Good final remark, I think the same. If no one is willing to give up their money, no one will be able to borrow money, it is an endless loop.

The reason why the rates for cryptos are different is related to the supply and demand for a specific crypto. Crypto with enough supply will offer lower rates in comparison to one that has lower supply. However, the ones with lower supply incur in higher liquidity risk.

Supply and demand control the rates.

Yes, the rates will continue to be lower during this crypto winter.

Agree. There are risks involved with the tokenomics.

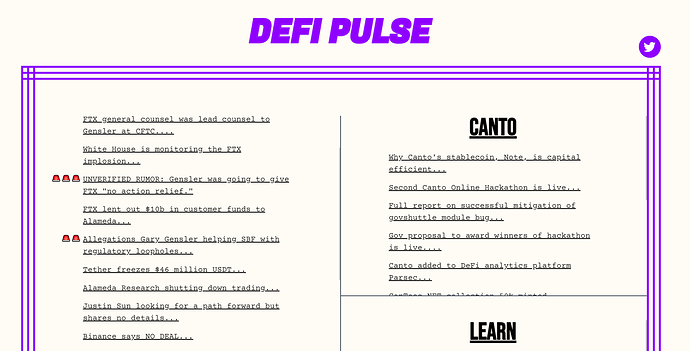

I try to do the homework, but when I go to the defipulse.com this is what I get

This is not the page I knew before

Yeah, good point, more people want to borrow than lend.

Yeah, I agree, different coins have different risks associated with.

Rates vary depending on the supply/demand and the trading volume, which is limited. If a rate is high, that may be due to the low volume at a given point.

Supply and demand drive the rates including volume. Currently the rates for Aave (USDT 2.14%, USDC 1.18%) & Compound (USDT 1.98%, USDC 1.62%) are pretty low in comparison to the rates when the video was recorded.

Looking at yields on

DAI yield on Aave:

- video: 2.91%

- now: 0.54%

DAI yield on Compound:

- video: 2.44%

- now: 1.80%

Why are yields lower today?

Some ideas:

- during the bear market many market participants have sold their positions into stablecoins and are now looking for a place to park their stables > more lending.

- Less trading activity during bear market > less leverage > less demand for borrowed DAI

Note that some fiat GBP savings accounts in the UK offer 2.30% today. This is more than Aave and Compound.

So it would make sense to invest in a vanilla savings account rather than DeFi. Good old fiat is also less risky.

Less risky, really? mmm…

- a fiat savings account can be frozen or seized by a bankrupt bank or government

- high interest rates are set manually by central bankers to influence the economy and do not reflect market forces.

- the money lent by central banks is printed through bonds purchase.

Centralisation + unsustainable promotional rates + tokens created out of thin air. Fiat savings feel very much like Terra Luna.

DAI yield on Aave:

- video: 2.91%

- now: 0.54%

DAI yield on Compound:

- video: 2.44%

- now: 1.80%

Why are yields lower today?

A number of economic factors that can influence the yield on a cryptocurrency like Dai. For example, if there is a high level of economic uncertainty or instability in the market, investors may be more likely to seek out stable and reliable investments, which could lead to higher demand for cryptocurrencies like Dai and lower yields.

Very helpful feedback indeed. Interesting to research this topic.

Straight to the point with supply and demand driving rates.

So, I think DeFi Pulse - atleast the main website - has gone the way of the dinosaurs.

I am using DeFi llama instead https://defillama.com/yields - to look at yield.

On the overview page:

- I see a median yield today is 3.376 across all tracked pools (including DAI)

I noticed on polka dot’s talisman wallet, the staked APY is up around 15%. And I’m curious to check out tokens that go to the best APY and accrue yield back vs going straight into a token like DOT and staking directly in the ecosystem - the risks and pros/cons.

So i wasnt able to find any prices of DeFi Pulse. So i used milkroad. This was the difference

in prices. Compound is providing 1.79% on USDC Tether 2.45% Dai 1.48% BUSD doesnt have a rate.

Aave is providing USDC 1.96% Tether 3.3% Dai 1.49% BUSD 1.02%

As for commenting I think that the rates are low becasue we are either in a bear market or end of it and by the time the bull market begins we will see these rates change. Depending on supply and demand during the next bull market.

Check out the DeFi Pulse link, look at the rates for different cryptos, compare them to the rates I mentioned in the video, and comment why you think they are different. Then comment on at least 2 other posts so we can all learn from each other.

Each Defi projects is different of their protocol to adjust the interest rate based on supply/demand of that token. If not enough supply is being met, then the interest rate will go up which will create inflation.

Excellent explanation Jak!

Interesting feedback thanks!