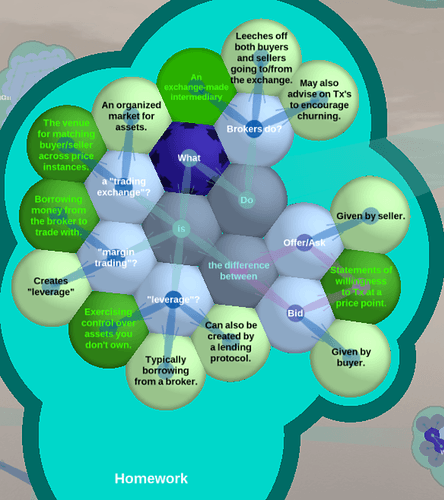

- What is a trading exchange?

Exchanges help us trade a wide range of financial instruments. There are two

types of exchanges depending on the controlling authority. DEX and CEX.

- What do brokers do?

Brokers are intermediary that facilitate trading between buyers and sellers.

They are provide some services while facilitating trading and in return they

take fees.

- What is margin trading?

It just a trading by borrowing money from a broker. It needs a collateral to borrow

for margin trading.

- What is the difference between Bid and Offer (or Bid and Ask)

Bid is the maximum amount a buyer can offer to trade a financial instrument.

Ask is the minimum amount a seller is ready to sell his/her financial asset.

The difference between the ask and bid is called the spread. The less the spread

the more liquid the asset is.

- What is the leverage?

Leverage is trading by borrowing money to increase the return on investment.

If not doing it properly, then there’s a chance you could get liquidated. In

other words, you could loose your money.

What is a trading exchange?

What is a trading exchange? What do brokers do?

What do brokers do? What is margin trading?

What is margin trading? What is the difference between Bid and Offer (or Bid and Ask)

What is the difference between Bid and Offer (or Bid and Ask) What is the leverage?

What is the leverage?