I had a difficult time finding anything that is missing from your defi digital stack. I am eagerly awaiting defi to come to the Cardano blockchain and polkadot ecosystem. The SPO model for Cardano’s Sundaeswap I think will be really successful as long as its implemented correctly. Great course lots of information and extra content, thank you!

I have been looking into Cardano ADA Ecosystem and although at this time it is in the early stages of smartcontracts, I am seeing this grow in to something that can be easily adopted by the mainstream financial world. The Cardano scalability, security and and timing to future products in the crypto world is on the brink of braking out. This seems to be the next level and is currently sitting where is belongs at number #3 top crypto. This has many opportunities to grow for lending, part of governments, and new cross chain bridging.

I have been looking on how to ‘short’ crypto and traditional assets with decentralised financial products.

What I have come up with is to borrow product A (which I want to short) with product B, then use product A to trade and get back product B. Wait for the downfall in price and then pay pay product A with a smaller share of B…

Let me know fit that makes sense?

ShibaSwap will become the next DeFi digital finance.

YouHodler only not available for U.S. customers but otherwise the have advanced trading tools, strict KYC, and AML processes and also very important a good customer service.

Hello!

It seems like they have an interesting proposal.

https://casper.network/network

https://arxiv.org/pdf/2101.02159.pdf

Thorchain - https://thorchain.org/ Extremely interesting as a decentralized liquidity protocol.

Deposit native assets into Liquidity Pools to earn yield. The network is 100% autonomous and decentralized.

Hello amadeo , Your course has helped me alot so far with understanding the DeFi jungle!

Im going to lend some crypto on Aave , and use Alchemist cruicible programs!

You also have renewed to me the concept of Decentralized Insurances and helped me to dive deeper into this !

By the way , what do you think about yearn finance fundamentals ?

wondering about who hacked cream… put up a post, but i’m not so savvy at crypto attacks yet…

Nope it will not … watch out…

Yes fully agree …

Agressive attacking of any protocols to other protocols is a red flag for me … we collaborate add value and meritt we do not attack.

I’m enjoying dharma.

[https://www.dharma.io/]

I wonder with stable coins such as DAI since they’re pegged to USD, if the dollar were to crash what would happen to them? How could it effect the DeFi space.

Fees have been way to high on Eth so I have been playing on the Avalanche C-Chain lately including:

https://traderjoexyz.com/#/home

https://www.penguinfinance.io/

https://pangolin.exchange/

I am also interested in the Matic network but it was easier to buy/convert to AVAX on Coinbase and then send to Metamask. I’m not using a lot of money yet so I can’t afford large gas fees.

Hey this might be a little underrated but I find the Solana ecosystem quite undiscovered yet I was heavily attracted mainly to the high costs of Gas in ETH. Is unbelievable that moving $8 from one wallet to another would result in $15 fee!!! completely insane.

-

Tarot

-

Xpollinate

-

Tokemak

-

Sunny Aggregator

-

Woo

I would like you to explore the DeFi digital finance stack for yourself and challenge you to spot new building blocks that are essential to the DeFi digital finance stack.

Cross-Chain Bridges that connect to the Ethereum (ETH) network provide users the ability to swap assets between a myriad of networks. Examples include Tezos Wrap Protocol Bridge, Binance Smart Chain Bridge, Solana’s Wormhole Bridge, Avalanche Bridge, and Bitcoin Cash Smartbch Bridge.

Also since the rapid evolution of this DeFi space what other Blockchains are you seeing developing a more mature DeFi infrastructure?

According to https://defirate.com/avalanche-defi/ there ar 58 apps classified as DeFi in the Avalanche ecosystem.

while reading this (https://www.coindesk.com/markets/2022/01/24/fantom-becomes-third-largest-defi-protocol-by-value-locked/), i came across this: https://medium.com/multichainorg/anyswap-launches-on-ethereum-nov-19-10-pm-gmt-91227d52e781

so my understanding of Multichain (was “Anyswap” and is now much much larger than even a year ago) is that you can swap assets between different chains, which is especially important now that solana, polygon, avalanche, etc are all developing their own ecosystems because keeping them isolated only stands to fractionate the group (and thus dry up potential liquidity) of crypto enthusiasts trying to exchange value of one sort or another, i think…

Advanced talk about DeFi (DeFi Course 201)

I just came across the Bancor protocol and an interesting thing to note, is that they have found a way they tackle Impermanent loss (for LQ). DeFi in its majority is composed from Lending and DEX´s.

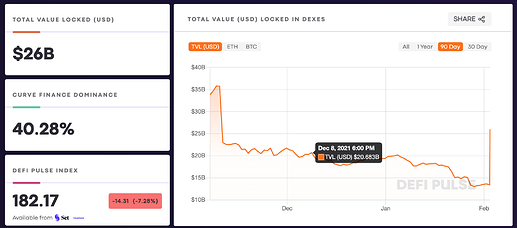

They tackle this problem specially in AMM´s markets. As we can see in the picture bellow, a total of 26 Billion Dollars are Locked up in this AMM´s (that is 32.68% of all the Value locked in DeFi), meaning that this is the total value provided by the liquidity providers.

So the innovative way to protect this enormous sum of money, Bancor did the following:

- Someone with capital wants to provide liquidity for an specific asset (This is a LP)

- The Bancor protocol provides with the equivalent value of the Bancor (BTN) token to the pool the user selected

- The protocol generates fees by using the liquidity given to the pool

- When removing liquidity form this pools, the BNT is Burnt (the equivalent value)

- Then the fees are used to pay the LP if any Impermanent Loss occurs, the rest of this fees are used to reduce the BNT token supply

Bankless link

From my understand, when it is said that the “dollar crashes” it means that the purchasing power tends to diminue. Then definitely the purchasing power of dai will be less as well, but get this : since BTC can be consider as an hedge to inflation, you will need more USD to buy BTC or get more USD when seling BTC. You’ll get more pegged token with less purchasing power, so it will be balanced. I hope it make sense.