Agreed - I guess it all comes down to risk/reward

Agree completely - the demand for Dai essentially fuels the supply of it, which maintains the coin’s stability. That’s why it’s used almost as the default token when entering other, more complex and feature loaded liquidity pools.

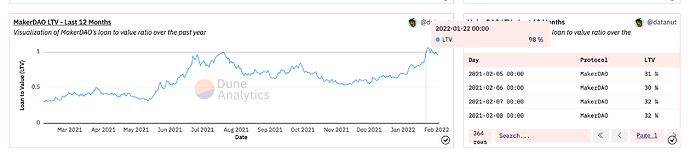

I don’t understand… but it’s the MakerDAO protocol, not DAI, that supposedly has a LTV of 98%. And my understanding is that the MakerDAO protocol requires 150% collateralization, which should mean that only 67% is loaned out, so the LTV should be 67%. Unless they are also loaning out the other 33%? Can someone please explain?

Hi, I’m confused, I checked out your aave webpage and it says the LTV for MakerDAO is 60%?

Hi, I need help. I have no idea why the LTV is so much higher for MakerDAO than AAVE and COMP because I’m not sure where this 98% LTV for MakerDAO comes from. Does it only account for the total amount of DAI that is allowed to be borrowed? If you can only borrow 67% of your total collateral, then only 67% of that value is considered for the LTV? If that is the case, then I can imagine people would borrow max amount they’re allowed to borrow because they feel the collateralization rate is high enough so they won’t end up getting liquidated.

For Aave and compound, they offer higher interest rates, especially with compound the longer you lock it in, to incentivize people to lock in their coins.

Hi @DeFiance, I understand your doubt.

Let me see if I help you, I am learning as well as you.

As we can see in this picture the 98% LTV

I recommend this page instead of the Aave:https://dune.xyz/datanut/Compound-Maker-and-Aave-Deposits-Loans-LTV

An in this link you can see the chart I have just displayed https://dune.xyz/queries/37352/74060

If I understand correctly, it is this:

the Loan To Value is the RISK given to a mortgage, not the maximum amount allowed to be borrowed. Meaning that the closer this LTV is to one, the higher the risk is borrowing this asset.

In DeFi Space, this means your borrowing position will get liquidated., resulting in a penalty fee of 13% I think.

Yes, in DAI, the collateral is 150% and you can only take out 67% of your total collateral.

You need to use the LTV ratio, so you can see if it is favorable for you borrowing that asset !!!

If you wish to go deeper for a better understanding or I failed explaining myself, I leave you some links below:

https://www.investopedia.com/terms/l/loantovalue.asp

https://www.thebalance.com/loan-to-value-ratio-315629

Hope I have cleared some of your doubts !!!

Edit: I’m deleting everything I wrote because I don’t want to confuse anybody with wrong information.

LTV is the loan to value amount. I.e. Loan = $100, Collateral value = $150, ratio = 100/150 = 67%. Makes sense that people would only borrow 30% to reduce risk of liquidation. Any slight change to your collateral (I.e ETH) can quickly liquidate you.

I think the dune graph is incorrect. The graph is supposed to correspond to the table beside it.

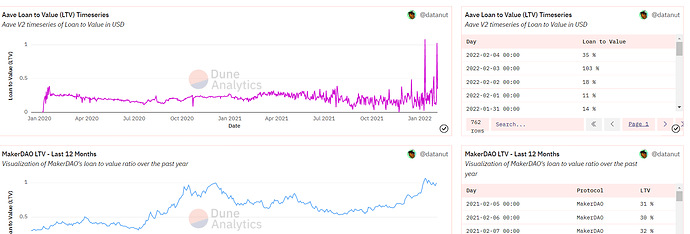

If you look at the picture I posted, you can see that the Aave LTV graph corresponds to the table beside it… where the spike past 1, you can see Feb 3, it was 103%, then dropped back down to 35% the next day, so it looks about right.

For MakerDAO, the table says 30%, but the graph shows 90%.

Yes, it is the ratio, not the actual collateral.

For example, in order for you to mint some Synthetic token (sToken), you need to have a 600% collateral. This means that you need $ 600 Of ETH, for you to mint $100 of ETH

Nooo. If I got it right, that 31% was the LTV from last year haha

The date says Feb 3, 2022 on it! It can’t be last year haha

EDIT: I was looking at the AAVE chart, my mistake. It does say 2021. But I’m still confused because the math doesn’t make sense to me

I also have the same question.

Aave and Compound have a variety of lending options compared to MakerDao. While both protocols make 90% of defi revenue, they don’t represent the net value. For example, Aave’s fee of .09% of borrowed amount for a flash loan is split, 70% to the depositor, the other 30% goes to integrators and burning of Aave tokens.

https://finematics.com/flash-loans-explained/

Maker Dao is closest to the settlement layer and it is the main AMM for the stable coin that gives the highest interest rates across crypto banks and defi protocols, Dai. Is there more demand for Dai, Maker will mint new Dia tokens, and when debt exceeds the amount held in base. Makers stability fee will increase making it harder to borrow.

“Thus, if Maker started liquidity mining or Aave or Compound dropped it, the basic TVL metric would completely flip and favor Maker.” - https://ambcrypto.com/aave-maker-compound-this-is-the-right-way-to-gauge-their-value/

Maker’s credibility in security will pull liquidity to maintain the stable value. Maker can take more risk than other protocols and it’s reflected by its LTV.

MakerDAO, having a first mover advantage and being an L2 to Ethereum, has consequently opened itself up to much more volume than Aave or Compound. As there are many Dapps running on ethereum, its much easier to link Maker into the mix than aave for example.

Aave and Compound seem to focus on lending to a higher degree which may be why the way they were build offers a larger rates.

The incentives at play that encourage deposits to Aave and compound are their liquidity mining as stated by ambcrypto. Could someone explain why as a primitive Maker does’nt offer liquidity mining??

MakerDAO has a higher LTV than Aave or Compound due to it being the first lending protocol on Ethereum, and also has higher borrowing fees than the other two. In addition, the TVL in MakerDAO protocol is higher than the other two. For Compound incentives versus MakerDAO, more assets from various different blockchains are supported and then governed by COMP token. For Aave, lenders are given less than half the collateral requirements as opposed to MakerDAO.

Wow that’s a really good answer !

It really help me to understand !

So Maker is in the botom of the pyramid so it’s grabing more LTV, but have less functionnalities.

The others options like AAVE or Compound are on a higher layer, grabing less LTV but offering more functionnalities.

AAVE and Compound offer better landing rates too !

-

Although the concepts are totally different, TVL and LTV it’s related. As we can define LTV as the maximum amount of currency that can be borrowed with a specific collateral, we must conclude that, analysing the numbers of it’s liquidity pool, Maker can offer the higher LTV to the players that trades in the protocol - and Aave and Compound prefers to play more cautiously (in this subject) -; firepower issue…

-

Aave it’s more revolutionary, as it offers new products as flash loans to it’s users and Compound it’s known by encourage yield farming opportunities and tokens incentives while Maker keeps the traditional services and products

Look at the LTVs of Aave, Compound, and MakerDAO and talk about the differences. Why does MakerDAO have a much higher LTV than the other two? What incentives are at play that encourages users to deposit more funds into Aave and Compound that are not at play in MakerDAO?

Aave and Compound offer yield farming, more tokens and variable rates than MakerDAO.

I’ll definitely need to read up a bit more on that, but if I understand correctly…

MakerDAO has less options for DeFi users, but is considered very safe and renown, despite its high LTV.

Aave and Compound on the other hand might be riskier due to lower liquidity, so they compensate this by providing more features and higher APY.