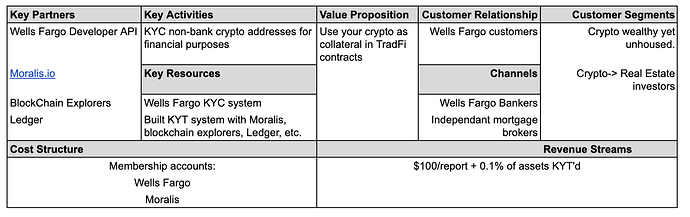

A brief business idea to solve a personal problem in USA that I’m having in using raw crypto in a real estate transaction: AML/KYT regulation support. If I can FinTech a solution with a bank API then why not make a company out of it?

My business model is based on developing an app that likes carbon credit generators, issuers and consumers ( Emitters) all in one app.

The idea is to save money and time and to cut out the speculators and the hoarders.

The digital app connects everyone via smart contract and enables the transmission of funds and settlement of carbon tax in a direct way circumventing the time consuming activity of verification and the challenges created by the hoarders and the speculators.

This helps the marketplace to grow and serve its intended purpose.

Thanks for the Lean Canvas, I will use that when my idea blossoms as I am still learning the ropes now and anything that I share would be letting the cat out of the bag so to speak, lol…

This actually addresses my fear with starting to realise a project from idea… sharing it with others that want to realise it with you rather than steal it from you

This is a great resource for future reference.

- Value Proposition

Build a real decentralized fintech to stack synthetic local currencies where Nodes should be distributed equally and geographically all over the world to allow stake, and local currency allocation of assets; emergent nations may not have all the resources to build enough nodes to stake or control pools of investments. This new fintech idea would allow non-western countries to fund themselves with sinthetic local assets as collateral and provide pools of resources for other investment instrument in the regional market :

- Governemtn Initiatives to boost local growth

- decreased forced migration

- boost local economies

- increase local productivity

- increase local development

2 Customer Segment

- local business owners

- local municipalities

- small medium investors

- stakers/miners operators

- Channels

- Municipal meetings

- youtube influencers

- local chambers of commerce

- startups & entrepreneur events

- VC sessions - think tanks

- Customer Relationship

Local Community’ Projects

Local Entrepreneurs looking for capital

Municipalities Projects looking for Private Investors

Local investors to allocate investment

Automated Makers

Blockchain Node Miners/Stakers Operators

- Revenue stream

- Fees from transaction, staking fees/ Lending fees

Negotiation and Yield management fees

- Key Resources

Cloud Nodes / local Nodes

Engineers/Admin

Lawyers/ Finance Experts

Financial and DeFinancial

- Key Partners

Local Banks

DeFi

L1 and L2 blockchains

Local investors

Goverment

- Key Activities

- Increase Funding Sources

- Developed Nations

- Fund must needed local business

- boost local circular investments

9 Cost Structure

- Value Driven

- Economies of Scope and Scale

- Fixed costs for Development and Admin personnel

I’m new here! This assignment sounds super interesting. I checked out the Business Canvas Model sheet and it looks like a useful tool for mapping out business ideas.

Regarding the fintech business idea shared, it sounds like a innovative and impactful concept. I’m curious to know more about the specific technology and infrastructure that would be required to make it work. Overall, I think this idea has a lot of potentials to make a positive impact on emergent nations and boost local economies. If anyone wants to discuss this idea further or has any other fintech business ideas, feel free to hit me up! You can also get more financial advice from The Finity Group. They’re always happy to help.

Blockchain-Based Digital Inheritance Planning

1. Customer Segments:

- Individuals and Families: Customers include individuals who want to plan the inheritance of their digital assets and families looking for a secure and automated way to transfer digital wealth.

- Estate Planners and Lawyers: Professionals involved in estate planning who can use the platform to facilitate the digital aspect of inheritance.

2. Value Propositions:

- Automated Digital Asset Transfer: Secure and automated transfer of digital assets upon inheritance, using blockchain and smart contracts.

- Privacy and Security: Ensures the privacy and security of sensitive digital information during the inheritance process.

- Ease of Use: Simplifies the complex process of digital inheritance planning.

3. Channels:

- Online Marketing and Advertising: Utilize online channels to promote the platform through targeted advertising and content marketing.

- Partnerships with Estate Planning Firms: Collaborate with estate planning firms to integrate the platform into their services.

- Educational Workshops and Webinars: Conduct workshops and webinars to educate individuals and professionals about the importance of digital inheritance planning.

4. Customer Relationships:

- Educational Support: Provide educational materials and customer support to help users understand the platform and its benefits.

- Personalized Assistance: Offer personalized assistance for complex cases through customer service channels.

- Regular Updates: Keep users informed about updates, security measures, and industry best practices.

5. Revenue Streams:

- Subscription Model: Charge users a subscription fee for access to the platform and its features.

- Transaction Fees: Implement a small fee for each digital asset transfer facilitated by the platform.

- Premium Services: Offer premium services, such as expert consultations for complex cases, at an additional cost.

6. Key Activities:

- Smart Contract Development: Develop and maintain smart contracts that facilitate the automated transfer of digital assets.

- Security Measures: Implement robust security measures to ensure the privacy and security of user data.

- User Experience Enhancement: Continuously work on improving the user interface and experience to make the platform user-friendly.

7. Key Resources:

- Blockchain Developers: Skilled developers to maintain and enhance the blockchain infrastructure and smart contracts.

- Cybersecurity Experts: Professionals to ensure the platform’s security against potential threats.

- Legal Advisors: Experts in digital law and blockchain regulations to navigate legal complexities.

8. Key Partnerships:

- Estate Planning Firms: Partner with firms to integrate the platform into their existing services.

- Blockchain Platforms: Collaborate with blockchain platforms to leverage their infrastructure and enhance the platform’s capabilities.

9. Cost Structure:

- Blockchain Development and Maintenance: Investments in the development and maintenance of blockchain infrastructure.

- Security Measures: Costs associated with implementing and maintaining robust security measures.

- Marketing and Education: Expenses related to marketing campaigns, educational materials, and workshops.