It’s just a web3 front-end. Zero solidity for that feature. We’ve a utility token, but all that does is zero out our 1Inch referral fee if we find it in your wallet. Meanwhile the token (since the course talks “tokenomics”) it’s designed to be anti-speculation and hard to pin a “security” label on it. It’s a bonding curve but extremely flat and linear. It’s minted in whole tokens (zero decimals) using USDC. It deposits USDC proceeds from minting at AAVE and our company keeps the interest. Meanwhile the price increases (barely) linearly with issuance. So you could technically pump and dump it. But USDC is never destroyed. And it takes a LOT of USDC to move the price as in $100,000 USDC moves the token price all of 70 cents. We’ve a 10 block hold vs. flash loan attacks so don’t even think about it. Whole thing runs on Polygon to dodge gas fees, but we’re having problems with network capacity in testing (“demand shocks”). You get what you pay for. No free lunches.

Base jus on user friendly i will keep this order.

- PancakeSwap

- SushiSwap

- Uniswap

- QuickSwap

Besides Pancakeswap already integrate limit orders to their dex , so that is super helpful for traders.

I’ve never personally used any of the Dexs discussed in this video. I did use EtherDelta/ForkDelta back in the day and remember how bad that exchange was. With that said, I was still able to handle some of my buys/sell when needed on those exchanges. I’m sure any of the Dexs mentioned in the video are far superior to Ether/Fork Delta.

He mentioned Binance’s BSC in the video and how centralized it is. I generally do most of my transactions through my SafePal wallet which has a binance exchange built in. I do like how cheap and fast BSC is compared to Ethereum. It’s a way better user experience. The gas fees for Eth are quite high, especially when the market is good. And quite slow. There is going to have to be some serious improvements in those areas in order for crypto to really become mainstream.

Uniswap is good if you’re doing trades on the ethereum blockchain, Pancake Swap for BSC I like pancake swap due to the features it has like predictions, NFT Markets, IFO’s etc. they create more usage and utility for the Cake Token, I tend to use Uniswap for Ethereum ERC-20 Tokens, there are other swaps too such as Shibaswap, Dojoswap which are all created from the Uniswap V2 frontend mainkey is to use a swap that makes a transaction successfully go through, is user friendly and able adapt to price changes and slippages immediately before a contract can be executed or else the risk would be having your swap transaction failing.

No experience yet on any of them, but did pause the video to go and look up Balancer website. It does look very interesting and will definitely be checking out more. At least now I believe I will be able to understand how to obtain some small cap coins if I want to.

I have used all except Quickswap. I liked PancakeSwap’s interface the best but do not like the fact that its centralised. I enjoyed Uniswap but not the high transaction fees.

niceeeee loooking very vwry good your UI skills are gettin better and beter ep it up

thoughts on 4 dexes:

Uniswap and Sushiswap have almos the same UX design.

however Sushiswap appears to have more features lately

Quickswap (appears a fork from UX design perspective from UNI)

it is simple to use and easy to understand the swapping and LP pool mechanism and APY

overall Quickswap, Sushiswap and Uniswap had a similar user experience. however haven’t use them.

however i don’t use them due to expensive gas fees for the amount I could invest.

I wasn’t very sure about Curve and Balancer so I have never used it due to it’s low yield ( i am a bit of a degen)

Curve interface is like the old 80s looking; which i like it however it was very complex to follow all links and buttons. I get confused to use Curve Dapp

the one i used more was pancake swap:

- cheap fees

- analogy of cakes and syrup was easy to follow

- interface was easy to follow; however on my beginnings I didn’t understand how to see LPs

- I like the staking of cake and compouding

- also staking cake to earn other interesting tokens (harmony, ada, dot) when those were in cents value

a drawback is the swap fees have increased and it’s mainly centralized however transactions were are fast. I just realized that they charge a % of bnb and also a% from the token you are swapping; incurring into 2-3% fees

from other chains I used:

traderjoe (avalance)

spookyswap (fantom)

reaper (fantom)

tomb.finance (fantom)

maiar.exchange (elrond) although it seems centralized i found it the closest to BTC

raydium (solana) great pools, swap and dexes and also airdrops

aldrin (solana) great pools, swap and dexes

solidly (fantom) was great new concept of LPs however it was another Andrew Conje saga.

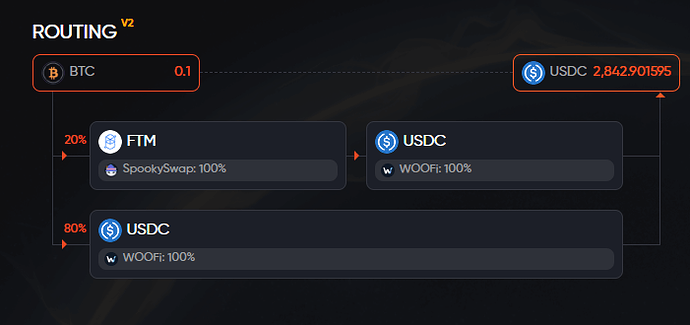

Used all of them multiple times. All basically the same. I will usually swap using a dex aggregator that break up transactions across multiple exchanges and really reduce price, see example below

I don’t have much experience with DEXs as I pretty much have mainly dealt with the centralized exchanges. However, as fees keep rising to move your crypto around I decided to take the plunge and educate myself regarding DEXs before I jump in. Anyways, regarding the assignment, the DEX I enjoyed interacting the most with would have to go to pancake swap, it’s a toss up between uniswap and sushiswap and quickswap I viewed as the DEX that you used when you needed to get stuff done ASAP. In the future I plan on using these four plus any others that will give me a leg up in this space.

sushiswap i havnt used much but its user friendly and i like the design. uniswap i have used and is my preferred as of now. quickswap i havnt used but i like the polygon network so i will probably be using it in the future. pancake swap i probably will stay away from. i do not like binance at all

I have limited experience with the named exchanges. I mainly used Sushiswap and Uniswap and i preferred Sushiswap.

quickswap is great to save on gas fees though the same could be said for sushiswap if used on a chain with cheap fees as well (ex. harmony). due to the same reason, Uniswap isn’t readily available to all end-users due to ethereum gas fees.

Spookyswap provides a lot of interesting trading and yield farming usecases to retain useers.

I actually have not used any DEXs as of yet. I would probably start out using QuickSwap as it seems to get a lot of positive reviews

I have yet to use any DEXs and look forward to learning more about each one. From the video it seems like Uniswap and PancakeSwap are the ideal ones to use, however, each has their own pros and cons.

I have used Pancakeswap a lot, because of how family friendly their website is, and how easy it is to use (the fact that they don’t charge you 80 dollars per transaction in bull market also helps;)).

At the beginning I used uniswap a lot, and I found it very easy to use, and very intuitive.

I have used Sushiswap some times when I didn’t find liquidity for some token in uniswap.

And quickswap I have used it very few times, only because of the low commissions.

After all, if you find something simple and easy to do, you will always prefer to do it rather than something you are not familiar with.

I never used any of the 4 DEX that’s covered on this topic but I’m hoping to one day use them. I do have a question that I’m curious though. Since this exchange is only on Ethereum network and Ethereum classic has a huge amount of gas fees (would be my only guess as it’s major downside). Now that Ethereum 2.0 is released do you guys think it will greatly replace CEX?

I’ve never used these DEXs before, so it’s hard to tell from a trade UX perspective. I will answer this question when I’ll use them.

I have not used any of the DEXs mentioned. I don’t like projects based on surveillance (Ethereum). I have had no need to use the DEX . Some assets are not there.

Uniswap, Pancakeswap, Quickswap, HOP