*Research and find out local fintech regulations in your region.

*Make a screening of RegTech fintechs in your region.

U.K. RegTech top 10

The top 10 UK RegTech companies

Aaron Hurst31 March 2020

As our governance, risk and compliance month winds down, Information Age looks at the top RegTech companies operating in the UK

Which RegTech companies are leading the way in the UK?

RegTech, or regulatory technology, is a relatively new area of IT. RegTech companies operate for the purpose of accelerating regulatory processes using capabilities such as big data, analytics and the cloud.

The sector’s functions include compliance, reporting and monitoring, and are carried out in collaboration with financial institutions and regulatory bodies.

Taking some workload away from compliance departments within businesses, RegTech providers work to ensure that companies don’t get penalised by regulators.

With this in mind, let’s take a look at the top 10 RegTech companies currently operating in the UK.

- Quantexa

Quantexa is a big data and analytics provider, the RegTech services of which include anti-money laundering (AML) and know your customer (KYC) capabilities powered by AI.

AML is offered for monitoring trade and markets, while its KYC model builds real-time network context in order to provide single views of customers.

Insight is provided to users using real-time entity resolution, a service that’s assisted by a strategic partnership with Accenture.

- SteelEye

SteelEye brings together a wealth of data under one lens to allow organisations to effortlessly meet regulatory needs.

SteelEye’s comprehensive RegTech suite consists of record keeping, MiFID II and EMIR reporting, trade and communications surveillance, trade reconstruction, best execution and transaction cost analysis.

By aggregating and analysing both structured and unstructured data across all asset classes and communication types, compliance becomes simplified. And with everything under one lens, you also gain fresh insight into your business, helping you improve efficiency and profitability.

How to approach modern regulatory change management in financial services

- Clausematch

The software-as-a-service (SaaS) platform offered by Clausematch aims to streamline necessary regulatory operations.

Its major services consist of a policy portal and management capabilities, as well as AI-powered content mapping.

The company graduated from Barclays‘ inaugural accelerator programme in 2014.

- ComplyAdvantage

ComplyAdvantage is a RegTech firm that collects AML data from around 10,000 data sources, including Interpol’s watch list and international sanctions.

Using its platform, clients and cases can be monitored, and users can send alerts out across in-house systems using its application programming interface (API).

Powered by AI and machine learning, ComplyAdvantage’s portfolio of AML solutions includes onboarding & monitoring, and payment screening.

- Onfido

The services offered by SaaS company Onfido focus on identity and document verification, and cater for AML and KYC needs.

AI-powered biometrics are used to bolster document verification, matching documents such as drivers licenses to their owners in order to determine legitimacy.

Onfido’s services are available for companies operating in financial services, marketplaces & communities, gaming, transport and e-commerce sectors.

- DueDil

RegTech platform DueDil consists of a database sourced from thousands of sources such as company websites and registry data, which allows compliance teams to carry out reports.

By gaining company information, users can determine which companies would be suitable customers.

Available as a web platform and an API, DueDil also offers its Business Information Graph (BIG), which makes connections between companies.

- Kompli Global

The RegTech services offered by Kompli Global span fraud prevention, risk mitigation, compliance screening, and reputation protection.

Assisted by AI and in-house insight, users can check the background of staff and customers, including compliance with AML regulations.

Additionally, if required, Kompli Global has a team of analysts on hand to provide extra assistance with Enhanced Due Diligence (EDD).

- FundApps

FundApps‘ outsourced, managed service combines a powerful rules engine with a dedicated team of compliance experts and legal information from aosphere and other regulatory data sources.

The service also provides pre-populated disclosure forms in an aim to crack down on possible human compliance-related errors.

FundApps’ services automate the monitoring and reporting of shareholding disclosures, position limits and disclosure thresholds for sensitive industries.

- NorthRow

Formerly operating under the name Contego, NorthRow focuses on AML compliance by verifying identification and through the examination of clients.

As well as customer onboarding and monitoring, NorthRow’s API also offers customer base remediation, which allows users to update relevant information.

The company’s customer base works within the financial services, hospitality, payments and property sectors.

- Recordsure

Recordsure differs from the other RegTech companies on this list in that it focuses on recording financial and regulation-related conversations.

The platform uses automation and machine learning to detect any possible risk factors within customer interactions and transactions.

