- What is MACD and how is it used?

MACD stands for Moving Average Convergence Divergence, and it is a popular technical indicator used in trading. The MACD is based on the difference between two exponential moving averages, typically a 12-period and a 26-period moving average. The MACD line is the difference between these two moving averages, and a signal line is typically added to the chart, which is a 9-period moving average of the MACD line.

The MACD is used to identify changes in momentum, trends, and potential buy or sell signals in the market. When the MACD line crosses above the signal line, it is considered a bullish signal, indicating that it may be a good time to buy. Conversely, when the MACD line crosses below the signal line, it is considered a bearish signal, indicating that it may be a good time to sell.

- What is the difference between MACD and RSI?

While both MACD and RSI can be used to identify potential buy or sell signals in the market, they have different strengths and weaknesses. MACD is better suited for identifying trend reversals and changes in momentum, while RSI is better suited for identifying overbought and oversold conditions.

- What is OBV and how is it used?

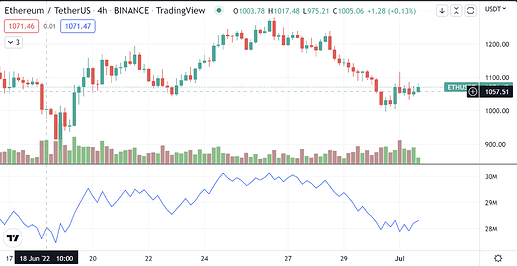

OBV stands for On-Balance Volume, which is a technical indicator used in trading to measure buying and selling pressure. The OBV indicator calculates the cumulative total of the volume of a security, where each day’s volume is added or subtracted from the previous day’s total, depending on whether the price closes up or down. The idea behind the OBV is that volume should increase when prices are moving in the direction of the trend and decrease when prices are moving against the trend.

The OBV can be used to confirm trends and identify potential trend reversals. When the OBV is trending higher along with the price, it suggests that buying pressure is strong and the trend is likely to continue. Conversely, when the OBV is trending lower along with the price, it suggests that selling pressure is strong and the trend is likely to reverse.