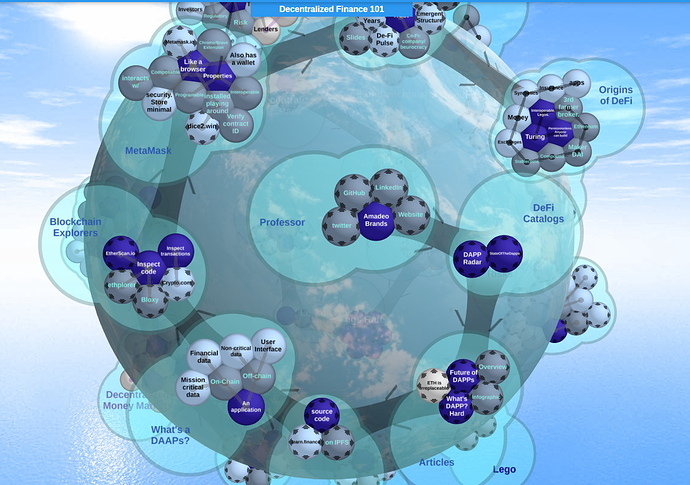

I ball-up all my notes. Just my way of putting my own spin on things. My old Fundamentals of Blockchain sphere is so vast that ThortSpace uses it in their release testing.

Further thoughts; NFT’s are going to get plugged in soon. Its just a matter of which Lego they fit with. It seems like all the legacy ERC-20’s need to be re-engineered to fit in with De-Fi. For example a wrapper protocol that mints ENJ from Compound from DIA from ETH so your in-game NFT collectable dohickey is now earning interest as another ‘leveling up’ vector…‘antique’ items would then intrinsically be more valuable. I’d call that ‘NOS’ for ‘ENJ’ and backronym it to “iNtrest Offering System”, or 'Non O-some Symbol".

REAL-T fascinates me as well. But it’s too…limited. It will take centuries to get all real estate into the system.

Imagine a synthetic geo-coordinate token linked to GPS, XYO, or 3-word grid squares, world-wide. Each location token could lock-up ETH/DIA/etc. to post augmented reality content to it’s tile at its real-world coordinates. All subsequent content pays a small posting premium to content lower in the tile’s stack, and to all the content on neighboring tiles. It becomes a network-effect-driven pyramid scheme, with real-world high-traffic locations costing more to post new AR content to. AR users could then select items or sets to experience at each location. Posts are just on-chain links to a centralized server where the real AR content is hosted, ala ENJ, but possibly in IPFS? Content is either free funded as advertising or pay-per-experience to the content creators. LOTS of Lego in that one, cross-chain if we’re talking XYO. But somebody’s got to do it open source and blockchain resolved before some stupid FAANG company absolves the whole earth into their walled AR/XR dystopian surveillance garden Niantic .

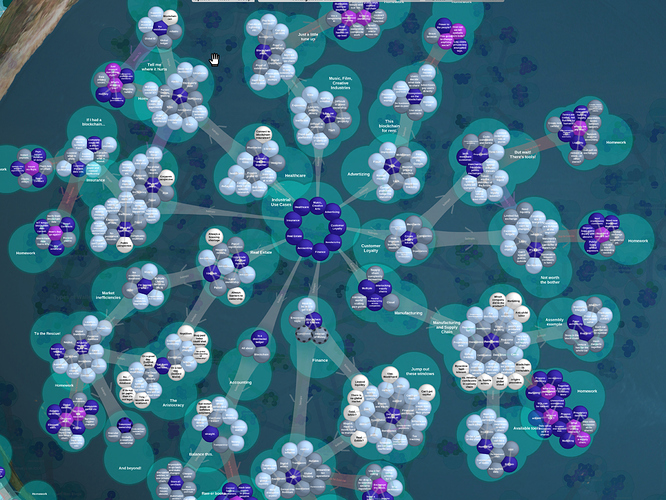

I grew up on Legos in the 70’s. It’s why I’m a rocket scientist, and a coder, and an artist. The whole “financial Lego” meme is really starting to turn my gears.

Interest-bearing supply-chain tracking anyone? The value in logistics is when things move. So the system should take out huge flash loans to earn bursts of short-term interest discretely only during transactions where items change hands, not as they sit in a warehouse…

Geez. SO many ideas…

Would like to talk with others about some idea’s i have for a DeFi project, message me. Love

Would like to talk with others about some idea’s i have for a DeFi project, message me. Love