Think more of the Ampleforth contract as a economic system on it’s own since it’s uncorrelated to any other asset. The reason why people are so bullish right now is because Ampl is basically the FED, but with fairly distributed money among all holders dependent on supply and demand only. There is nobody in between you and the printer. Demand goes up supply increases, demand goes down supply decreases - and so does the amount of coins in your wallet.

The other reason people see value is since the protocol will at some point find it’s equilibrium in market cap where the price will be stable around the 2019 dollar. So the ampl is right now in what they call marketcap discovery instead of the price discovery you see in other cryptocurrencies, hence the boom in marketcap.

The high price we are at right now is just because the incredibly high demand and the protocol can barely keep up increasing it’s supply (rebase happens every 24h). So for ampl the price is only a reflection of demand, nothing more. As far as I know this is the first asset where trading on marketcap is more important then trading on price.

As for use cases:

- Already I see people talk about using ampl as a store of value since they see the benefit of not having a volatile asset like Bitcoin.

- When the equilibrium phase is reached it could be used as a stable coin in theory, even though I have to mention Ampleforth states that it is not trying to be a stable coin. Nearing equilibrium price should by then stay around the 1$. This could be with a billion or more market cap - nobody really knows when equilibrium will be reached.

- Being used as a collateral with other assets.

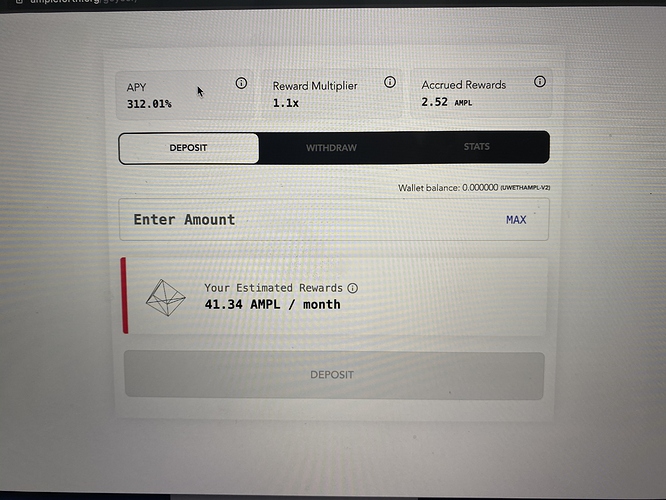

- Bringing liquidity in the DeFi ecosystem. Ampl is already the biggest liquidity pool on uniswap.

One of the most beautiful things of ampl right now is that basically anyone holding doesn’t have any incentive to sell, and probably will not have anytime soon. It almost looks like a ponzi scheme, but it’s only just the marketcap discovery of a decentralized contract.

I hope I answered your question clear enough. I’m only involved in ampl since barely 2 weeks, and still learning every day. But I really do think this might be a revolutionary tokenomics that crypto always needed.

Feel free to ask more and maybe someone else will join this topic with their perspective!

I’m just wholly averse to something referenced as akin to the Federal Reserve as it is not making sense to the economics in my head

I’m just wholly averse to something referenced as akin to the Federal Reserve as it is not making sense to the economics in my head