In order for defi to grow from were it is now we will see a bigger cross section of more pure defi and more cefi. interestingly if politics permits the regulators once they really grasp the transparency of blockchain tech will become the heralds for mass adoption. Defi is has gone through a lot of initial teething issues and is sort of going through puberty now it’s looking fantastically promising the stablecoin issue and dodgy USDT will all get dealt with by a better informed market and future world economic developments. Will the US even maintain seignorage of currency will it flip to some other or others? The main market is due for a big shakedown, defi will continue to respond and as the legacy system uproots it will continue to graft to defi as it already has and we’ll go forward. I have faith that as defi matures the communities will progressively shake off the cobwebs including coins that don’t have a real value base. I don’t really like any of the centralised coins. In as much as Maker has them on board as collateral their dealing with the times as those coins have an undeniable adoption and opportunity use case. That aside Maker’s ethics and purpose and vision make their Dai my choice.

One of the most interesting topics of all for sure.

Now that Polkadot has offcially launched Parachains is very interesting whats happening on MoonBeam/MoonRiver network and FRAX their price stability paper.

I think stable coins are an essential part of the crypto ecosystem now. If you want to do some trading or you want to buy any crypto on an exchange. Srable coins are a good way to securize profits when you get out of a good trade. It give you opportunity to get a good yield by staking.

I’m concerned that we cannot really know what the real reserves of tether ares. It make it less secure to the eyes of the pepoles.

Stable coins are here to stay, we will se in the future if some regulation bring some down.

-

It’s really important to emphasise here that we’re talking about prices fluctuation when you read about “USD stability”… and this shouldn’t affect you in the long run - as long as you’re not a trader - and it really souldn’t matter to you. Ok, you can buy normal things easier with stables but for me all of it - centralized or decentralized - is part of the same garbage… you will lost value at time with a crypto - holding stables… i mean, it’s totally counterintuitive talk and invest in fiat-stables.; but ok, for exercises pourposes, i would prefer descentralized ones, how to deal with a central planner - actually a central holder (wich can be even worst) - in crypto ecossystem?

-

Definitely

-

None

-

Dai is beautiful - although i don’t like it - but it’s a prime work. Actually what it’s used as collateral don’t matter, as long as the market feels confortable with it. The code behind it must be real nice

This is a great thread. I’m also learning about stablecoin projects as I go, everyone’s thoughts have been helpful !

Tether’s reserves are indeed shady. This is a great video about Tether’s scheme in case anyone would like to learn more about it:

https://www.youtube.com/watch?v=-whuXHSL1Pg

However, I understand stable coins are important because they can ensure the stability of value in the market, uniquely serving the currency function of cryptos.

I think it’s not great that DAI is in large part pegged to USDC but this is probably a better option than being pegged to other projects, like USDT.

DAI is one of my favourites stable coins. I believe is a great project with a great ecosystem that aspires to be a decentralized reserve bank. Hopefully this or another decentralized project maintains good governance and potentially pass centralized stablecoins like Tether.

Terra luna’s UST seems like another very great project that’s becoming a more robust stablecoin, It recently raised 1 billion dollars worth of BTC by hedge funds, that seems like a good sign.

Here’s an interesting quote by Terra labs founder Do Kwon, about their vision for the future.

A decentralized economy needs decentralized money, and decentralized money needs decentralized reserves.

Tethers reserves, We can assume its not backed by anything at this stage.

Does tether have the ability to create existential risk? I dont personally believe so. if it fails people will simply swap it for BTC. this would be good for BTC.

Favorite Stable would have to be USDC closely followed by Dai

Dai heavily backed by USDC is only a problem when there is not enough diversity backing it.

100% Eth would be a problem due to the volatility of Eth.

I agree with @Bsse that USDT should not crash… at least yet. While everyone, including me, would like to see it gone, it’s worth 78B USD in market cap. Too big to fail with no consequences.

Personally, I like USDC. Also, looking at the market cap in the last 3 months, it went from 38B to 53B (15B), while Tether only increased by 5B. Since I’m mainly using Binance, when I’m using exchanges, BUSD has some nice features (trading with no fees, if I’m not wrong?).