Conversation recordings can be used to train employees to be aware and confident in being compliant when it comes to customer data.

Honourable mention

- Arachnys

Arachnys offers a platform that streamlines and speeds up compliance investigations, as well as centralising compliance across policies around the world.

All information gathered from investigations conducted using Arachnys can be reused, meaning that work isn’t duplicated by compliance teams.

Additionally, reports featuring heat maps and step summaries can be generated based on these investigations.

Arctic Intelligence - provides financial crime audit, risk assessment and AML compliance solutions to help regulated businesses assess risk and deploy effective controls for risk mitigation.

GuardX inc - uses AI to extract unstructured data at scale

Asset Control (alevo) - financial data integration solutions

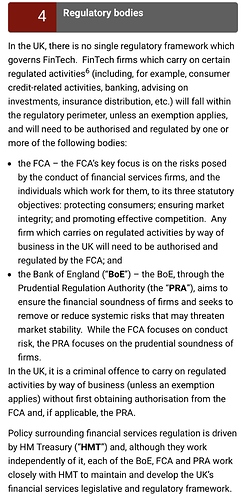

Fintech Regulation . There is no single Canadian regulatory body, either at the federal or provincial level, which has jurisdiction over fintech businesses. … In particular, securities regulators have been open to providing exemptions to certain securities legislation requirements for fintech

Depending on services, different bodies have jurisdiction.

Research and find out local fintech regulations in your region.

In Germany, the Federal Financial Supervisory Authority (BaFin) is the central body for the regulation of FinTech. This includes regulation of the areas of account information, payment transactions, investment and loans.

Make a screening of RegTech fintechs in your region.

- Alyne: Cybersecurity and Risk management

- Cleversoft: Onboarding process & reporting systems

- Dataguard: Cybersecurity

- 4Stop: Onboarding verification and Cybersecurity

- HawkAI: Onboarding, Monitoring Detection

The local Financial Supervisory Authority has collected links to regulations and guidelines, but only some of those are translated into English.

https://www.finanssivalvonta.fi/en/regulation/FIN-FSA-regulations/

According to a database there are 15 Finnish fintechs that are in compliance, for instance Vorna ID which is in identity governance and administration, and Clento, which provides a SaaS based KYC tool.

https://www.helsinkifintech.fi/database/#home/?view_5_page=1&view_5_search=compliance

CANADA (As of Dec 31, 2018)

1* Research and find out local fintech regulations in your region.

2* Make a screening of RegTech fintechs in your region.

1*

Canada remains in the top 10 for Fintech innovation with investment by both start-ups and incumbent banks, insurance companies and asset managers.

Canada has been gaining ground in key areas of Fintech, namely payments, cryptoassets and blockchain, online lending, and wealth management.

Federal politicians in Canada are pursuing a policy of benign neglect towards the Fintech sector, preferring to leave policy to provincial governments and regulators while focusing on other innovation priorities. Canada has not published a national strategy on Fintech, none of the funding for superclusters was directed to Fintech, and no politicians are offering speeches to support this sector. The only recent indication of support is the public consultations on open banking, which has already been adopted in the European Union, United Kingdom and Australia.

Canada prefers to be a follower on open banking, balancing the need for more openness with the desire to maintain a sound and stable financial system.

2* Regions=Provinces

#1 Ontario (98 Compnies)

• Home to 98 out of the top 150 FinTechs

• Biggest sectors are payments & money transfer and blockchain & cryptoassets

• Raised C$2.1 billion in funding & created 9,000 jobs

#2 British Columbia (34 Companies)

• Second largest concentration with 34 companies

• Representation across 9 out of 10 sectors

• Raised C$725 million and created 2,200 jobs

#3 Quebec (16 Companies)

• Second largest concentration with 34 companies

• Representation across 9 out of 10 sectors

• Raised C$725 million and created 2,200 jobs

#4 Alberta (2 Companies)

• Only 2 in Top 150 FinTechs (ZayZoon, Lending Arch)

• Both operated in lending & credit

• Founded in 2014 and 2015 respectively COMPANIES with approx. 10 employees each

Employment impact (Aveerage, per company)

Alberta - 10 pax

BC - - 6.5 pax

QC - 90 pax

- Of the FinTech 150, Ontario employs the highest total with 8,959 followed by B.C. & Que. with 2,200 each.

