Hi everyone,

I am completing the course on TA, and I have some questions about understanding long and short positions still. I understand that a long position, is one where we’d like to enter the market, and for the market to go up in value (by generating money through holding), and that in a short position, i understand that we’d like to exit the market, and sell at a certain point to make profit from avoiding loss. However, in trading view (but this also seems to be what happens just as people trade), why would there be a third level? For example:

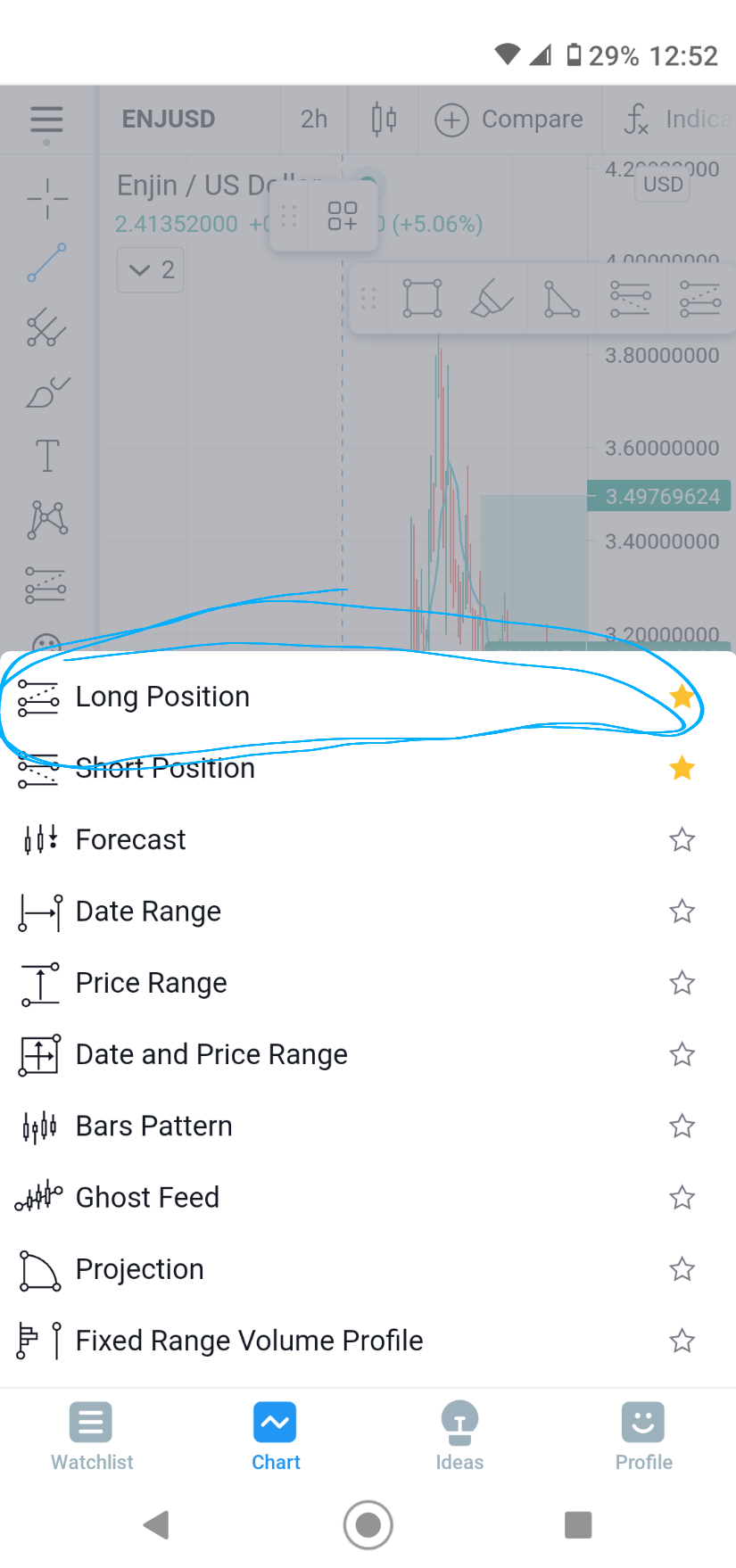

long position: OPEN at price X, purchase when it dips to price Y. Why is there a top line that indicates another level to be reached for something to happen? (is that triggering a sell order??)

short position: OPEN at price X, sell when it jumps to price Y. Why is there a bottom line that indicates another level to be reached for something to happen? (is that triggering a buy order?)

essentially, from what I understood is that a L/S stop/limit/loss orders made one move in a sequential order of moves that a trader makes to turn a profit. In this model, it seems that two ‘moves’ are being made?