I live in the US:

Coinbase, Robinhood, Chime, Plaid, and Ripple are all examples of US based FinTech. Coinbase is a cryptocurrency exchange, Robinhood is for stocks and equities mostly, Chime was a hybrid challenger bank, and we all know about Ripple. The SEC is having its way with Ripple currently over securities regulations and classification. Coinbase is currently going through the motions to have an initial IPO launch later this quarter, they are buddy buddy with SEC and super chum with the OCC, toeing the veritable line of regulation; Coinbase also has its own SEC sanctioned stablecoin USDC.

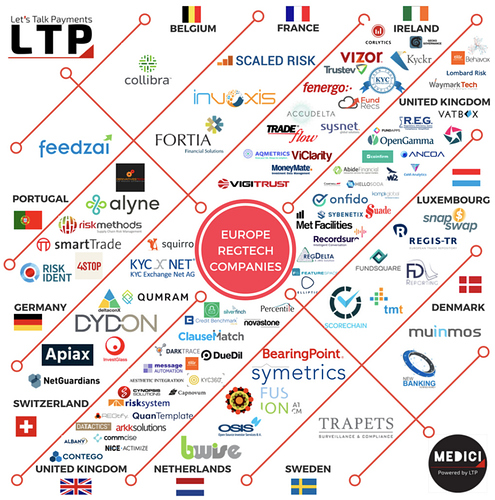

As far as RegTech in the US is concerend:

“…there have only been a handful of new federal banking licenses issued by the Office of the Comptroller of the Currency (OCC) in the U.S. (across all States) between 2008 and 2017. That figure in the United Kingdom will be 14 and an unbelievable 21 and 38 in India and China respectively. Message is simple, the Financial Sector in the U.S. which has been the backbone of its economic and political leadership in the modern world, have been somehow stagnant since 2008.” - Dr. Subas Roy, Chairman, International RegTech Association