- Total Employees – 13,400

Equity Raised

- $3.4 Billion is the total Equity invested in the Fintech 150

- $32 Million is the Average Equity Received

Please note:

- Montreal, Quebec’s Lightspeed, Inc. had the highest total Equity invested with $292 Million

- Canada is strongest in Payments and Money Transfer, with 35 companies creating 3,941 jobs (29% of FinTech 150 employees)

- Canada is strongest in Payments and Money Transfer, with 35 companies creating 3,941 jobs (29% of FinTech 150 employees)

- In 2019, Canada is debating whether to legislate open banking, following the U.K., EU and Australia.

Fintech Sector (150 Companies)

PAYMENTS & MONEY TRANSFER 23%

LENDING & CREDIT 16%

BLOCKCHAIN & CRYPTOASSETS 11%

CROWDFUNDING 10%

WEALTH MANAGEMENT 9%

CAPITAL MARKETS & TRADING 8%

INFRASTRUCTURE & SERVICES 8%

BANKING & PERSONAL FINANCE 7%

INSURANCE SECURITY & IDENTITY 3%

YEAR FOUNDED – The surge in creation of Canadian start-ups from 2012 to 2016 mirrors the wave of investment in FinTech globally (2/3 od the companies founded since 2012.

| ompany Logo | Company Name | Industry | Location | Number of Employees |

|---|---|---|---|---|

| Agreement Express | Capital Markets & Trading | Vancouver, BC | 109 | |

| Aion | Blockchain & Crypto | Toronto, ON | 83 | |

| Amber Financial | Lending & Credit | Vancouver, BC | 18 | |

| Analyze Re | Insurance | Halifax, NS | 50 | |

| AscendantFX | Payments & Money Transfer | Toronto, ON | 40 | |

| Beanworks | Payments & Money Transfer | Vancouver, BC | 54 | |

| Bench | Infrastructure & Services | Vancouver, BC | 258 | |

| BioConnect | Security & Identity | Toronto, ON | 65 | |

| Bitaccess | Blockchain & Crypto | Ottawa, ON | 19 | |

| Blockstream | Blockchain & Crypto | Victoria, BC | 60 | |

| Borrowell | Lending & Credit | Toronto, ON | 60 | |

| BTL | Blockchain & Crypto | Vancouver, BC | 11 | |

| Canada Drives | Lending & Credit | Vancouver, BC | 300 | |

| Canalyst | Wealth Management | Vancouver, BC | 66 | |

| Carta Worldwide | Payments & Money Transfer | Oakville, ON | 106 | |

| ChangeJar | Payments & Money Transfer | Ottawa, ON | 11 | |

| CHIMP | Crowdfunding | Vancouver, BC | 57 | |

| Coinkite | Blockchain & Crypto | Toronto, ON | 2 | |

| Coinsquare | Blockchain & Crypto | Toronto, ON | 138 | |

| CoPower | Crowdfunding | Westmount, QC | 19 | |

| CORL | Crowdfunding | Montreal, QC | 15 | |

| Covera | Insurance | Montreal, QC | 10 | |

| CrowdMatrix | Crowdfunding | Toronto, ON | 3 | |

| Curexe | Payments & Money Transfer | Toronto, ON | 10 | |

| Decentral | Blockchain & Crypto | Toronto, ON | 37 | |

| Delego | Payments & Money Transfer | London, ON | 35 | |

| Dessa | Infrastructure & Services | Toronto, ON | 43 | |

| Dojo | Banking & Personal Finance | Vancouver, BC | 5 | |

| Dream Payments | Payments & Money Transfer | Toronto, ON | 30 | |

| Drop | Payments & Money Transfer | Toronto, ON | 93 | |

| Dwello | Payments & Money Transfer | Toronto, ON | 10 | |

| Easyfinancial | Lending & Credit | Mississauga, ON | 2000 | |

| Elastic Path | Payments & Money Transfer | Vancouver, BC | 173 | |

| Element AI | Infrastructure & Services | Montreal, QC | 331 | |

| EnStream | Security & Identity | Toronto, ON | 18 | |

| EQ Bank | Banking & Personal Finance | Toronto, ON | 600 | |

| Equibit Group | Blockchain & Crypto | Toronto, ON | 14 | |

| eSentire | Security & Identity | Cambridge, ON | 420 | |

| Espresso Capital | Lending & Credit | Toronto, ON | 32 | |

| Ethoca | Payments & Money Transfer | Toronto, ON | 219 | |

