@ivan @filip @joshcross @amadeobrands do you guys have another link for this paper?

Exactly… I was just about to mention the Avalanche chain.

Phantom makes it safe and easy to store, buy, send, receive, swap tokens and collect NFTs on the Solana blockchain. This is much faster and cheaper to use than on the ERC-20 network.

Prism Protocol from Terra ecosystem

the CRV wars are slightly above my paygrade concerning the Tokenomics of it but i understand the essential premise of layered financing.

For those who dont understand, i higly recommend watching these video as an itroduction before reading the article: https://www.youtube.com/watch?v=-0Q3fp-wzXI. Anyways, I will try to expain it myself: Defi protocols from a long time dont work with order books(like binance or coinbase do), due to its inefficiency(high gas fees and slow).So these protocols work with liquidity pools now, where investors can add a pair of tokens to the protocol to be used in the trades, and these liquidity providers would get a yeild for locking their tokens there. Most protocols would pay with their own token, but this was a problem for the token itself. First , it was a inflationary token, because it was released litle by litle to pay to the investors. For that reason many of the investors would swap those tokens for more solid ones. Second, the price of the token would not grow in long term. But all this changed with Curve Protocol: now the liquidity providers would have reasons to hold the protocol tokens, because with them they could participate in the voting system in order to decide which pairs to add and what rewards to give. This started a battle between the other protocols , they all want to take control of the governance of curve, so they can vote for higher rewards in their token and make their ecosystem grow. These defi protocols are compiting to get the curve governance tokens locked in their protocol, offering insane APYS for it. This is profitable for the protocols because curve will atract much more capital to their protocols in return(it hash crazy market cap), once they reach a high governance percentage in curve and can raise their own tokens pairs rewards. Following this strategy, Convex Finance was offering over 40% reward for locking curve tokens in their protocol. Now they control more thhan 50% of the curve governance, so by now they have just won the war. Yeild farming means taking advantage of this competition and look for the best APYs in the different protocols.Hope this helped.

For those who dont understand, i higly recommend watching these video as an itroduction before reading the article: https://www.youtube.com/watch?v=-0Q3fp-wzXI. Anyways, I will try to expain it myself: Defi protocols from a long time dont work with order books(like binance or coinbase do), due to its inefficiency(high gas fees and slow).So these protocols work with liquidity pools now, where investors can add a pair of tokens to the protocol to be used in the trades, and these liquidity providers would get a yeild for locking their tokens there. Most protocols would pay with their own token, but this was a problem for the token itself. First , it was a inflationary token, because it was released litle by litle to pay to the investors. For that reason many of the investors would swap those tokens for more solid ones. Second, the price of the token would not grow in long term. But all this changed with Curve Protocol: now the liquidity providers would have reasons to hold the protocol tokens, because with them they could participate in the voting system in order to decide which pairs to add and what rewards to give. This started a battle between the other protocols , they all want to take control of the governance of curve, so they can vote for higher rewards in their token and make their ecosystem grow. These defi protocols are compiting to get the curve governance tokens locked in their protocol, offering insane APYS for it. This is profitable for the protocols because curve will atract much more capital to their protocols in return(it hash crazy market cap), once they reach a high governance percentage in curve and can raise their own tokens pairs rewards. Following this strategy, Convex Finance was offering over 40% reward for locking curve tokens in their protocol. Now they control more thhan 50% of the curve governance, so by now they have just won the war. Yeild farming means taking advantage of this competition and look for the best APYs in the different protocols.Hope this helped.Cheers

There’s a bunch of topics in this video.

Link to the framework research paper is broken, as noted in earlier comments. I tried looking around for a replacement. Best I found was an oblique article about the generations of token economic frameworks.

The Curve war seems to me like a drama-based war with forks and then come up with a new protocol execution solution there is also another war happening with Tokemak apparently, these wars in my opinion are profitable wars as they create new opportunities and solutions in the DeFi space. The curve war is mostly a war which had led to briberies through the voting system by convex as to where the rewards take place within the curve protocol, with curve in order to have more votes you’d need to lock your liquidity for up to 4 years to get the maximum voting rights from the curve voting token, the topic itself seems confusing at first but it is mostly about control and where to direct it to yield high returns people started using convex to direct proposals into curve and thats like hitting 2 birds with one stone because now you have two dex’s that you have control of in a way and convex was offering better features on top with liquidity pair APR’s. I’d say that ultimately DeFi protocols that will win are the ones like pancakeswap (BNB smart chain), spookyswap (Fantom), ones running under polygon etc. where cheap tx fees are embedded ethereum based protocols at the moment have scalability issues and even with ETH 2.0, gas fees will still be high regardless and the congestion issue in my opinion won’t really be fixed with a proof of stake model meme tokens, and meme NFT projects are taking much of the transaction space in the ETH blockchain the actual war itself is a blockchain protocol war DeFi wars are more like territorial civil wars with whale mobs trying to take over, whereas blockchain wars are taking over an entire infrastructures, voting systems themselves are flawed systems in my opinion when one entity has over 51% of voting power controlling an entire protocol but thats just my opinion after all…

Curve war article was no easy to understand as I never tried Convex. However some of the issues are similar to traditional finance, for example the cartel of few and barriers of entry to others. Defi should be free for everyone to use and interact however I can understand someone trying to take adavantage of someone else protocols, it shouldn´t go into legal disputes which will bring us closer to centralized finance the system we are trying to escape.

