What is a trading exchange?

An exchange is a marketplace where securities, commodities, derivatives and other financial instruments are traded. The core function of an exchange is to ensure fair and orderly trading and the efficient dissemination of price information for any securities trading on that exchange. Exchanges give companies, governments, and other groups a platform from which to sell securities to the investing public.

What do brokers do?

A broker is a person who buys and sells things on behalf of other people. A broker may also arrange transactions between a purchaser and vendor. After the parties have completed the deal, one of them pays the broker a commission

What is margin trading?

Margin trading is when you buy and sell stocks or other types of investments with borrowed money.

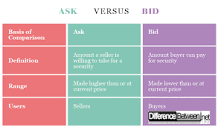

What is the difference between Bid and Offer (or Bid and Ask)?

The term bid and ask refers to the best potential price that buyers and sellers in the marketplace are willing to transact at. In other words, bid and ask refers to the best price at which a security can be sold and/or bought at the current time.

BID = Price at which buyer is willing to pay.

ASK = Price at which seller is willing to sell.

What is the leverage?

Traders use leverage to get bigger returns from small investments. They only provide part of the capital needed to open a position, but this cash deposit is then magnified – or ‘leveraged’ – so the profit or loss is based on the total value of the position. If all goes well, the final return could be much greater than your initial cash stake. But if it all goes wrong, then so could your losses.