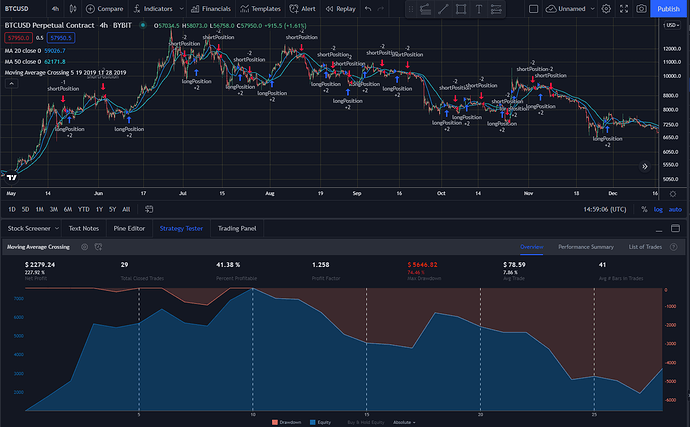

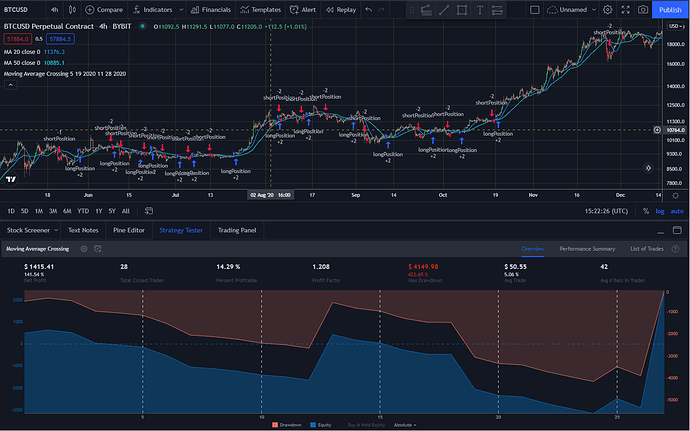

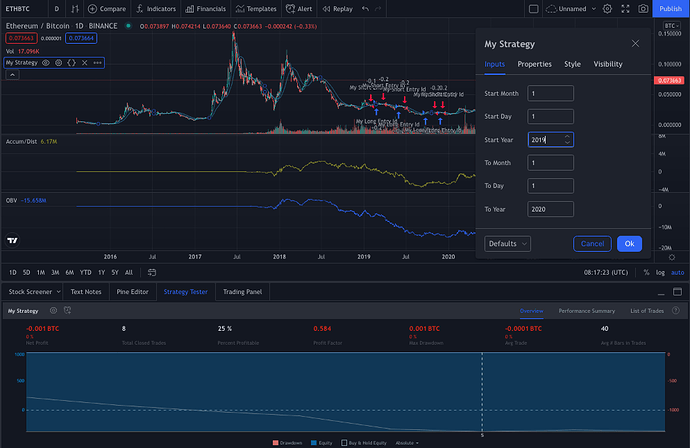

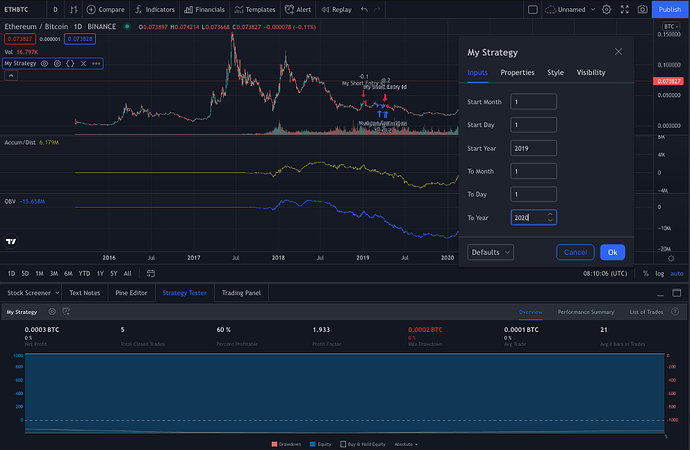

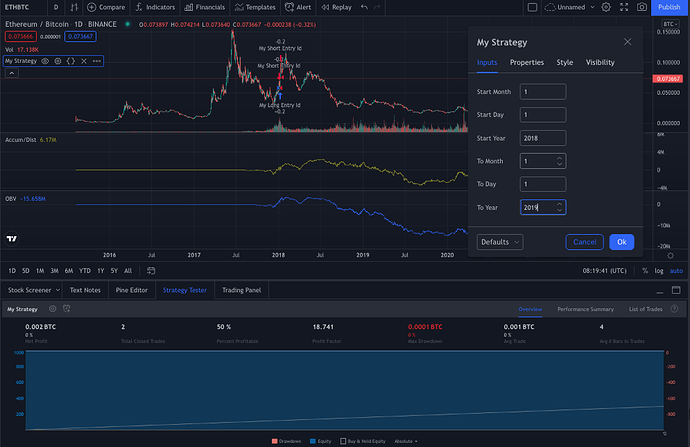

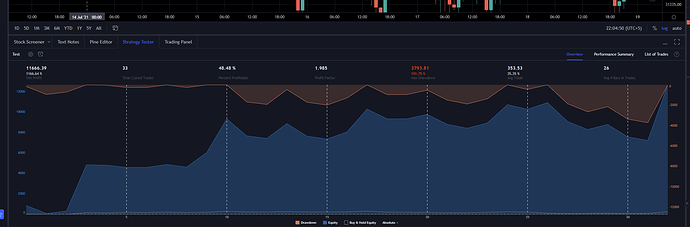

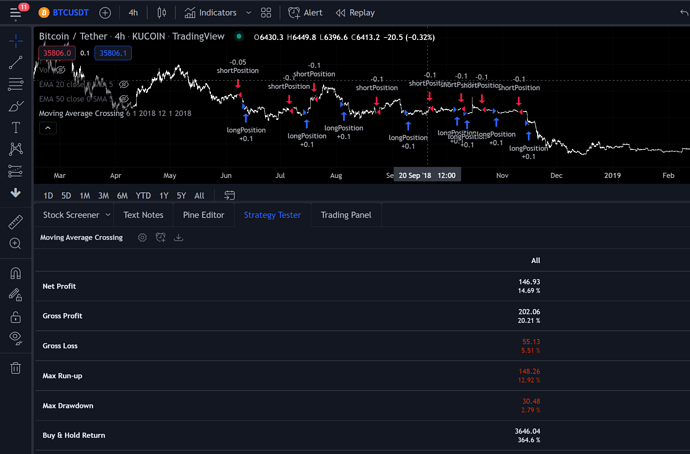

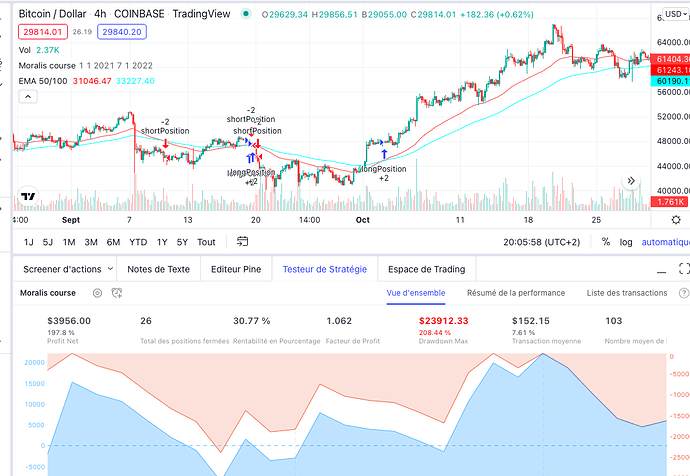

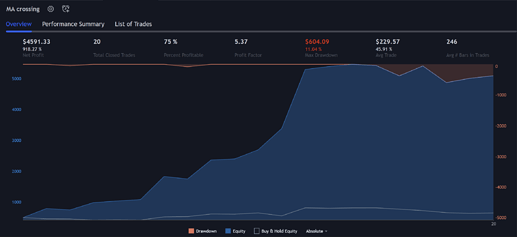

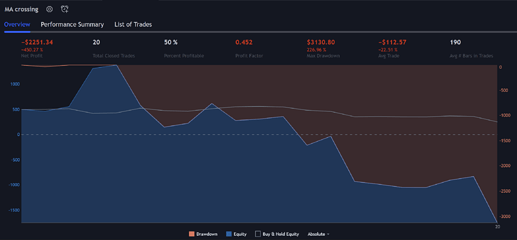

