Uniswap is the only DEX I’ve used so far, although I’ve heard a lot of buzz around PancakeSwap and it’s friendly experience for DeFi users. The few times I’ve used Uniswap, it was a very simple and easy process to initiate trades. A cool aspect of these DEX’s is that one can gain investment exposure to up-and-coming projects much quicker than exchanges, such as Binance or Coinbase, can be updated with.

I personally like pancake swap, i’m pretty new to crypto and dexes, it’s less stressful to tade with cheaper fees. I personnaly like the interface of Pancake swap, I find it nice with vibrant colors.

For sure it’s not ideal, i know there is some issues about centralisation on the Binance smartchain but as long as Uniswap will continue to have such high gas fee i will remain less pleasant to use !

- About the video, of Finematics, i will study more about the DEXes so i can really understand everything that it’s explained, but it’s a real awesome video. I’ve never used a DEX, so i don’t have any experience or opinion to share but when we talk about finance, capital efficiency is something that people expect about DeFi; and the V3 of Uniswap seems to be the most interesting project around. So i will try it and then i let my impressions here. But i really need to study Liquidity Pools and AMMs to have a clear impression about the subject but it’s really interesting - and yes, i’ll probably have a bunch of questions about it… -

To be honest, I’ve only tried Pancakeswap at the beginning when I started to learn about DeFi. Quite straightforward for a newbie. I’ve heard of SushiSwap and Quickswap, but never tried or visited them. However, Uniswap… well, maybe it’s because I only had a couple of hundred to play with, but horrendous fees (a few swaps and I’m outta money haha) turned me away from it.

Nowadays, I use Solana, and Orca seems like something my grandparents could use.

I am new to the defi space and never used any of the four dexes, how ever after skimming through the four and looking into the dev teams involved with them and seeing what they have to offer on the dapp side of things I was most impressed with sushi swap. particularly with the bento box dapps. However as time goes and I interact with these DEXES my opinions on them are bound to change. Side note what’s the deal with sushi and pancake swap trying to make everyone hungry while trying to stake their crypto😂

- Uniswap. The original and most trustworthy on L1. V3 also available on Polygon which works excellent

- Quickswap. Fantastic to use and great farming opportunities. High trust on L2.

- Sushiswap. have used but always found the fees to be a bit higher than expected.

- Pancakeswap. Never used and never will. I don’t trust BSC at all.

I enjoyed navigating through the various dexs

I liked pancake swap and sushi swap.

It looks like you can use Polygon on Uniswap now, so this should mitigate the high fees, no?

Since I don’t use the Ethereum network very much I am only a basic users of these, so the elegant simplicity of the Quickswap interface works best for me. It’s interesting reading about the features other DEXs have tried out though.

I have used Uniswap and Quickswap and continue to use which ever one has lower gas fees. They are both kind of the same and it seems just a matter of timing, so its worth it sometime to enter in to the swap more than once to see if the fees reduce next time. I’ve found this works to a cheaper trade sometimes. If it get more expensive I don’t do the swap and wait for a later time.

The Uniswap experience has improved a lot with V3.

I have used all 4 of the dexes mentioned. I would say my favorite one to use is Uniswap v3 due to the brilliant design of their concentrated liquidity pools. Being able to provide liquidity in a specified price range can be very powerful if used correctly. Otherwise, they are all pretty similar and provide essentially the same function when swapping tokens.

I haven’t used any of the 4 DEXs mentioned in the video as I’m still trying to educate myself on this and then come up with some sort of strategy / plan.

I would say that Uniswap V3 would be the most trusted DeFi DEX as it has been around the longest and has the most adequate liquidity so I look forward to learning more about this DEX and using it.

I don’t mind using Pancakeswap due to the lower gas fees, however, this is owned by a centralised exchange so I do have my doubts and some may even argue this isn’t DeFi!

I like uniswap 2/3

I also like paraswap.io DeFi aggregator that unites the liquidity of decentralized exchanges and lending protocols into one comprehensive and secure interface and APIs.

your remark on pancakeswap isnt entirely true. the team is anonomus but there are backed by binance, but this has nothing to do with its centrality. the pancake protoocl is governed by smart contrcts which are secure and have been audited by the best in crypto. therefore the qctual panckae protoocl like all (mainstream) dex protoocls are out of the control of the creators in a lot of ways, instead of some admin functions in the smart contracts. they are however based on the binance smart chain which is developed by the binance exchange which is centralised. many people dont like BSC for this but to say that panacke swap itself us centralised is incorrect

I have used only Pancakeswap, didn’t use other exchanges so far.

I will have to say Sushiswap because it is cross chain in a way and not as limiting as Uniswap.

UI/UX wise, I love pancakeswap but there is only so much you can do on the platform as it is BSC backed. Quickswap is also great as it gives you an opportunity of buying into some new ETH tokens for a very cheap transfer fees.

I have only used Quickswap so far. I’m trying not to do a lot of swaps or transfers because they are decentralized and not sure how the tax forms work, or if they work at all. Meaning, am I responsible for keeping up an excel spreadsheet of my transactions or is there an easier way. I didn’t find the UI very hard to work with. I guess the only question that I have for now, is how do you keep up with the impermanent loss. Does anyone have a spreadsheet or calculator that is easy to use for impermanent loss.

I have used the 4 DEXs mentioned but don’t really have a favorite. I don’t use it often enough to tell who has cheaper fees. I just go by which one has the trading pair I’m looking for at the time. They’re all easy to use but I do find myself going to Uniswap first since I’ve always had good experiences with it.

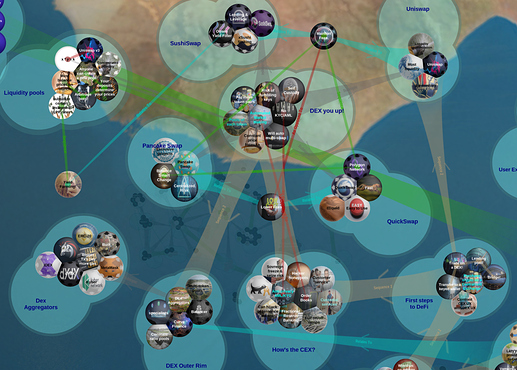

A mind map of my thoughts on the matter.

I’m in the midst of developing a “DEX” (really a 1Inch client). So I took some design and usability notes from the 4 web3 front-end examples. They’re all quite streamlined and address the same basic Tx parameters.

@marsrvr this is very cool. are you trying to implemt from scratch like the lquidity pools or jjust going to write a sapping contract that ececutes via oneinchs functins