I believe people underestimated one of the major drawbacks of DeFi ( as well as BTC , ETH and most projects) is the lack of fungibility and privacy.

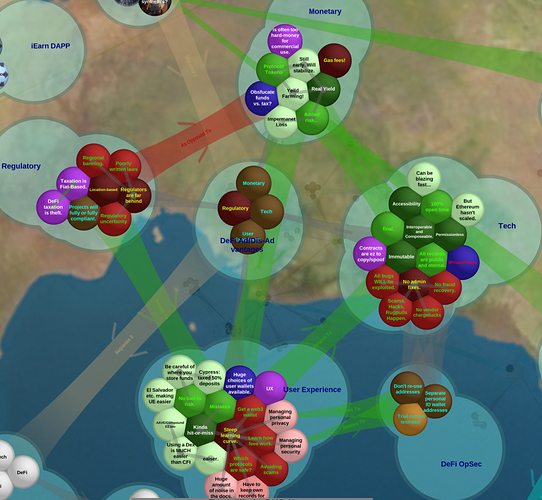

1.the most prevalent issue i can see is the broad based misunderstanding of the DeFi system as a whole.

For sure the defi space is too new for the public at large to really understand. And them hearing about the lack of regulation would be more of a turn off.

I think - If I die or become incapacitated I lose all my crypto unless I tell my dependents how to access them - there is no central organisation to help, for instance, my children claim my assets on my death.

@Val_CK, @DamianP, one point yous should also consider which is probably one of the biggest drawbacks of DEFI is to do with smart contract validation & and yes as you say @Val_CK, the lack of missing standardization and regulation frameworks since BC is such a new emerging technology.

on the point of smat contract validation, not 3 months goes by in defi before we hear about some 100 million dollar hack on some dao or exchange. just the other day axi infinity got hacked for like 400 million dollars woth of NFT’s and ETH. putting it at the second largest hack in crypto to date.

so these are very important point sto not when looking at DEFI and you should never ever keep large amounts of crypto on exchanges. always keep large amounts in cold sotrage

The negativity from Media surrounding the space and keeping others fearful about it.

I had to google things as I went along because I didn’t know what it meant. I also had to google “how to” a lot. Also, the videos that ppl post only give you the meat of the how to, and not the “explain it to me like I’m 5” version.

Drawback of DeFi could be that not everyone is using it, not everyone is trusting it.

Defi offers more freedom but more responsibilities. This could be a drawback for some users

I think one of the drawbacks may be that it’s more risky to delegate investment and wealth management to other people in DeFi. The custody of funds depends solely on the private key of the owner, where it is supposed to be safest when the owner does not share the private key with any other person. That makes it very risky to ask other people to manage one’s crypto assets, whereas it is common practice to delegate the management of one’s wealth to professional fund investors with CeFi.

Right, and I think the lack of knowledge, hesitation, or even doubt about DeFi among a large majority of the public would likely make governments pass disproportionally stringent laws against DeFi.

I have been thinking about this as well. Even if I put in my Will who I want to inherit my crypto, they will not be able to get it anyway unless I put my seed phrase in there, which is probably not a good idea. And if I tell people beforhand how to access it, maybe they will get greedy and steal it.

The biggest drawback for me at the moment is that even though there are many on ramps, there are less off ramps. Meaning it is easy to buy crypto, but if you need to convert it back into fiat there might be issues. I would prefer not to need fiat at all, but at the moment I can not pay my mortgage with crypto. The biggest issue in my country is that the banks might freeze your accounts if you withdraw money from a crypto exchange. They claim that it is for anti money laundering reasons. There have been people that have gotten all their fiat assets frozen and they have been banned from all major banks in the country. It really messes their lives up. Maybe this isn’t a drawback of DeFi itself, but with the public and corporate view of it. It will take time before it is accepted.

Onboarding is simply not smooth and it is easy to make a costly mistake. There is no undo- Bank of America isn’t going to text you to validate a transaction

You make a couple of good points- I use some platsforms not necessarily because they are the best financially, but they make getting yuur money out a lot easier. And some assets might not be available on a platform I’d like to use.

And my goodness we aren’t being led by our betters when it comes to regulations. People act like cash isn’t used in illicit activities but they’d like to ban crypto. The whole idea of certain investments not being available unless you are accredited is nuts, too.

Too many scammers, is difficult to separate the good from the bad in DEFI.

Regulation that difficult innovation on DEFI, like banning for not KYC individuals…

Another drawback I’ve with DeFi would be that to it is so foreign to most people and there is quite a bit to learn and practice in the space to fully feel comfortable.

It all depends on the smart contract security that a Defi platform has which hasn’t been fully explained in the video,if you have a weak smart contract that has a lot of flaws you can expect hacks to happen and you can have your investors lose money and this all really depends on what kind of contracts the defi smart contract is going to interact with which is a major drawback so defi platforms do require an audit on their own contracts and as a user you can’t really put all your money on one defi platform.

Yes it is difficult at the beginning especially with risks such as impermanent loss which occurs when you provide liquidity to a Decentralized exchange and that is something that many people don’t know about.