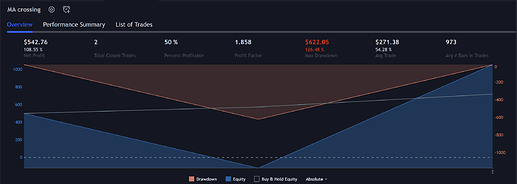

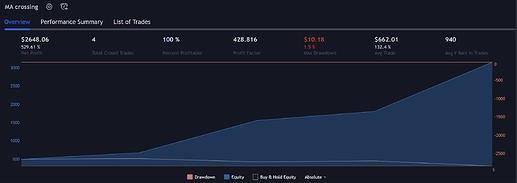

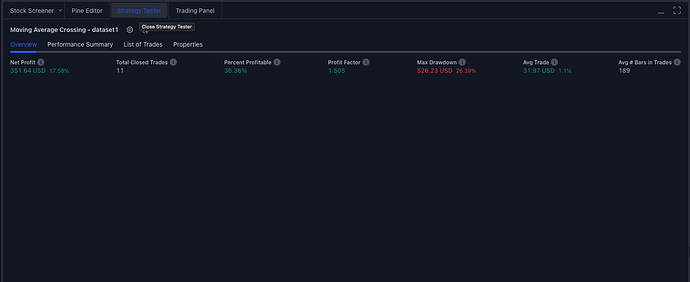

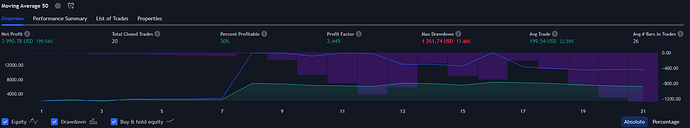

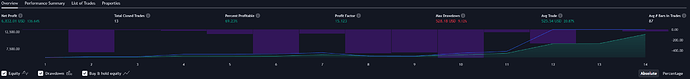

This was interesting… I played around and smaller data sets looked fairly promising, but then implementing is on a full year, the results didn’t pan out so hot… fun exercise and figuring out how to be better with stop-loss could potentially improve this!

