Enjoying the course! non-computer background but long time trader finally figuring out how this stuff properly works. When Ivan says wait for 6 confirmations to ensure a transaction is correct. Does that mean it effectively takes 1hr to know if a transaction is 100% successful?

Since you use exchanges you probably noticed that most of them will not allow you to trade newly deposited bitcoins until a certain number of confirmations have passed.

After 6 confirmations it technically means the transaction is settled and you can be certain it will not get dropped. Accidental forks are in fact rare, but either way should be considered as a possibility especially when you are dealing with large funds.

When you “sign” a message or transaction using your private key when sending it, how and what exactly is this “signing” doing mathematically/in practice?

Hi @raphipik, welcome to the forum!

You utilize the elliptic curve function. It usually has a formula like (k + j)H = kH + jH , where:

kH = PubKey

k = PrivKey (this is the number of transformations on the curve)

j = shared secret

kH + jH is publicly know

By using this function you can prove you know k by providing the solution to k + j without revealing k.

If you want to learn more you can check our privacy course that explains this in more detail.

Hi, I have a question regarding the stale blocks and the rewards for a miner. Since I either missed it or it is not discussed in the video regarding stale blocks.

Does the miner still get his/her rewards from having the block validated before it became a stale block? Since all the transactions are moved back into the mempool.

The block reward for the miner is stored in a special transaction called a coinbase. When the block is dropped, so is the coinbase.

Is owner’s private key always the same one or are different one used for same wallet.

Each private key has a corresponding public key, but since HD wallets, we can use mnemonic phrases that can convert it to a master seed xpub /xpriv and have multiple public / private key pairs in some kind of derivation paths

Check this video for more info from Andreas:

https://youtu.be/tPCN3nDVzZI

And check standard derivation paths from different wallets:

https://walletsrecovery.org

heey @ivan , i have a question about the block rewards and the halvening lecture.

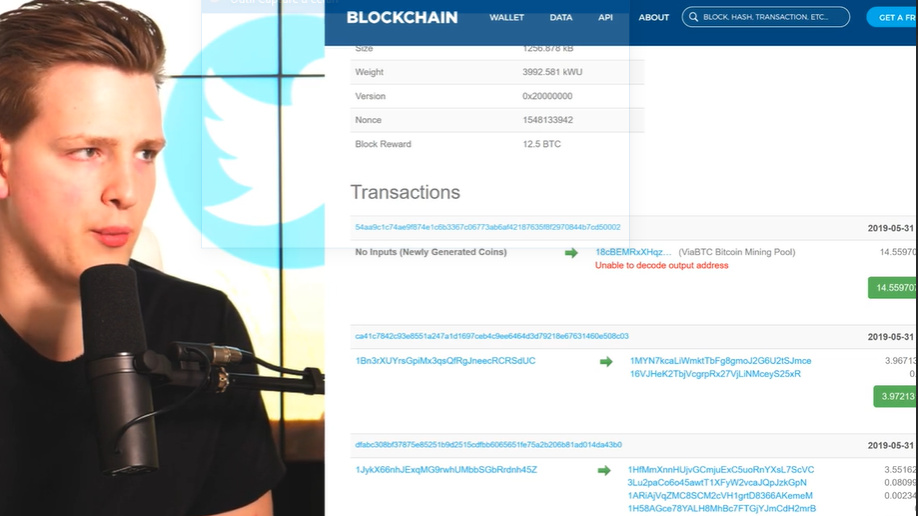

you said that at the beginning of the block , the first transaction doesn’t have inputs because they are new generated coins from the block reward , but you said that the 14.5btc is composed of the 12.5btc +2btc as fees .

so as i understand the 2 btc of fees are UTXOs , so how come there are no inputs???

thank you

The fee is not an UTXO, its the remainder of the transaction input - output. The coinbase transaction contains all as a newly generated output.

The first transaction in a block is the block subsidy + fee’s from all transactions that the miner included in that block.

It has some asci data in the input and the block subsidy + fee’s of all transactions in an output + they can add additional op_return data as well in the output

A technical explanation of the coinbase transaction:

https://learnmeabitcoin.com/technical/coinbase-transaction

Example of a coinbase transaction :

https://explorer.btc21.org/tx/b3faea27a889068678874e1740ef1b9db2ea83365b9a393b1a2db9971b46ae64

The famous first coinbase transaction of the genesis Block:

https://explorer.btc21.org/block/000000000019d6689c085ae165831e934ff763ae46a2a6c172b3f1b60a8ce26f

Hmm , i see , great thank you!

thank you mister Fabrice , i understand now!

hello guys i’d like to get a better understanding of this situation:

I buy 100$ worth of btc all at once (1 tx)

I buy 100$ worth of btc in 5 transactions

is the following true?

-

in the second situation because i made more transactions I have more utxo’s

-

therefore, when i’m going to sell i’ll pay more fees

-

the fees are 5 time higher in the second case in comparison with the first situation

thanks

The first two are correct but the last assumption is not. You would not pay 5 times more for a tx, because this also depends on other factors, like the number of outputs and how complex is the unlocking script of those inputs.

I’m not sure about the exact values, but a larger number of inputs generally doesn’t drastically influence the tx fee.

These are some questions I came up with: thank you team in advance

Do all competing miners get rewarded with transaction fees according to their work for validating transactions, or the miner who completes the latest block is the only one receiving all transaction fees plus the newlycreated block reward?

What would stop the most powerful computer system from wanting to modify the previously created block against less powerful computers?

Thanks in advance anyone commenting:)

Only the miner that finds the block. Winner takes it all.

Because one powerful computer is still marginally less powerful than a majority of less powerful computers.

Hi all, I just watched the video “PoW and Incentives”, and here is something that isn’t entirely clear to me:

Ivan explained that if a malicious miner were to attempt to alter a transaction and re-mine blocks they would have to do so at a very high difficulty/hashrate, to the degree that re-mining a single block would take hundreds of years. How can this increase in the hashrate/difficulty be explained? Is it just in relative terms (as in the miner must do everything alone and it is therefore difficult)? But normally they don’t receive help from other miners either when creating blocks - they are in competition too. I would really appreciate if someone could clarify this. Thanks a lot in advance!

Miners are all looking for a block by themselves, but do this by providing hashrate to the entire network.

If a malicious miner would want to change the block he would have to mine with a higher hashrate than all the good miners combined since he would probably want to change a block that was already mined and also mine as many blocks as necessary to overtake the network.