For sure first time movers will have an advantage to attrack liquidity as the industry is starting…I have use Pancakeswap, Quickswap, Pangolin…all good experience…I guess give me more comfort than use Convex or similar protocol that I believe there is higher probabilities to get rekt…

Interesting game theories…

I believe, in order for mass adoption to occur in DEFI investing I think there needs to be a better way to explain with examples using traditional finance examples. This can be challenging, but using examples like what is a “Certificate of Deposit” in traditional finance and how it may apply to a DEFI investment may help the 99,99999% of folks who are new to the Crypto space.

These are fundamental questions that I personally have about the DEFI space:

-

Who controls the liquidity pools and is this not contradictory to the term DEFI itself.

-

Is there a master administartion key that is owned by the top person of the DEFI ecosystem in question ? I refer to the Quadriga FX trading platform where the rug pull occured and the CEO mysteriously disappeared leaving millions of dollars missing

-

Where are the master node servers located that manage the DEFI pools ?

Are they on a server in someone’s basement or are they on an Amazon , Google or Microsoft data center ?

the conclusion of the article that is about fighting for power; not really about wealth and also that developers build their code based on strategies to obtain more users and liquidity; then bribe users through a voting mechanism…

all of this, bring me to question the DeFI concept; which is centralized by these players Curve, Convex, Dao on this monopoly curve-wars game.

the beauty and complexity maths of the Curve DAO is amazing, it may require a whole week for me to understand; also what is Aragon and if it’s related to Aragon Fundraising; there is a lot of VC that are taking profits from end users? it may be a more complex ponzi schemes that Bitcoin maximalist are warning?

Personal thought: we need better theories to conceive a DeDeFi (democratized and decentralized Finance) "maybe i am missing something into the game-theory; otherwise all this games will be catch on fire with more regulations for current governments; the purpose of non-sovereign DeFi is not achieved with this kind of platforms; else it would fail or evolve or BTC will sucked all these systems; probably CRV would survive but not sure in this model.

*What other projects have strong game-theoretical model?

the one that comes to my mind is TraderJoe wars in the Avalanche; although i don’t have more history about it; it has the same concept to stake veJOE token through different DeFi platforms: bifi.finance, vector, platypus, and yieldyak. https://avalanche.today/vector-joins-the-joe-wars/

https://sites.google.com/view/avaxdashboard/joe-wars

i am not sure what is the intention to follow a similar process of CRV wars

but i don’t see yet a governance token in TraderJoe

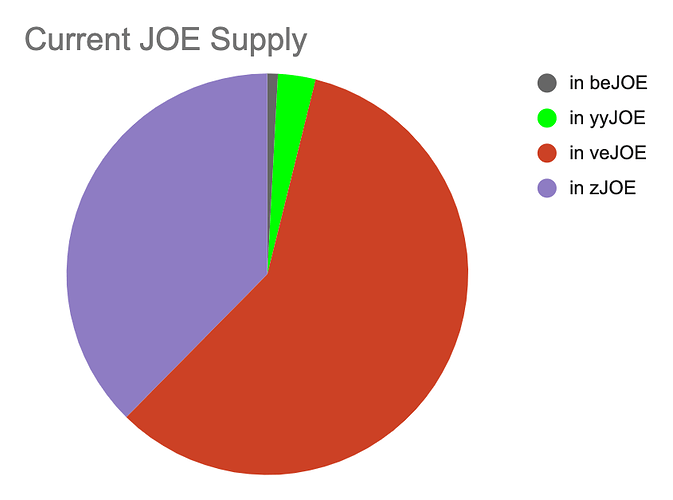

There are currently only a couple of protocols in the JOE War currently:

- Beefy Finance with beJOE

- Yield Yak with yyJOE

- Vector with zJOE

- North Pole (no token and not shown here)

- SteakHut (launch TBD)

-

JOE staked in veJOE pool by remaining addresses

what is the difference between application and protocol?

Curve & Convex can be a difficult protocols to understand, even for experienced Defi users. Not sure how anyone could reasonably be expected to understand much from that lecture.

Frax or Abracadabra could be simpler models to explain.

Mochi-Inu a young player to the DeFi space, recently made some calculated positional moves towards Curve. Mochi-Inu called it clever maneuvering taking advantage of certain loopholes to procure a better position in the space. However, the Curve emergency Dao viewed it as a governance attack. Regardless the small person collective with limited powers made moves of their own to stop the perceived attack by cutting off rewards, singling out and blacklisting the young protocol, but many in the community are bringing attention to the issue claiming what Curve has done goes against the very nature of an open and permissionless environment.

if i had to choose i would probably chose yearn finance, i no its built on top of curve, ive used it before actually i used both and i feel more comfortable using yearn. maybe compound is another choice but i havnt tried it yet to give my honest review

look into the synthetix rewrds distrbituin formual. its reallly special because you dont need a for loop to update all your users’ rewards. its all done through really clever algorithm design and mappings on the code side. you will find this useful https://www.paradigm.xyz/2021/05/liquidity-mining-on-uniswap-v3

yearn finance no longer a thing

application is the user interfce you use i=to interface with the underlying smart contracts which are the protocol

From my understanding,

Curve wars is a term referring to the competitive market of supply and demand between different crypto related exchanges. Differences being based on protocol.

Perhaps one could compare Ethereum network and Cardono network as similar things competing in the same space by having slightly different protocol.

Doing the best i can to understand, i am excited to learn more.