| Evolocity Financial Group | Lending & Credit | Montreal, QC | 45 | |

| Evree | Banking & Personal Finance | Toronto, ON | 12 | |

| Finaeo | Insurance | Toronto, ON | 22 | |

| FINCAD | Capital Markets & Trading | Surrey, BC | 161 | |

| Finn AI | Infrastructure & Services | Vancouver, BC | 58 | |

| Flexiti Financial | Lending & Credit | Toronto, ON | 65 | |

| Flinks | Infrastructure & Services | Montreal, QC | 37 | |

| Flybits | Infrastructure & Services | Toronto, ON | 50 | |

| FrontFundr | Crowdfunding | Vancouver, BC | 18 | |

| Fundever | Lending & Credit | Vancouver, BC | 18 | |

| Fundingportal | Infrastructure & Services | Toronto, ON | 4 | |

| FundRazr | Crowdfunding | Vancouver, BC | 8 | |

| FundThrough | Lending & Credit | Toronto, ON | 27 | |

| Fusebill | Payments & Money Transfer | Ottawa, ON | 11 | |

| Goldmoney | Capital Markets & Trading | Toronto, ON | 82 | |

| Goowi | Crowdfunding | Montreal, QC | 3 | |

| Grow. | Banking & Personal Finance | Vancouver, BC | 44 | |

| HIVE | Blockchain & Crypto | Vancouver, BC | 12 | |

| Hockeystick Inc. | Capital Markets & Trading | Toronto, ON | 20 | |

| Honk Mobile | Payments & Money Transfer | Toronto, ON | 11 | |

| Inovestor | Capital Markets & Trading | Montreal, QC | 40 | |

| Integrate.ai | Infrastructure & Services | Toronto, ON | 40 | |

| Invisor | Wealth Management | Oakville, ON | 16 | |

| IOU Financial | Lending & Credit | Montreal, QC | 39 | |

| Justwealth | Wealth Management | Toronto, ON | 8 | |

| Katipult | Crowdfunding | Vancouver, BC | 45 | |

| KOHO | Banking & Personal Finance | Toronto, ON | 56 | |

| Kooltra | Capital Markets & Trading | Great Lakes, ON | 19 | |

| League | Insurance | Toronto, ON | 200 | |

| Lendesk | Lending & Credit | Vancouver, BC | 45 | |

| Lendful | Lending & Credit | Vancouver, BC | 10 | |

| Lendified | Lending & Credit | Toronto, ON | 29 | |

| Lending Loop | Lending & Credit | Toronto, ON | 31 | |

| Lightspeed | Payments & Money Transfer | Montreal, QC | 605 | |

| Market IQ | Capital Markets & Trading | Toronto, ON | 30 | |

| Merchant Advance Capital | Lending & Credit | Vancouver, BC | 46 | |

| Mindbridge Ai | Infrastructure & Services | Ottawa, ON | 64 | |

| MLG Blockchain | Blockchain & Crypto | Toronto, ON | 65 | |

| ModernAdvisor | Wealth Management | Vancouver, BC | 66 | |

| Mogo | Banking & Personal Finance | Vancouver, BC | 277 | |

| Mylo | Wealth Management | Montreal, QC | 20 | |

| nanopay | Payments & Money Transfer | Toronto, ON | 42 | |

| Nest Wealth | Wealth Management | Toronto, ON | 36 | |

| NexusCrowd | Crowdfunding | Toronto, ON | 4 | |

| NorthOne | Banking & Personal Finance | Toronto, ON | 12 | |

| Nuvei | Payments & Money Transfer | Montreal, QC | 966 | |

| Nymi | Security & Identity | Toronto, ON | 60 | |

| Overbond | Capital Markets & Trading | Toronto, ON | 20 | |

| PayBright | Lending & Credit | Toronto, ON | 37 | |

| Paycase | Blockchain & Crypto | Toronto, ON | 17 | |

| Payfirma | Payments & Money Transfer | Vancouver, BC | 22 | |

| Payment Rails | Payments & Money Transfer | Montreal, QC | 11 | |

| Payment Source | Payments & Money Transfer | Toronto, ON | 46 | |

| PaymentEvolution | Payments & Money Transfer | Mississauga, ON | 22 | |

| Peerfunder | Crowdfunding | Toronto, ON | 6 | |

| Pegasus | Blockchain & Crypto | Toronto, ON | 10 | |

| Planswell | Wealth Management | Toronto, ON | 62 | |

| Plooto | Payments & Money Transfer | Toronto, ON | 25 | |

| Polymath | Blockchain & Crypto | Toronto, ON | 54 | |