Never used TUSD or others so far. Still learning about DAI/UST, as great decentralised options. UST is super complicated, at least at the first glance, while DAI is there a bit longer and I like it that it’s backed by USDC. I don’t think centralisation is bad, definitely not in the crypto & DeFi infancy, early stages.

I’m not too keen on USDT. If I have to use it, I treat it as a hot potato. It certainly doesn’t create an existential risk for crypto. I suppose one could argue that some kind of major disaster with a common stablecoin could be used to help push for CBDCs, but I don’t really think it would make a difference. I’ve always favored the elegance and certaintly of TUSD, but now that I finally understand how Terra works, I think I prefer that now. True decentralization is especially important in light of what we see around the world right now, with money being frozen or seized without any kind of due process. The question of whether DAI being backed by a centralized stablecoin means it is more or less secure is an interesting one. At the end of the day I think I would have to say less secure because in the case of a deliberate attack, crashing a decentralized cryptocurrency is a lot more challenging than crashing a centralized one. In the case of black swan events we also have to take the value of the fiat the stablecoin is pegged to under consideration. Being assured that your coin = 1 USD doesn’t mean much if the practical value of 1 USD is radically unstable. We may see more projects similar to the Cappuccino token become popular in the near future.

I’m in agreement on many of the comments regarding USDT. It’s something I try to only use sparingly or not at all if I can get away with it.

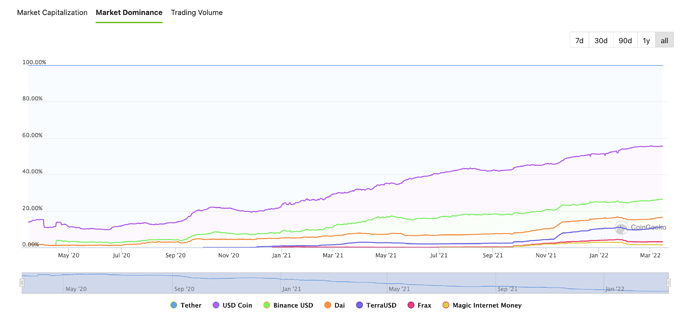

Something interesting that I noticed on the CoinGecko site is that even though USDT is the most common stable coin in the market, it’s losing marketshare drastically over time.

- Mar 2020 - USDT was 85% of the stablecoin market

- Mar 2021 - 70%

- Mar 2022 - 44%

That’s a telling trend. And probably speaks to the market perception of USDT’s unbacked unaccounted status.

for a first timer in crypto learning about USDT would be terrifying which it is but when the market is dipping the amount of money pumped into USDT as a safe net is huge.

USDC seems more safer in that its transparency is not as foggy.

USDT on many protocols is a popular par for swapping coins.

if backed by btc or eth would this make the Stablecoin more unstable in shorter intervals as it try’s to get back to a dollar, please could you a explain

I personally never hold USDT due to their sketchy reserves situation. I don’t think USDT collapsing is something that should be of major concern considering it continues to hold its peg just fine and has for quite a while. It would be nice to see exchanges move away from using it in so many trading pairs so we can have less reliance on USDT in case some collapse were to happen. Whether a USDT collapse causes a big pump to coins from investors trying to get out of it or a collapse in the whole market is yet to be seen but overall it would not be a good look on the crypto markets and would likely cause some turbulence. Personally, I think the potential crash it imposes is nothing the market couldn’t recover from in the long term.

As far as other stable coins go, my favorite is USDC but this can and likely will change in the future. DAI is not something I have a strong opinion on. From one angle, I see DAI as an asset that is backed by many assets, giving it multiple points of potential failure. However, DAI being over collateralized seems to make it less risky since if one of the assets backing it were to drop in value, it has other assets also backing it to make up for the potential loss.

I agree with most everyone here that USDT presents some definitely sketchy issues, and if you have to hold a centralized stablecoin, better in my mind to use one of the other options. I do really like the concept of decentralized stablecoins, mainly because they accomplish similar goals to the whole DeFi space - permissionless, taking out centralized control, etc. As Josh mentioned, they have a way to go but I think in a few years they will probably become more of the standard.