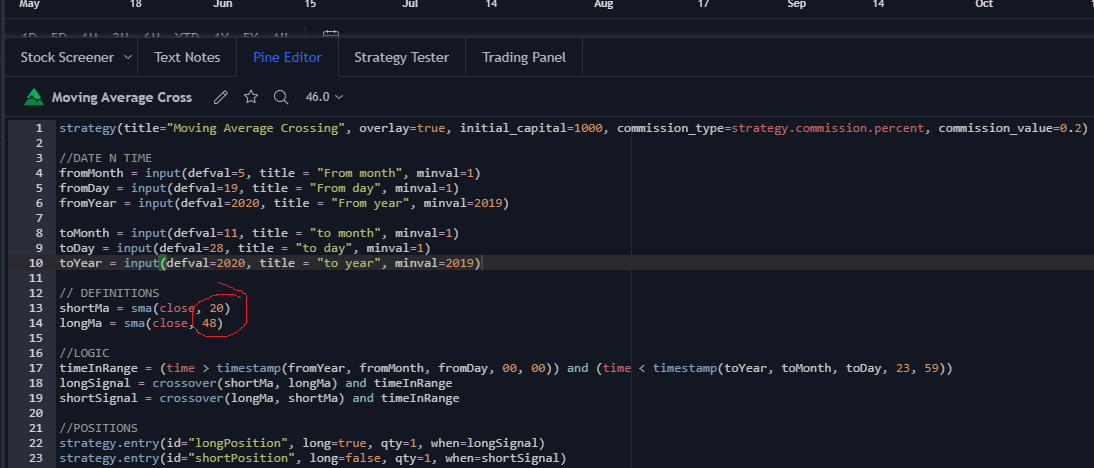

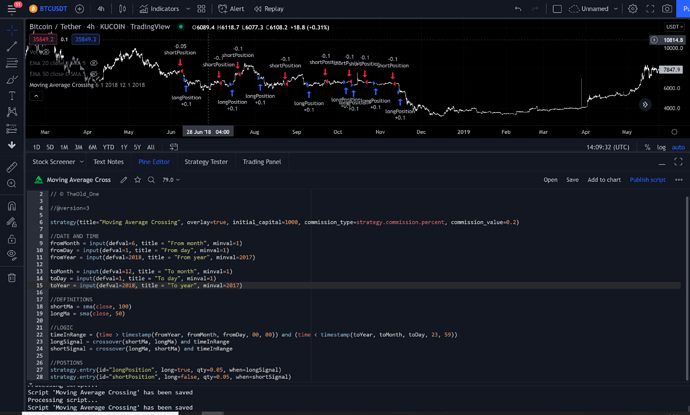

//@version=4

strategy(title="MA Crossing Strategy", overlay=true, initial_capital=1000, commission_type=strategy.commission.percent, commission_value=0.2)

//sma inputs

shortVal = input(defval=20, title="Short SMA", minval=1)

longVal = input(defval=80, title="Long SMA", minval=1)