| Progressa | Lending & Credit | Vancouver, BC | 118 | |

| Q4 | Capital Markets & Trading | Toronto, ON | 193 | |

| Quandl | Capital Markets & Trading | Toronto, ON | 51 | |

| Questrade | Wealth Management | Toronto, ON | 427 | |

| Ratehub.ca | Banking & Personal Finance | Toronto, ON | 48 | |

| RealStarter | Crowdfunding | Quebec City, QC | 3 | |

| RentMoola | Payments & Money Transfer | Vancouver, BC | 25 | |

| Rubikloud | Payments & Money Transfer | Toronto, ON | 91 | |

| Salt Edge | Infrastructure & Services | Toronto, ON | 65 | |

| Sebright Capital | Capital Markets & Trading | Toronto, ON | 1 | |

| Securefact | Security & Identity | Toronto, ON | 42 | |

| SecureKey | Security & Identity | Toronto, ON | 100 | |

| Security Compass | Security & Identity | Toronto, ON | 150 | |

| Sensibill | Banking & Personal Finance | Toronto, ON | 66 | |

| Senso.ai | Infrastructure & Services | Toronto, ON | 8 | |

| SheEO | Lending & Credit | Toronto, ON | 322 | |

| Smart Money Invest | Wealth Management | Toronto, ON | 8 | |

| smile.io | Payments & Money Transfer | Kitchener, ON | 65 | |

| Smooth Commerce | Payments & Money Transfer | Toronto, ON | 36 | |

| Snap Financial Group | Lending & Credit | Vancouver, BC | 92 | |

| Sonnet | Insurance | Toronto, ON | 159 | |

| Soundpays | Payments & Money Transfer | Toronto, ON | 10 | |

| Street Contxt | Capital Markets & Trading | Toronto, ON | 44 | |

| Tacit Innovations | Payments & Money Transfer | Toronto, ON | 15 | |

| Thrinacia | Crowdfunding | Vancouver, BC | 9 | |

| TickSmith | Capital Markets & Trading | Montreal, QC | 33 | |

| Tier1CRM | Infrastructure & Services | Toronto, ON | 107 | |

| TIMIA Capital | Lending & Credit | Vancouver, BC | 8 | |

| TokenFunder | Blockchain & Crypto | Toronto, ON | 12 | |

| TouchBistro | Payments & Money Transfer | Toronto, ON | 250 | |

| Trulioo | Security & Identity | Vancouver, BC | 62 | |

| UGO Wallet | Banking & Personal Finance | Toronto, ON | 25 | |

| Venbridge | Lending & Credit | Toronto, ON | 9 | |

| VersaBank | Banking & Personal Finance | London, ON | 167 | |

| VersaPay | Payments & Money Transfer | Toronto, ON | 85 | |

| Wagepoint | Payments & Money Transfer | Toronto, ON | 31 | |

| Wave Financial | Infrastructure & Services | Toronto, ON | 128 | |

| WealthBar | Wealth Management | Vancouver, BC | 27 | |

| Wealthsimple | Wealth Management | Toronto, ON | 175 | |

| WeiFund | Crowdfunding | Toronto, ON | 6 | |

| Zafin | Infrastructure & Services | Toronto, ON | 417 | |

| Zayzoon | Payments & Money Transfer | Calgary, AB | 10 | |

| Zensurance | Insurance | Toronto, ON | 18 |

I was actually quite impressed with the content available in the regulation space here in Australia and related advocacy groups. https://www.fintechaustralia.org.au/ for example advocates for “all members across all levels of government to help shape the regulatory framework of the future”.

There’s a fair bit of information available at https://iclg.com/practice-areas/fintech-laws-and-regulations/australia also

Interestingly, there isn’t much in the way of specific laws and acts for cryptocurrencies, regulation is broadly captured by a suite of existing leglisation.

In general, a licence is required to provide any product of services involved or partly involved in the following domains.

Australian Financial Services Licence

- Investment or wealth management.

- Payment (except for cash).

- Advice (including automated systems also known as robo-advice).