I am really fascinated by what Terra’s UST is doing, especially with the recent news that they might be buying up to $10B in BTC as collateral for their stablecoin!

UST is the future of decentralized stablecoins.

USDT can`t hold it long term. Believing in USDT is like believing in american dollar.

USDC, DAI, BUSD are acceptable.

I stay away from USDT as much as I can and only use it if I need it for a trade. My favorite right now is USDC.

USDT can be useful when you need to change your crypto in a stable coin that is widley accepted, for a limited period of time.

My favourite stable coin is PAXO

For DAI having diverse type of collateral is good, maybe in the future USDC size will be less, let’s see!

Tether risk) Yes, I think Tether does create a very real risk to crypt, and I think it will at some point in time. I like USDC, but then again, I haven’t branched out very far into the world of stable coins. I don’t see USDC putting DAI at any risk in the future.

USDT has been one of those coins that has given crypto a bad name. I avoid using it unless its really needed in a trade. I like using USDC, as many here do. As far as DAI being backed by ETH, I feel like it would be less secure (due to its volatility) than it being backed by something stable like USDC.

This article helped me understand better the sketchiness of Tether

https://www.publish0x.com/crypto-banter/holding-tetherusdt-is-a-very-bad-idea-heres-why-xqmmjpx

I’ve always made sure to get rid of my Tether as soon as I get it. I don’t trust it. They are like the central bank of crypto and i’ve been hearing for years now that they didn’t have the reserves to back Tether. It’s definitely concerning that they can instantly print millions of tether and buy up the market.

My go-to Stable coin is USDC simply because of Coinbase being a publicly traded company. I’ve also used DAI in the past and personally don’t mind the swings of a few cents.

It’s concerning that some of the centralized stable coins have full control over the coins even when you own them. Didn’t realize that was the case. I’m not sure if that is the case with USDC, but once again, i’d imagine it’s safer than most simply because of Coinbase being a publicly traded company.

Well there are really three risks with “backed”, centralized stablecoins: even if counterparties are just and not a risk. Even if fractional reserve doesn’t create a “stablecoin run” and implode the crypto economy. Stablecoin is still pegged to fiat which over the long term is driving their value to zero regardless.

The only real use is to reduce lending risk. Their usefullness will fade long-term as real crypto token prices stabilize. It’s not entirely ironic that fiat itself–is debt.

Forum task – Look into the stablecoins I’ve mentioned and let’s share some opinions in the forum. What do you think about Tether’s reserves? Do you think USDT creates an existential risk to crypto? What is your favorite stablecoin? Looking at DAI Stats, we can see that a significant amount of the collateral backing DAI is USDC. Do you think this makes DAI more, or less secure than if it were backed by, something like ETH? Sound off in the forum and let’s talk about it.

USDT (Tether) is a huge risk to the crypto industry due to no proof of backing, no attestations or audits, UST Terra tries to create their own token through the burning of Terra it is like creating their own scare resource to mint something that may seem of value but to me it looks like a money printing machine using keys to mint UST, the other part that doesn’t add up with UST is why some $1 Luna burned not all the luna, isn’t that considered inefficient? also the idea of arbitrage opportunities from UST can be alarmingly dangerous to keep the price stable. Also the idea of no collateral on UST is alarming to me and answers with mathematical algorithms do not add up, the whole idea is if terra is stable and its marketcap is more than USDT were somehow safe if terra drops hard then UST will drop with it. Maybe the answer is creating more utility usage for UST. Stable coins such as Ampleforth using algorithmic computations had extreme volatilities their values even dropped so bad at some point, other stable coins turned out to be failures. Coinbase and Binance seem to have centralized stable coins, Binance though has monthly attestations which are beneficial. DAI seems to be backed up mainly by ethereum collaterals which is still volatile, the whole idea of decentralization shouldn’t be about pegging values to the US dollar when the US dollar is a fiat currency not backed up by the gold standard anymore. Probably it is better to use USDC and BUSD than decentralized stable coins at the moment because they are more centralized and the US dollar is more centralized on its own. This is still my opinion my analysis I could have missed a couple of important points