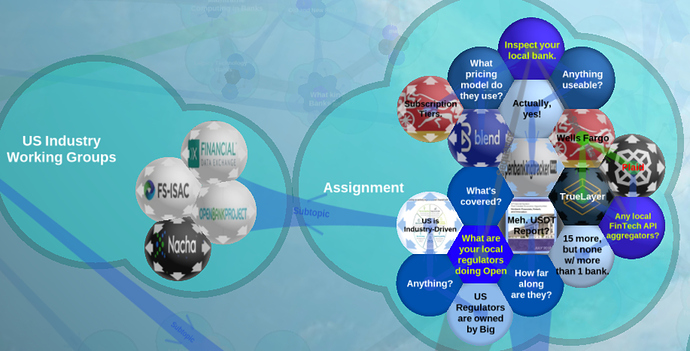

- Find out what the regulators in your region are doing within Open Banking. Are they doing something? If so, try to figure out how far have they come and what will or is included in the regulation. Share your findings in the Forum.

I’m in the USA and it doesn’t appear that any real clear initiatives have been put in place yet for Open Banking. From my vantage point, i’m guessing that we will see more progress on this front once they get crypto regulations settled first. From there, they will build upon that to include more clear direction on Open Banking in the future

- Take a look at a couple of banks active in your region and what kind of developer portals and help they are offering. Can you use any of this for your fintech ideas? Is the service for free or how much will it cost? Share your findings in the forum.

https://www.openbankingtracker.com/country/united-states

American Express- They offer a developer portal through Yapily and up to 7 api aggregators, one of which is Tink, which was mentioned in one of the videos.

Capital One- They have a developer portal and have their bank stack through Chime. They’ve got 2 api’s and 3 separate API aggregators.

- Research some Fintech API Aggregators in your area and share them in the forum.

MX

Founded in 2010, MX aggregates data for our clients using multiple account aggregators, which gives us the ability to switch connections in the event that one becomes deficient. In addition, we offer direct connections via partnerships as well OFX, CUFX, DDA/OAUTH, etc. With access to more than 16,000 organizations via 50,000 connections, MX makes it easy for financial institutions and fintech companies to access transactions, investments, account verification, identity verification, assets, liabilities, balances, PDF Statements, and more.

Finicity

Finicity started with a focus on money management and evolved to give special attention to account aggregation. Founded in 1999, they have nearly two decades of experience on this front. Finicity helps end users with credit decisioning, offering a new credit scoring methodology called UltraFICO.