokens locked in one protocol for tokenmetrics purposes, especially as an early fund investment, and liquidity provision.

This can also provide access to opportunities to compensate for impermanent loss of tokens in auto-market making liquidity pools. The Sync Network project provides bonds to compensate for impermanent loss at liquidity pools.

Therefore interests in interoperability incentivizing the growth and development of the decentralized capital market as we know it.

Yeah I ran into the same issue. My transactions fees were just as much as total amount I wanted to invest. The fees are related to gas that powers Eth network to compensate the miners. Eth is becoming more popular which is great, however, the demand has skyrocketed the gas fees. Eth is great, but this is one of its current issues that need to be addressed if its going to be adopted by the masses.

HELP! I must be missing something.

I understand the mechanics of the class but what I don’t see is how this relates to real world lending at this point. In the real world, let’s say I need to borrow value (money) to buy an asset (building). So in order to get a loan I need to deposit 150% of the value of what I need to borrow in equity. In this world of decentralized finance I can not deposit the building as collateral. I would need fiat currency to trade for ETH and then deposit ETH into this system. Well… this still ties me to a traditional lender. The traditional lender takes the value of the building as the collateral. So how is this decentralized finance helping the masses?

Question #1 if I have this equity why do I need the loan?

Question #2 If the value of my collateral (ETH) drops by 30% or so I take a chance that my loan will be liquidated. why would I do this. This is a fools gamble and makes no sense to me.

So I get the mechanics of it but until I can see the real world scenario of how this would be applied it makes no sense to use this at all.

In doing this exercise I spent way more to move a little money around than the amount of money I was moving.

So at this point I’m not sold on this as a viable lending institution for real life and the masses.

So tell me what I missed?

I’m trying to see the forest for the trees!!!

I could see the benefits but right now ETH gas fees are in excess of $100 USD which is prohibitive not only for buying alt coins but also for completing an exercise like this for the rate of return expected.

This was some dense information, and difficult to follow at times.

Seems that much of it is close to being outdated too, with ETH gas fees up where they are, and many new ideas getting out there into the market.

I believe ETH-2 is going to address much of the gas fees problems.

https://mempool.space/ as described on a recent Stephan Livera is looking into some way of addressing this.

Thanks for an amazing course. Looking forward to see this space evolving and off course with the general inflow of people you have to evolve the system so that it functions better.

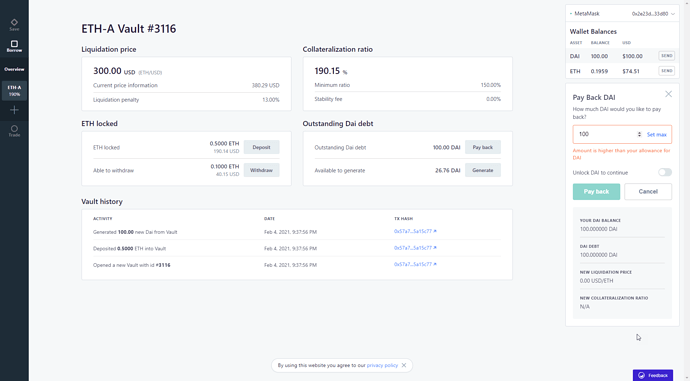

Hi @amadeobrands i cant pay back my debt in the kovan network and dont understand why… maybe you or someone else know why?

thx