Different rates can come from different levels of demand for that specific token. Higher rates create incentives to use that protocol and at some point when enough people are participating, rates must be lowered so it can stay sustainable.

The rates on the protocols differ from time to time depending on the supply and demand. Also, one should consider that the higher the yield they get, the riskier it is as an investment.

The law of supply and demand cannot be broken

As at 28 March 2022, the current lending rate of BUSD is 5.36% on Aave.

In the video it was 16.92%!

This comes down to supply and demand. As the demand goes up, the lending rate reduces.

1.Maker-15.93b , Aave-11.92b and Curve-10.75b

2.the reason for the volatility in the market stems from a number of reasons including but not limited to new tech,new investors, new tooling the whole Defi arena is in a state of innovation.

Tornado cash is growing

It is worth adding that interest rates are different for reasons such as: perceived trust, network effect and marketing, operating costs. We also have CeFi and DeFi here.

they change the defi pulse website and I do not see the rate.

TVL on:

1)Maker Dao is 14.47B

2)Aave 10.97B

3)Curve 10.28B

My have bigger rate on DeFi protocol because:

-it is beginning of the new system

-creator want to attract more people to their protocols

-so of the protocols are use ponzi technology

I think rates are different, because it depends on various factors, as global situation, Defi is beginning of something new so there is vulnerability risk.

I think the rates are different, because of supply and demand. Markets go up, markets go down, and right now everything is unpredictable because our world right now is unpredictable.

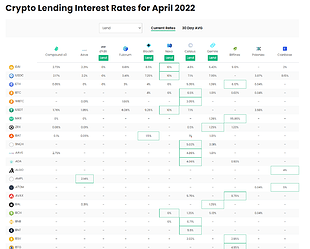

Noticed that the rates for AAVE and Compound have decreased since the time of the video.

AAVE 4.34% --> 2.51% ( as of 4/22/22)

Compound 3.53% --> 2.4%

As with similar posts, this change is a reflection of supply and demand. I also saw Cream was not on the list and found that it had suffered multiple hacks, the largest one being $130 million. Yikes! Be careful out there folks!

Agreed. But where are the higher rates coming from? Do newer lending platforms attract liquidity by subsidizing high returns from their accumulated investor funds? Probably. They’re strategically buying your vote. Seems staking platforms can subsidize through inflation, but lending platforms have to subsidize directly at market prices. But wouldn’t that drive up the rates elsewhere? They can’t drive up the price since they’re dealing mostly with stablecoins. So they have to affect rates on other platforms when they go buy bulk tokens elsewhere.

Best way to destroy yield rates: get hacked. The rates and contract security are closely linked.

Rates are definitely a contact sport. Lending on DeFi is as volatile as trading. I think this is due to the constant influx of new platforms and stablecoins. They each bring investor capital to subsidize on-platform lending when they launch. I would not invest in this manually. I’d want a bot handing things to constantly monitor rates and shift funds around to catch new launch windfalls and leave before the inevitable rates crash happens. But the network fees on all that churning would burn out any gains. So…hm…

I’m seeing 3.85% for aave and 4.28% for convex… Honestly, not sure why the rates are all different. I’m guessing it’s based on the lenders vs borrowers for each protocol

I looked at Ampleforth; it’s rate is higher ( I saw different amounts, could really use an explainer on those charts- but it’s higher because it is newer there is less in the liquidity pool so they need to incentivize deoposits

Just market capitalization does not always go up, now it will be possible to fall (even deep). Rates are likely to go up.

Rates change based on supply and demand in the market, In addition the increase of Dexes, and competition to the ETH network having more incentives to attract liquidity for newer chain like AVAX, Solana, Terra, Polygon, Cardano,…

Appreciate some comments mentioning about mature protocols have lower rates, where newer protocols need to have higher rates to compensate for security…

I can’t seem to see the crypto lending and borrowing rates however I am able to comment on the TVL per the website. For example, in 2022 the TVL of Aave has dropped significantly from its all time high in September 2021 at 18.085$Bn to 748.252M I do believe it all happened because of heavy competitions from other protocols and also due to how the current market is at the moment with all the uncertainty happening.

Edit: I was able to get the crypto data rates from defirate and alot of the protocols are offering such low returns making it really unprofitable especially to lend like with USDT in the video 2.94% was the APR and now its sitting at 1.85% now this is probably due to the launches of other protocols but the more I look into it its all got to do with demand and supply less people borrowing meaning less people will likely lend and vice versa.