Hi there, long time I hadn’t logged in to the academy. Came back for a little orientation.

Turns out that I have become a LP in quickswap, with these kind of rewards, who wouldn’t:

and when I joined the pool the rewards were at 700% APY …well, so I joined this one and others, but turns out that when I check the “accrued fees & analytics”, this shows up:

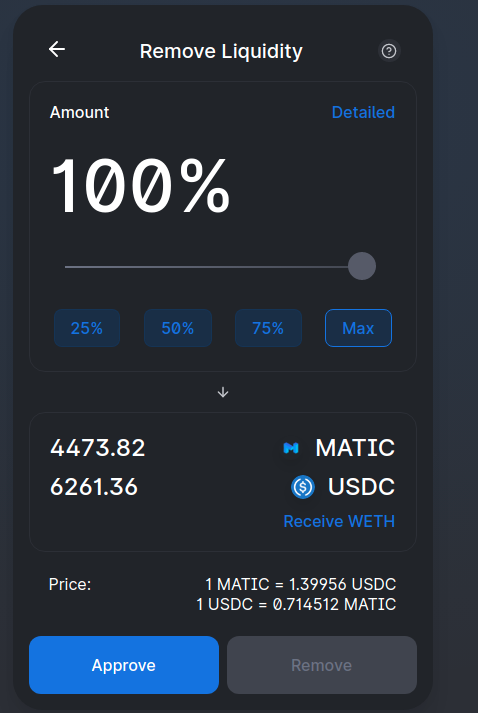

yesterday, the matic/USDC pool was at minus 800USD, so I tried to remove my liquidity, and this shows up:

So … i’m like … wait, I’m not losing money (those -500 that you can see in the second picture or -800USD that I mentioned earlier), but then … what does the “accrued fees & analytics” shows???

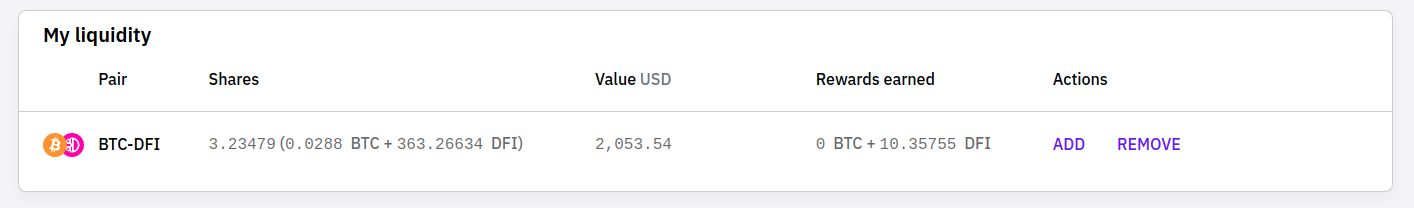

As my understanding (Iam also a LP on defi chain), for being a LP you get rewards in the form of both of the tokens you provide liquidity for, like this:

(that 0 BTC is in fact 0.000000something)

but it seems like, when I removed my liquidity, I got some quickswap tokens (like 16USD worth of it) which kind of matches the APY of the period when I was providing liquidity in (like 2 days)…

So my question really is: does quickswap only reward quickswap tokens for providing liquidity?

or does it reward both of the pool tokens? or does it provide both of them plus some quickswap?

I know what impermanent loss is, I have done my own research, but still I cannot figure out quickswap. I saw a lot of people like me asking these king of questions on reddit as well

hope that anybody can help @thecil or @filip or @amadeobrands