//Date and Time

fromMonth = input(defval=2, title="From month", minval=1)

fromDay= input(defval=15, title="From day", minval=1)

fromYear= input(defval=2021, title="From year", minval=2014)

toMonth = input(defval=9, title="To month", minval=1)

toDay= input(defval=15, title="To day", minval=1)

toYear= input(defval=2021, title="To year", minval=2014)

tsiLong = input(title="TSI Long Length", type=input.integer, defval=25)

tsiShort = input(title="TSI Short Length", type=input.integer, defval=13)

tsiSignal = input(title="TSI Signal Length", type=input.integer, defval=13)

//Definitions

short=sma(close, shortVal)

long=sma(close, longVal)

price = close

double_smooth(src, tsiLong, tsiShort) =>

fist_smooth = ema(src, tsiLong)

ema(fist_smooth, tsiLong)

pc = change(price)

double_smoothed_pc = double_smooth(pc, tsiLong, tsiShort)

double_smoothed_abs_pc = double_smooth(abs(pc), tsiLong, tsiShort)

tsi_value = 100 * (double_smoothed_pc / double_smoothed_abs_pc)

//Logic

timeInRange=(time > timestamp(fromYear, fromMonth, fromDay, 00, 00)) and (time < timestamp(toYear, toMonth, toDay,23,59))

//buy=short >= long

longSignal = (crossover(short, long) or crossover(tsi_value, ema(tsi_value, tsiSignal))) and timeInRange

//sell=long >= short

shortSignal = crossover(long, short) and timeInRange

//Position

if(longSignal)

strategy.entry(id="longPosition", long=true, qty=0.1, comment="buy")

strategy.exit("longSignalExit", "longPosition", comment="longOut") //, profit = 5000000

if(shortSignal)

strategy.entry(id="shortPosition", long=false, qty=0.1, comment="sell" )

strategy.exit("exitLong", "longPosition", profit = 500000)

//Stop-Loss

strategy.exit("exitLong", "longPosition", profit = 500000) //, loss = 100000

strategy.exit("exitShort", "shortPosition", profit = 250000) //, loss = 100000

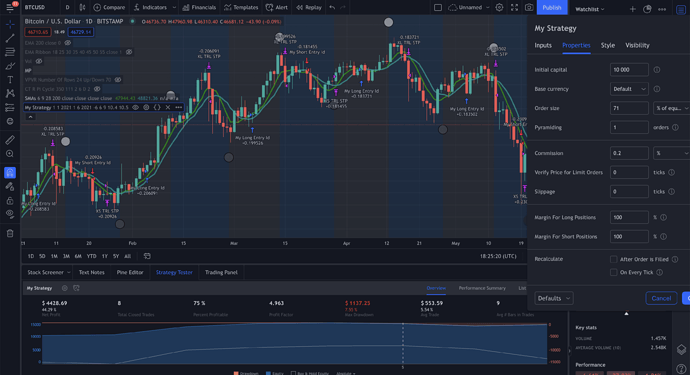

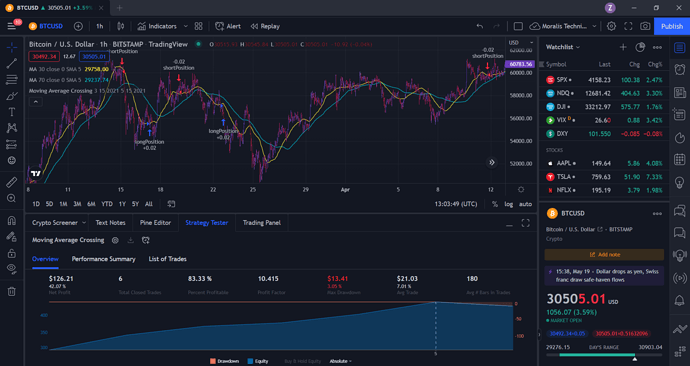

On 1 hr BTC I got:

58% NP, 45% profitable, 1.1 profit factor, 80% Max Drawdown

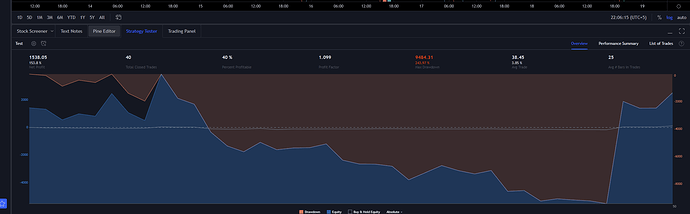

1hr ETH yielded: 4.83% NP, 35% profitable, 1.1 factor, 22% max drawdown