Japanese fintech

Here are my findings on Japan:

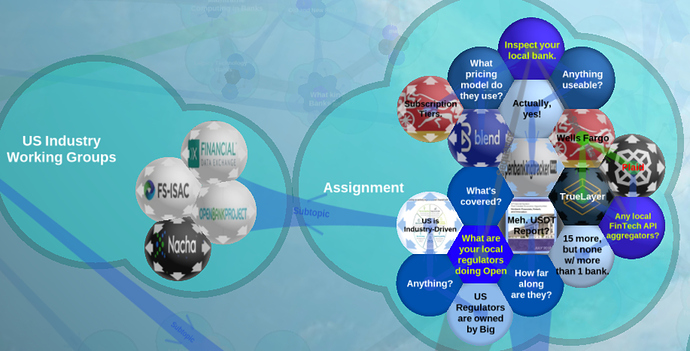

- Find out what the regulators in your region are doing within Open Banking. Are they doing something? If so, try to figure out how far have they come and what will or is included in the regulation. Share your findings in the Forum.*

The Financial Services Agency in japan has a fintech support desk that companies can contact for further support to make sure their services and products are within regulatory limits.

https://www.fsa.go.jp/en/news/2018/20180717.html

It is nice to see the government fully supporting the changes in open banking with new technologies.

Take a look at a couple of banks active in your region and what kind of developer portals and help they are offering. Can you use any of this for your fintech ideas? Is the service for free or how much will it cost? Share your findings in the forum.

There are about 64 1st tier regional banks in Japan that are offering banking APIs. That is only the regional ones that exclude foreign and 2nd tier regional banks.

A more substantive breakdown is found in this pdf:

https://www.jetro.go.jp/ext_images/australia/banners/OpenBanking_Factsheet_f.pdf

Research some Fintech API Aggregators in your area and share them in the forum.

Netstars is a payments api aggregator company in Japan. They just got funded not too long ago for their ambitious goal.

https://www.netstars.co.jp/en/246/

From what I can tell, various foreign fintech companies are trying to build subsidiary companies and branches in Japan since Domestic fintech startups are a bit late to the fintech game relatively compared to european counterparts (Revolut is a good example as they are already starting to hire local Japanese staff to expand domestically in Japan)

)

) )

)