- Trading

- Crowdfunding platform, triggering the requirement to hold an AFSL

Australian Credit Licence

- Lending including P2P

There’s also a Clearing and Settlement facility licence so the space seems arduous from a compliance point of view.

Any product or service provided in Australia is also covered by the Australian Consumer Law which is actually not all that unfamiliar I’d say. The ACL deals with generic issues such as false advertising, fit for purpose issues, warranty etc.

The Anit-money Laundering and Counter-terrorism Financing Act applies to the general sounding “designated services” relating to Australia in some way. Relates to AUSTRAC (Australian Transaction Reports and Analysis Centre)

The Banking Act 1959 defines the term Authorised Deposit-Taking Institution and relates to the regulator APRA (Australian Prudential Regulation Authority)

Then there’s the Financial Sector Collection of Data Act, Financial Sector Shareholdings Act and the Privacy Act

In terms of RegTech FinTechs, there’s an interesting article at https://www.encompasscorporation.com/blog/regtech-compliance-australia-themes-2020/ which speaks to the landscape in Australia and how RegTech is becoming recognised as increasingly useful considering the recent Royal Commission into Banking in this country exposed some woeful breaches of the law.

Interestingly, KPMG offer RegTech solutions as described at https://home.kpmg/au/en/home/insights/2020/03/embracing-regtech-revolution.html

Amazing responses! Thank you for teaching us something new

Thank you for researching local fintechs in your region.

Could you also make a screening of RegTech fintechs in your region to finish the assignment?

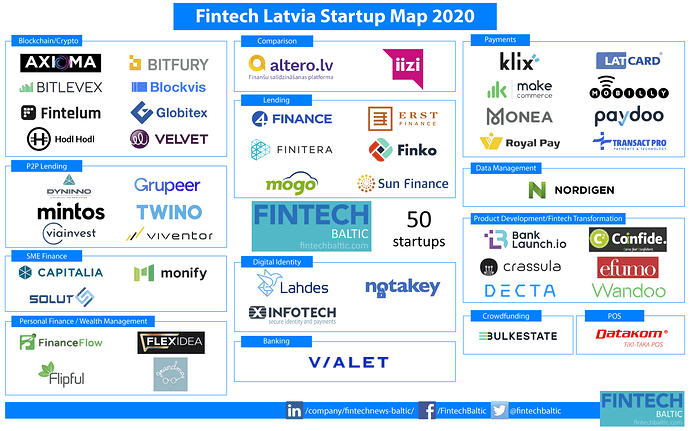

Latvia

I was able to find a registration page for workshops in Regtech, which unfortunately have already passed, but I was able to read over the agenda and it seemed very interesting. Link here:

https://www.financelatvia.eu/regtech-and-operational-solutions-for-effective-public-private-partnerships-to-disrupt-national-and-cross-border-financial-crime/

While doing some Google research I also came across a law firm that specializes in Fintech laws and regulations, so now I have a very good resource if I ever want to start my own Fintech!

In Slovakia we have these guys: https://finas.sk/ - it is a platform to share knowledge in the FinTech area and to connect the community

More from fintech in slovakia: https://fumbi.network/sk

https://blockchainslovakia.sk/en/

https://finstat.sk/

Just recently, there was an online conference about taxes and other in our country, I haven’t had the time to watch it yet.

Fintech regulators in the US

There is a wide range of regulatory bodies that may govern the activities of fintech businesses operating in the US. Some have extremely broad jurisdictions, while others focus on specific activities.

Federal Trade Commission (FTC)

The FTC is responsible for tackling “anticompetitive, unfair, or deceptive” practices amongst businesses that offer services to consumers. It has also developed a significant corpus of regulatory requirements for businesses operating in the US, including obligations regarding privacy and data protection.

Consumer Financial Protection Bureau (CFPB)

The CFPB regulates financial services offered to consumers. It also carries out general enforcement against what are deemed to be deceptive or unfair practices.

Federal Deposit Insurance Corporation (FDIC)

The FDIC administers the US deposit protection scheme, which insures deposits up to $250,000 per account. It also regulates banks that are not members of the Federal Reserve Scheme.

Securities and Exchange Commission (SEC)

The SEC regulates the US securities market. It has jurisdiction over businesses including securities exchanges, brokers, and dealers; investment advisors; and mutual funds.

Commodity Futures Trading Commission (CFTC)

The CFTC regulates the US commodities markets, and has jurisdiction over businesses such as trading organisations and intermediaries.

Office of the Comptroller of the Currency (OCC)

The OCC regulates national banks, but in 2018 it announced that it would also begin accepting applications for special purpose charters from fintechs. The charter is restricted to fintechs that accept deposits, pay cheques, or carry out lending activities. Fintechs that receive the charter are required to comply with the same requirements imposed on national banks.

Financial Crimes Enforcement Network (FinCEN)

FinCEN is responsible for enforcing the US Anti-Money Laundering (AML) regulations. It sets the terms of AML compliance amongst financial companies, and collects and shares information with other agencies.

Financial Industry Regulatory Authority (FINRA)

FINRA regulates businesses offering investment activities, including crowdfunding. All crowdfunding portals must be registered with FINRA as well as with the SEC.

Industry associations

As well as being subject to federal and state regulation, businesses conducting payments-related activities will also have compliance obligations to a number of industry associations. These include the payments card associations and NACHA.

State governments

Finally, it is vital to remember that fintechs operating in the US will be regulated not only by federal bodies but also at a state level. Laws can vary significantly between states and the compliance landscape is complex - but some measures are being taken to simplify and rationalise the state-level regulatory frameworks, as we will see in a later section.

Fintech regulations in the US

The specific regulations with which fintechs must comply will depend on the activities they are pursuing. However, there are some particularly common regulations that every fintech operating in the US should consider.

Gramm-Leach Bliley Act (GLBA)

Also known as the Financial Modernization Act, the GLBA requires all financial institutions to explain to their customers how their information is being shared, and to safeguard their data.

Fair Credit Reporting Act (FCRA)

The FCRA determines the ways in which financial institutions can collect consumer credit information, and extends consumer rights regarding access to the credit reports.

US Anti-Money Laundering regulations (AML)

There are two main AML Acts in force in the US: the Bank Secrecy Act, and the USA Patriot Act. Between them, these laws include obligations regarding anti-money laundering risk management programmes, customer due diligence (CCD), and various record-keeping tasks. The Patriot Act also includes specific requirements regarding cross-border transactions.

JOBS Act

Crowdfunding platforms and other funding portals are required by the JOBS Act to register with the SEC and FINRA. The JOBS Act also introduces additional obligations and restrictions on these businesses, including maximum fundraising amounts and disclosure requirements.

Fund Transfer Act and CFPB Regulation E

The Fund Transfer Act and CFPB Regulation E are two of many laws governing payments-related activities. Specifically, they impose requirements on financial institutions to resolve errors in transfers.

Securities Act and Exchange Act

Initial Coin Offerings (ICOs) are popular amongst fintech startups. The treatment of these activities has been controversial in the US, but precedent has now been set with what is known as the Howey Test. This test determines the legal status of the ICO and, if it meets the threshold requirements, it will be subject to the Securities Act and Exchange Act.

CAN-SPAM

These regulations place restrictions on businesses carrying out email marketing.

12 MOST POPULAR REGTECH COMPANIES IN USA

- Chainalysis

- ComplyAdvantage

- Ascent Regtech

- Forter

- Hummingbird

- Continuity

- Trunomi

- Ayasdi

- IdentiyMind

- Sift Science

- Elliptic

- BehavioSec

Canadian FinTech Regulations

Most interesting part I found is that there is no single regulatory body for Fintech. So compliance is in relation to a bunch of general laws.

https://iclg.com/practice-areas/fintech-laws-and-regulations/canada

My search result found a lot of really terrible websites. Eventually I found the below

website it is awesome not just for Canadian Regtech but also global regtech.

https://www2.deloitte.com/lu/en/pages/technology/articles/regtech-companies-compliance.html

So many companies to look through thanks.

Absolutely. Sorry about shorting the assignment. This article had great insight into fintechs in the US that are entering the regulation space.

https://builtin.com/fintech/regtech-companies

One of the more interesting companies was Sift Science based out of California. The companies machine learning assigns “sift scores” to help detect ML, fake accounts and fraud.

In my country Spain, I found this interesting article as there is not specific regulation for Fintech. It will depends on the nature of the business and the type of activities, therefore applicable regulation will be applied.

https://www.globallegalinsights.com/practice-areas/fintech-laws-and-regulations/spain